On February 6, Berachain officially launched its mainnet. Leading crypto exchanges listed its native token, BERA.

The developers had previously announced the mainnet launch on February 4.

Berachain is a modular Layer 1 blockchain with EVM compatibility, operating on a unique Proof-of-Liquidity consensus mechanism. Unlike traditional delegated PoS, this model allows users to stake tokens while simultaneously providing liquidity to the ecosystem.

Three-Token System

The platform utilizes a three-token model:

- BERA – used for gas fees,

- BGT – governance token,

- HONEY – stablecoin, preventing centralization and incentivizing on-chain activity.

Market Performance and Price Dynamics

At launch, Berachain’s market capitalization reached $814.2 million, with a fully diluted valuation (FDV) of $3.79 billion.

Within a day of the TGE, the BERA token dropped 4.2%, settling at $7.51.

- All-time high (ATH): $14.83

- All-time low (ATL): $6.99 (according to CoinGecko)

Trading volume for BERA perpetual contracts reached $5.7 billion in less than 24 hours (Coinglass). Additionally, funding rates turned negative across all seven tracked platforms, indicating prevailing bearish sentiment.

Airdrop Details

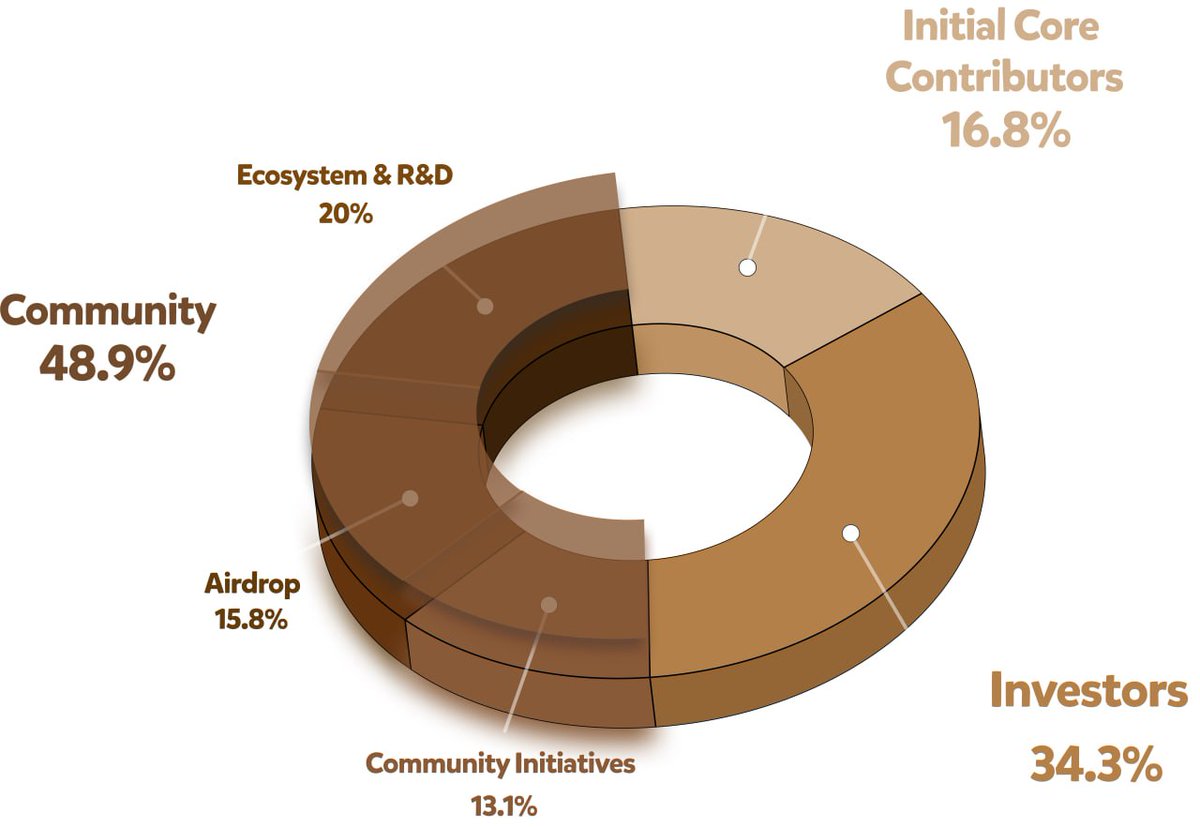

As part of the airdrop, the Berachain team distributed 15.8% of the 500 million BERA tokens. The full token distribution is as follows:

- 48.9% – allocated to the community (15.8% via airdrop, 20% for R&D, and 13.1% for long-term ecosystem incentives, including grants for developers and dApp rewards).

- 34.3% – reserved for investors.

- 16.8% – for early key contributors.

Tokens for investors, key contributors, and long-term ecosystem incentives are subject to a vesting schedule:

- 1/6 of the allocated tokens will unlock after 1 year.

- The remaining 5/6 will be distributed linearly over 24 months.

Out of 79 million BERA designated for the airdrop, 55.75 million have already been distributed. The remaining portion is reserved for selected developers, teams, and active community members under the Request for Broposal program. Additional rewards are allocated for Boyco contributors and Berachain liquidity providers before TGE. The distribution will take place over 30 to 90 days.

Secured Investments

In April 2024, Berachain secured $100 million in a Series B funding round led by Framework Ventures. Other notable investors include:

- Brevan Howard Digital

- HashKey Capital

- Tribe Capital

- Arrington XRP Capital

At the time, Berachain’s valuation exceeded $420 million.