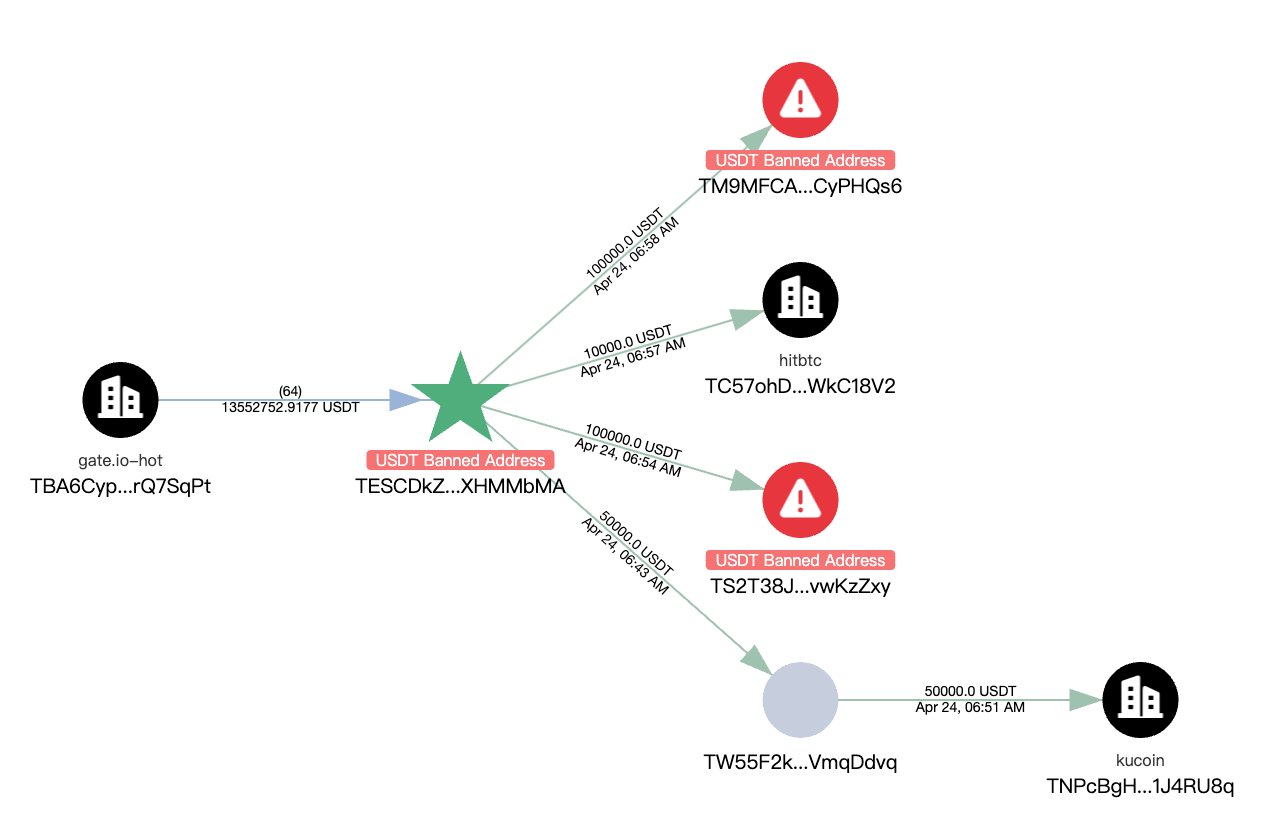

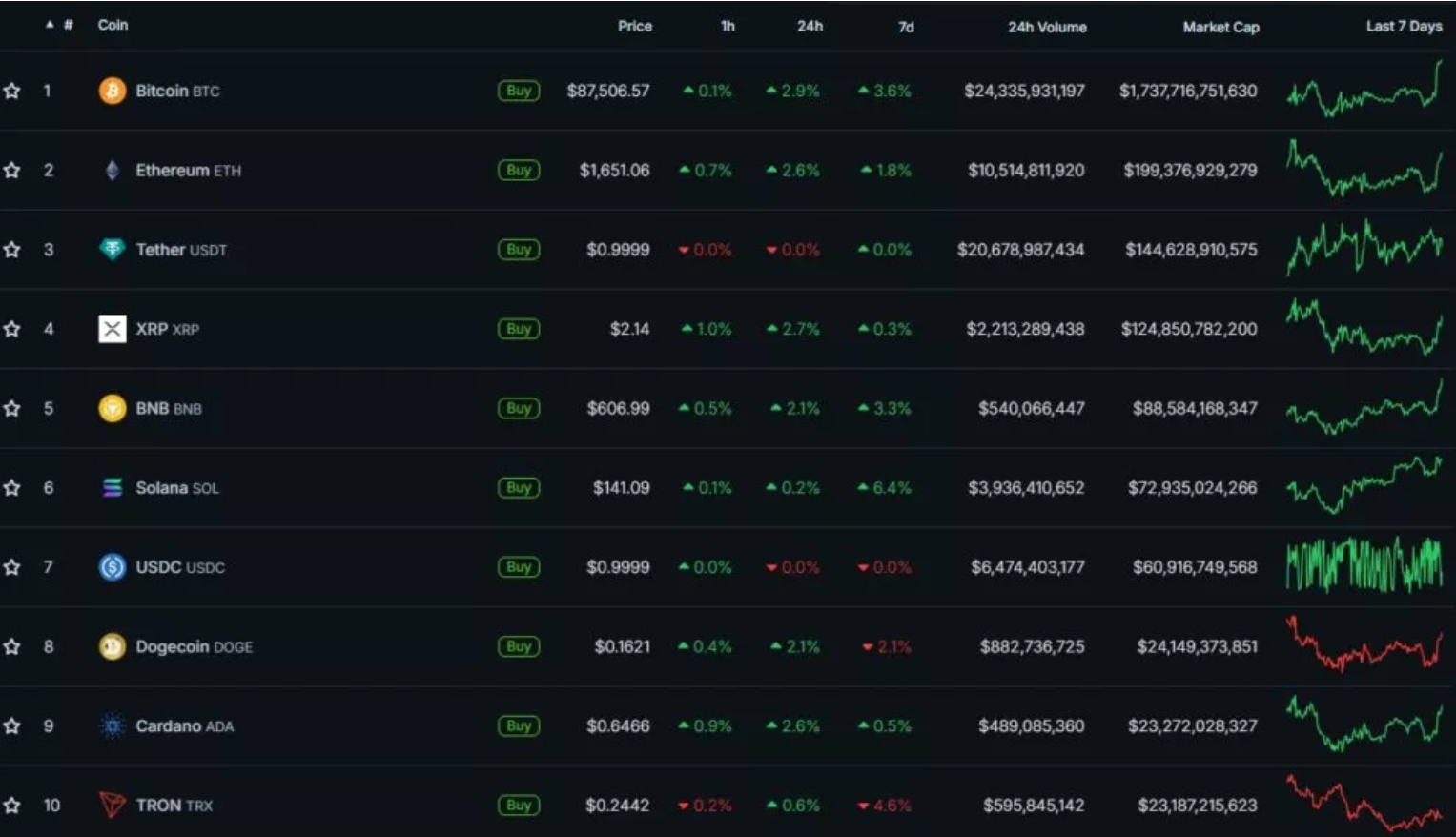

Tether, the issuer of the largest stablecoin USDT, continues its fight against illegal activity by freezing $28.67 million across 12 addresses on the TRON network and $99,630 on an Ethereum wallet, according to analytics service MistTrack.

Analysts noted that the frozen funds were transferred through major crypto platforms like Gate.io, KuCoin, and HitBTC, and also interacted with addresses listed on blacklists. These actions are part of Tether’s regular practice of freezing assets linked to suspicious activities. In April, the company also froze $870,000 on three crypto wallets, reinforcing its commitment to combating illegal use of cryptocurrencies.

In March, Tether froze 601,798 USDT across four TRON addresses, which sparked criticism from the crypto community. Jacob King, founder of WhaleWire, expressed his discontent with these measures, stating:

“This is a harsh reminder that we live in the world of centralized stablecoins. No explanations, no warnings — just freezes and control.”

According to Dune Analytics, Tether has frozen 2,203 addresses holding a total of $1.43 billion in USDT. The largest frozen sum on a single wallet amounts to $87.5 million.

In early 2024, UN experts raised concerns about the popularity of USDT among fraudsters and money launderers. Tether representatives expressed disappointment over such claims, emphasizing their commitment to cooperating with law enforcement. The company pointed out that the freezes are implemented solely when necessary to protect the system and users. They also highlighted that these actions do not affect legitimate users or their funds, and serve primarily to prevent money laundering and financing illegal activities.

The company further stated that it will continue its efforts to ensure compliance with international regulations and cooperate with law enforcement, freezing wallets linked to illicit operations. Importantly, these measures are designed to protect the platform from illegal use, without impacting the legitimate activities of users.

Tether continues to enhance its monitoring and analytics systems, focusing on preventing the use of its assets in criminal schemes and adhering to the requirements of global regulatory bodies.