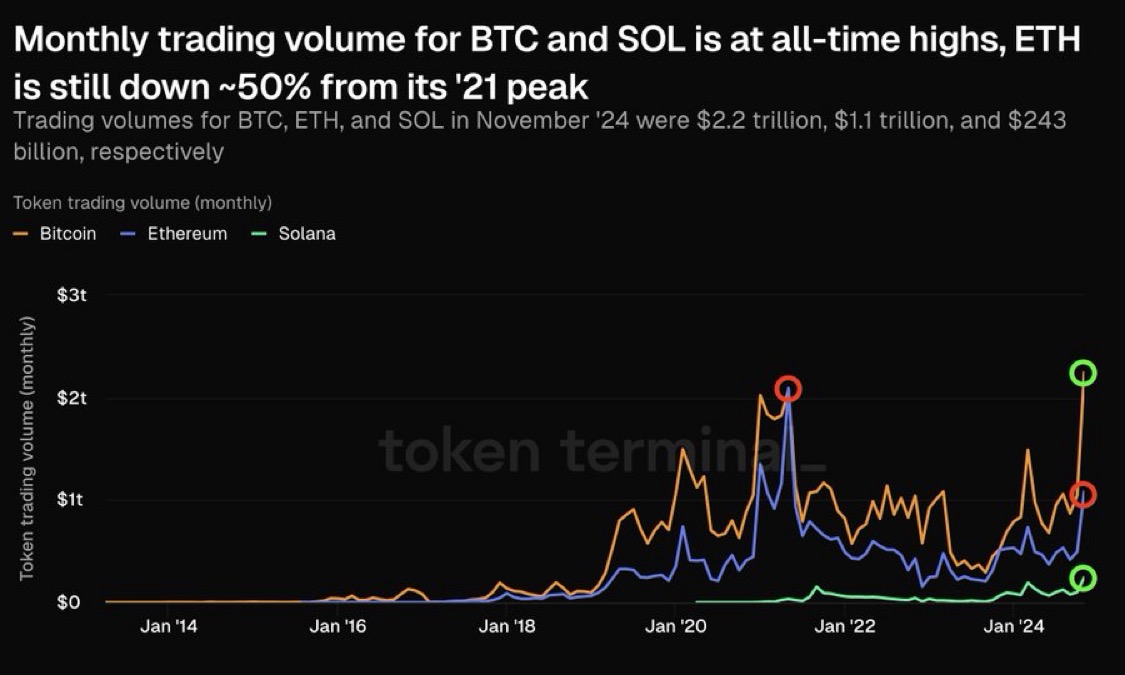

In November, trading volumes for Bitcoin and Solana reached record levels, totaling $2.2 trillion and $243 billion, respectively. Meanwhile, Ethereum’s trading volume grew to $1.1 trillion, which is still 50% below its 2021 peak, according to Token Terminal data.

Weekly average trading volumes for Solana exceeded its 2021 highs by 46%, while Bitcoin and Ethereum metrics remain below their previous bull run levels.

Solana’s trading volume is approximately 20% of Ethereum’s, aligning with the proportional market capitalizations of the two assets.

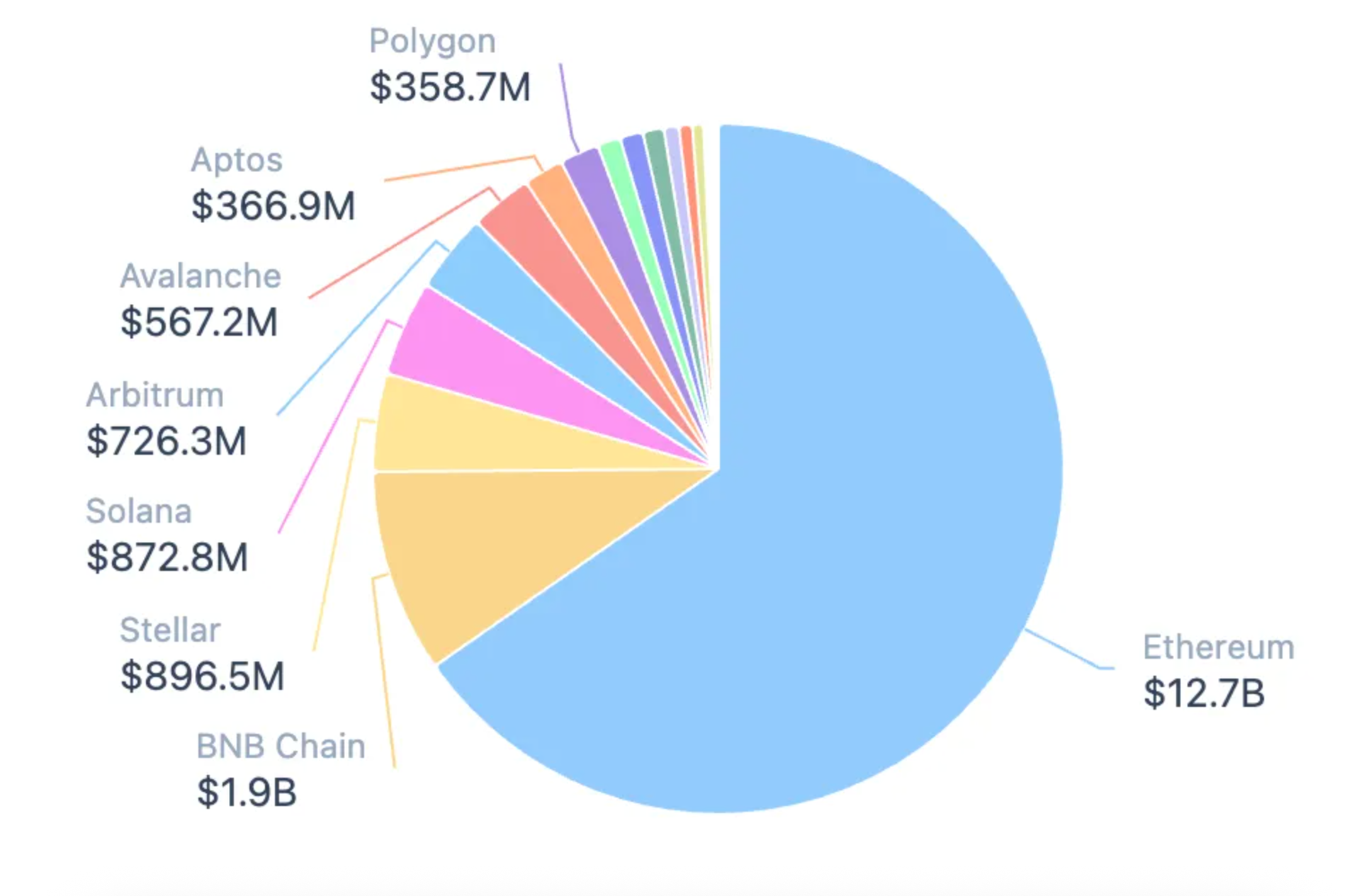

In terms of fees, Ethereum’s share dropped to 18% in November, compared to 61% in 2021, while Solana’s share surged to 18.5%, up from just 0.2%.

Solana also leads in the number of active users, reaching 132 million—a growth of 81 million compared to November 2021 and twice the combined user count of all blockchains at that time.

However, a decline in on-chain metrics has been observed in December.

Glassnode highlighted the resilience of Solana’s net inflows since September 2023, with a daily record of $776 million previously recorded.

An analysis of realized profits reveals that 51.6% of Solana’s total volume is concentrated in coins acquired within three timeframes: one day to one week, one week to one month, and six months to one year. This indicates strong interest from investors across different market segments.

The sharp recovery of Solana’s price following the FTX collapse reflects significant inflows of new capital into the asset. Since December 2022, when Solana hit its low, its 30-day moving average of realized market cap change has outperformed Bitcoin and Ethereum in 389 out of 727 trading days.

Experts also assessed the asset’s “overheating” level using the MVRV ratio, which helps identify extreme deviations in investor returns compared to the long-term average. Currently, Solana’s price is consolidating between the average level and the +0.5 standard deviation range, indicating potential for the bull run to continue.

CEO of Two Prime Digital Assets, Alexander Blum, previously predicted the launch of a SOL ETF by the end of 2025.