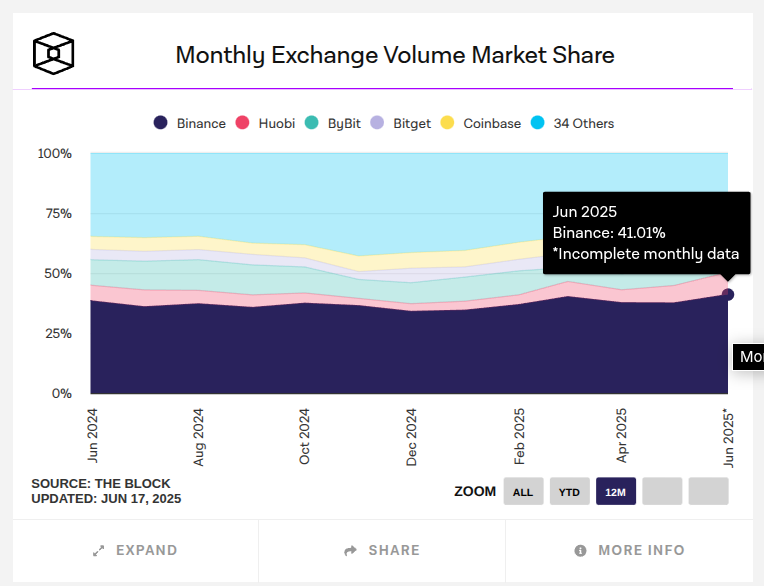

The world’s largest cryptocurrency exchange, Binance, is once again expanding its dominance in the market. According to data from The Block, its share of global spot trading has reached 41% — the highest level in the past 12 months.

On the Bitcoin market, Binance accounts for 45.6% of trading volume, marking the highest share since July 2024. In the Ethereum (ETH) market, the exchange has consistently held around 50% since March 2025, occasionally exceeding this level — despite a general stagnation in overall trading activity across the industry.

Key Factors Behind Binance’s Growth:

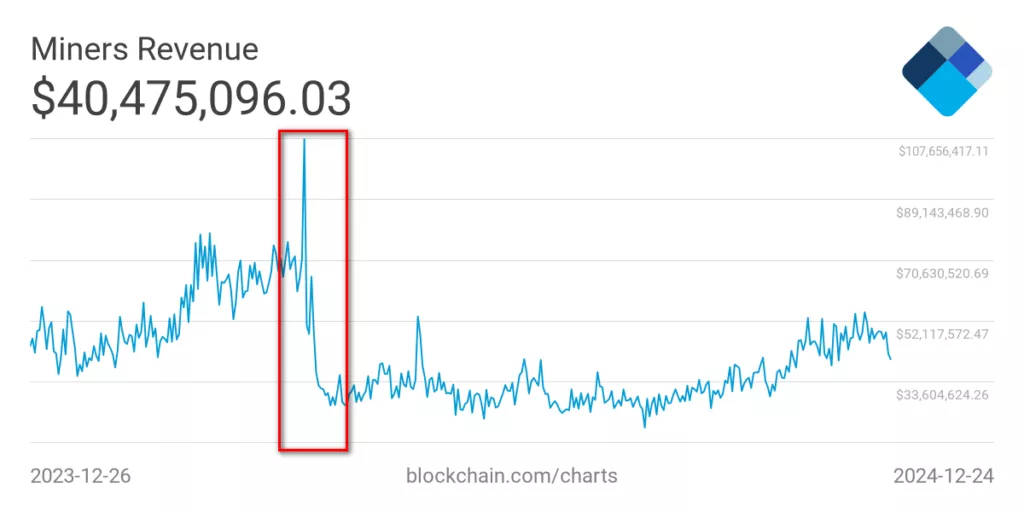

- Client migration from competitors. The February 2025 hack of Bybit may have triggered a mass migration of users concerned about the security of their assets. Many turned to Binance as a more stable and trusted platform.

- Launch of new services. In 2025, Binance rolled out its market analytics platform Binance Alpha, providing traders with deeper insights. Additionally, its gamified rewards program Alpha Points boosted user engagement by offering points for platform activity, which can be redeemed for bonuses, discounts, or exclusive access to features.

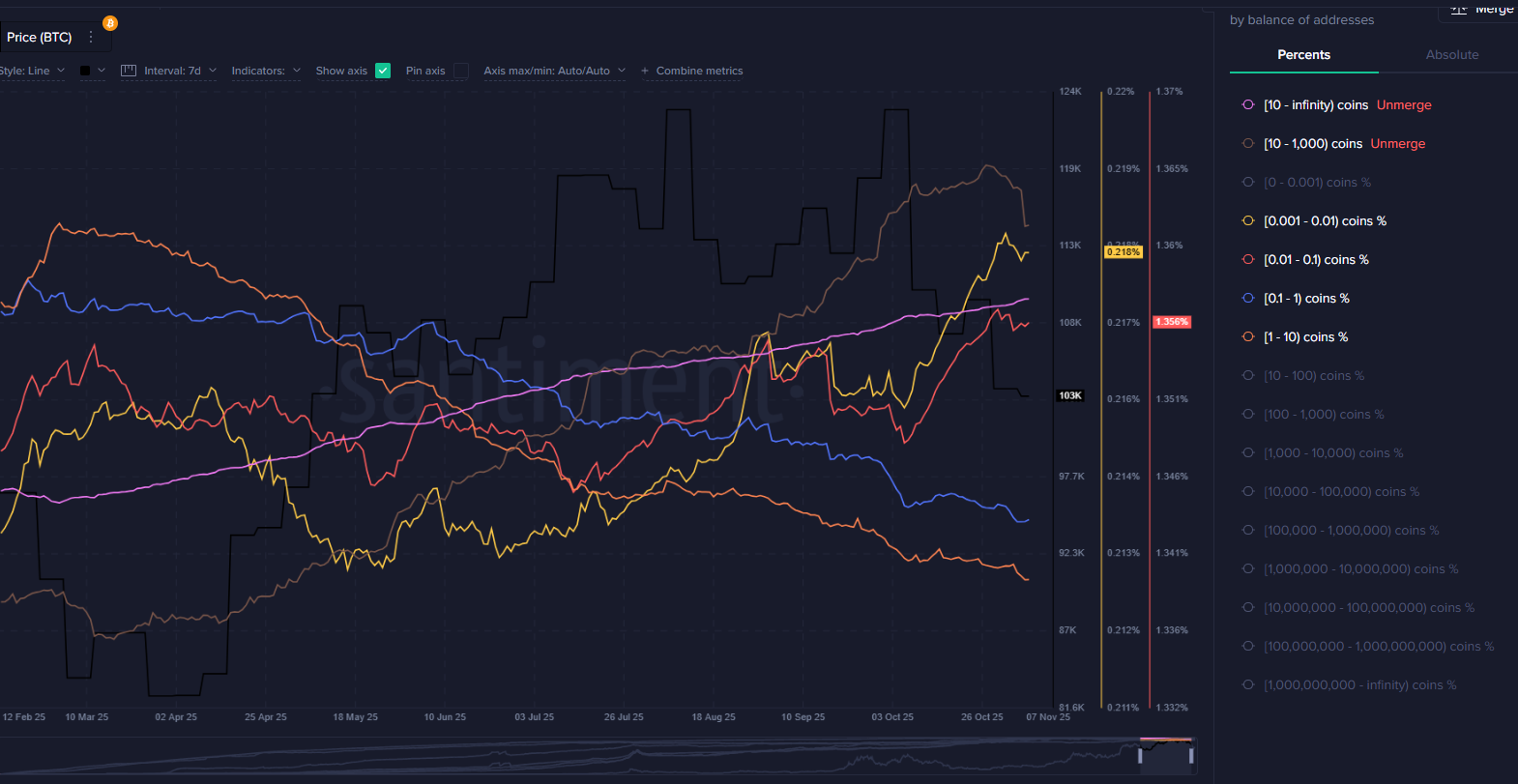

- Financial resilience. Binance has continued to strengthen its reserves. In May 2025, the exchange consolidated $31 billion in stablecoins (USDT and USDC), accounting for nearly 59% of the total stablecoin reserves across the top 20 trading platforms. This move has reinforced trust among both institutional and retail investors amid market volatility.

The Broader Trend:

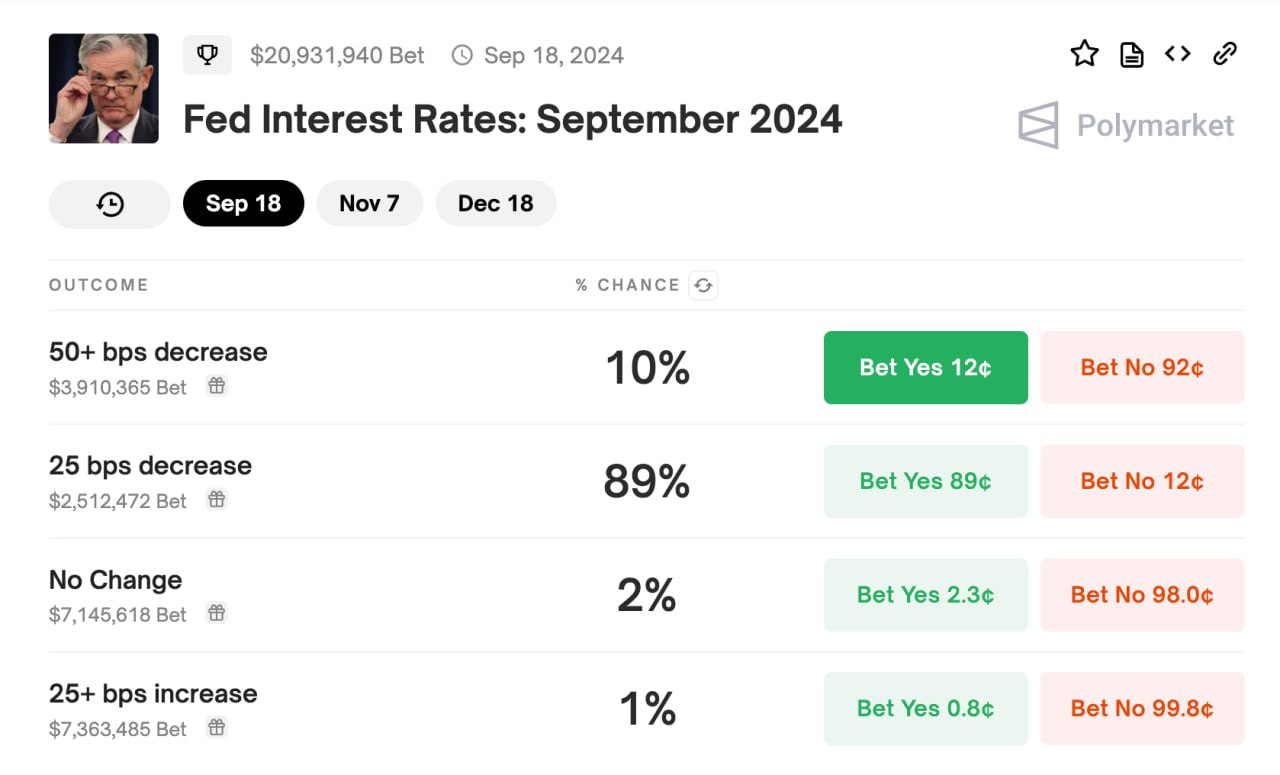

Interestingly, Binance’s rising dominance comes at a time when overall crypto trading activity is declining. Many exchanges are reporting reduced volumes due to looming regulatory changes, rising interest rates in the U.S., and cautious investor sentiment. Yet Binance, with its robust infrastructure, strong security, and new product launches, continues not only to maintain but expand its influence.