Technical analyst Peter Brandt has stated that Bitcoin could reach record levels and climb to $185,000 if the market continues its countercyclical movement. According to him, the world’s first cryptocurrency may enter “uncharted price territory” if it does not reach the peak of the current cycle in the coming days.

In an interview with Cointelegraph, Brandt noted that “it’s quite reasonable to expect the top of the bull phase at any moment,” referring to the classical market cycle theory.

Cycle Timing and a Potential Turning Point

Brandt recalled that 533 days passed between the bottom of the current Bitcoin cycle on November 9, 2022, and the halving event on April 20, 2024.

“If you add those 533 days to the halving date, you get exactly last week — October 5,” he explained.

The following day, Bitcoin set a new all-time high above $126,000. However, Brandt emphasized that the strongest trends tend to emerge when the market breaks beyond its traditional patterns.

He estimates the probability of the classic scenario (a peak around the halving) at 50%, but remains optimistic. Brandt maintains a bullish stance and expects Bitcoin to move “well beyond $150,000, potentially reaching $185,000.”

“Sooner or later, everything changes. Still, betting against a cycle with a flawless 3:0 record should be done with extreme caution,” Brandt warned.

Debate Over Bitcoin Cycles Rekindles

In 2025, the debate over the validity of Bitcoin’s cyclical theory has flared up once again.

Analyst Rekt Capital suggested that, similar to 2020, the market peak could occur in October.

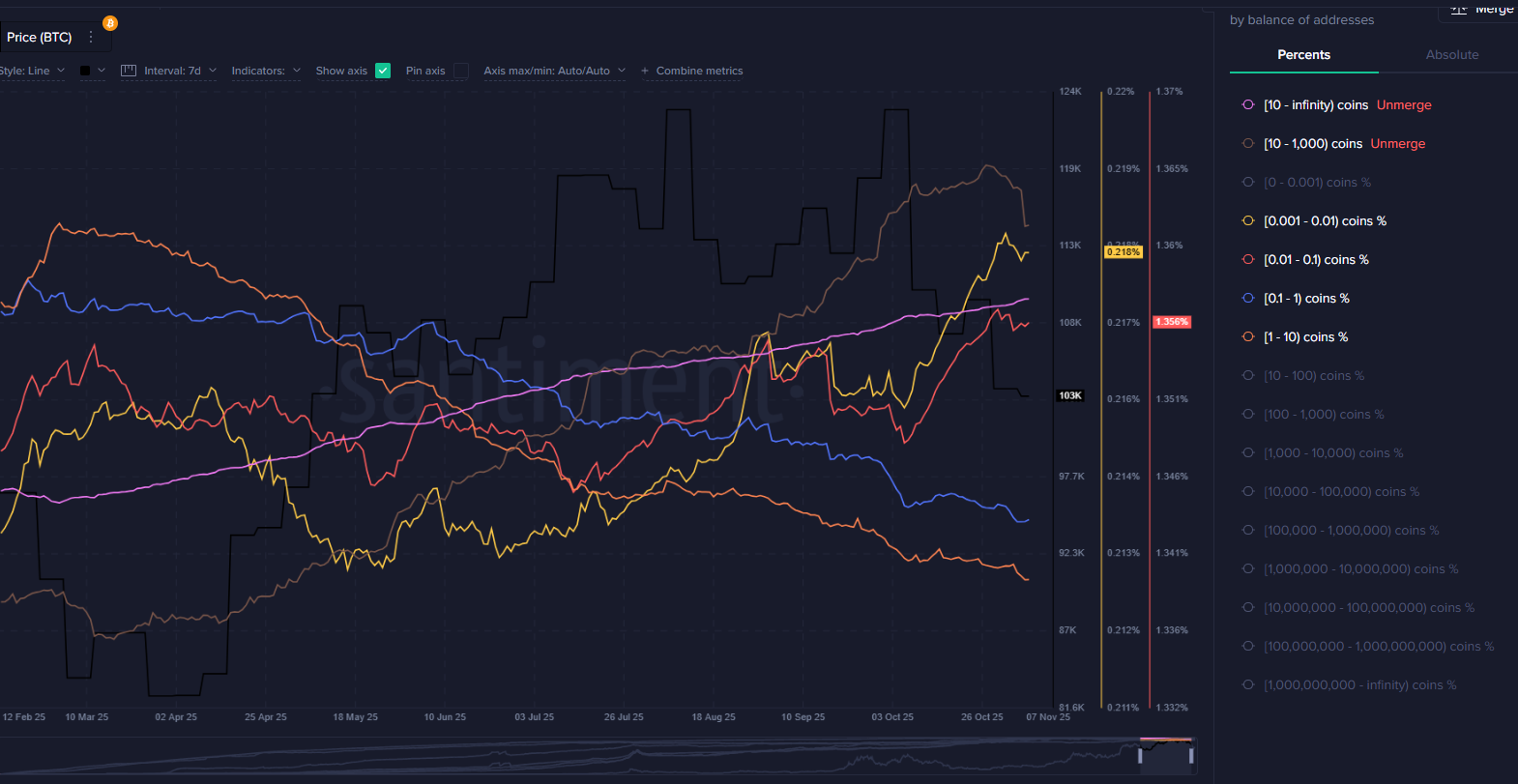

However, not everyone agrees. Ki Young Ju, CEO of CryptoQuant, argued that the classical model has lost relevance due to the increasing influence of institutional investors.

This position was later echoed by Bitwise’s chief investment officer and analysts at K33, who believe that Bitcoin’s movements are now driven primarily by institutional capital and macroeconomic policy, not traditional halving-related patterns.

Market Awaits a Breakout

At the time of writing, Bitcoin is trading around $123,000.

According to CoinGecko, the asset’s price rose 0.1% over the past 24 hours and 3.5% over the past week.

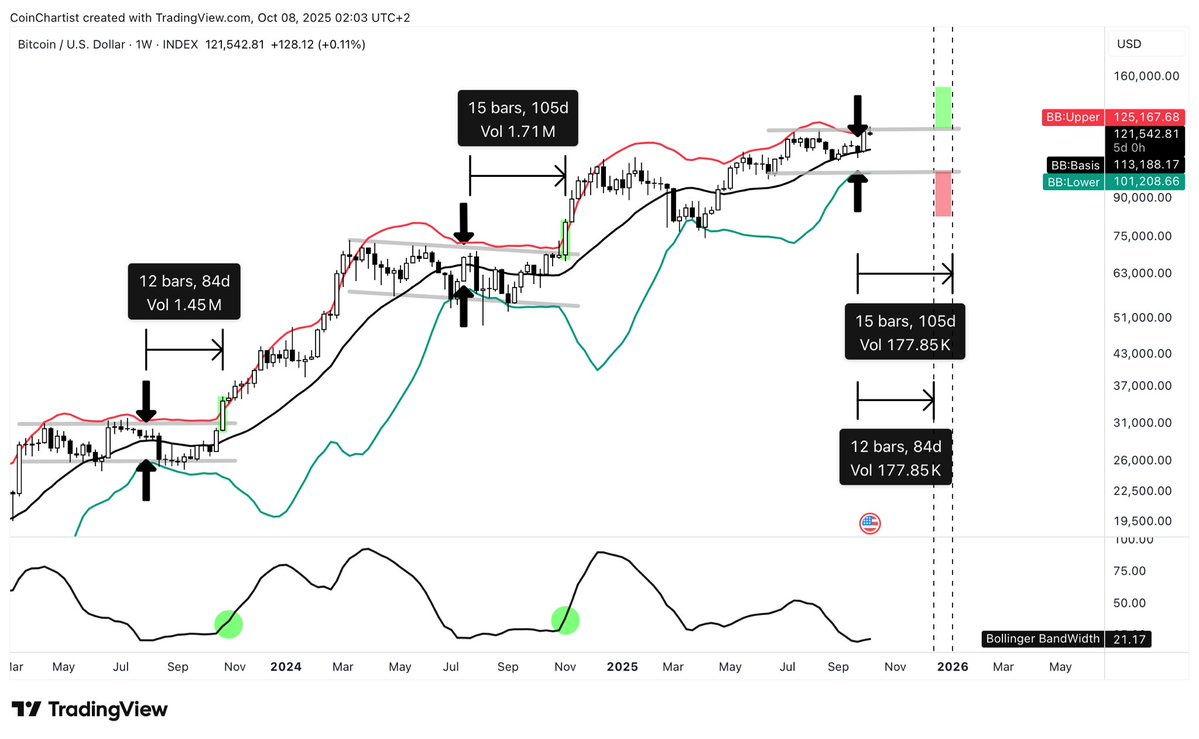

Trader Tony Severino highlighted that the Bollinger Bands, a key volatility indicator, have reached a record level of “compression” on weekly charts — a signal that often precedes a major price move.

“Historical consolidations show that a real breakout (or collapse) can take over 100 days. The key signal will be a clear breakout candle,” he explained.

Severino added that the recent surge to $126,000 might have been a false breakout, and Bitcoin could still test the lower boundary before reversing upward.

“This scenario could either trigger a parabolic rally or mark the end of the three-year bull trend,” the trader concluded.

Glassnode: A Pullback to $117,000 Could Precede a New Rally

According to Glassnode analysts, 97% of Bitcoin’s circulating supply is currently in profit after the recent rally — a sign of market strength.

At the same time, realized profits remain moderate, indicating an “orderly rotation” rather than selling pressure. This dynamic is typical of a healthy bull market, where profit-taking is balanced by new demand.

Glassnode analysts do not rule out a correction to $117,000, where approximately 190,000 BTC were purchased by investors. However, such a pullback could act as a catalyst for renewed growth:

“Although entering uncharted price territory always carries correction risks, a retracement to $117,000 could form a strong foundation for a new upward trend,” they noted.

Conclusion

As Bitcoin hovers near its historical highs, analysts and traders continue to debate whether the cyclical theory still holds true.

If Peter Brandt’s forecast proves accurate, the cryptocurrency could indeed enter a new era of growth — potentially reaching $185,000.

Yet, as experts caution, the road to such heights will likely be accompanied by high volatility and major tests for even the most steadfast bulls.