The primary cryptocurrency has once again forced the market to hold its breath, consolidating above the psychological $70,000 mark. While retail investors remain cautious, analysts are scrutinizing charts and on-chain metrics to determine if we will see $80,000 in the near future.

Technical Outlook: “Adam & Eve” and the Path to $80,000

A classic bullish “Adam and Eve” pattern has formed on the Bitcoin chart. According to the analyst known as Ash Crypto, the key resistance level is currently $72,000.

- The Forecast: A decisive breakout above this zone could trigger momentum toward $80,000.

- Expert Opinion: Michaël van de Poppe, founder of MN Trading, shares this optimism, noting that the asset has established itself in a “potential bounce” zone, clearing the path to new local highs.

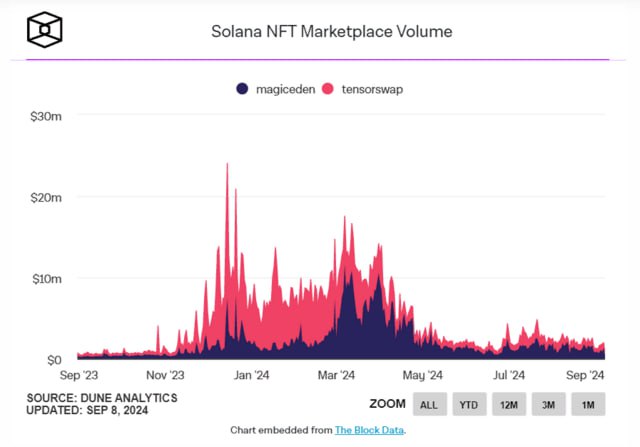

Interestingly, the OTHER/BTC index (the ratio of altcoin market cap to Bitcoin) has hit a four-month high. This signals that altcoins are showing unexpected strength, suggesting that “altseason” might be closer than it appears.

Headwinds: Echoes of the 2026 Bear Trend

Despite the price increase, not all indicators are flashing green. Analyst Daan Crypto points to the Coinbase Premium, which has remained negative (a discount) throughout almost all of 2026.

“The significant discount on the US exchange is tied to the prolonged bearish trend and net outflows from spot ETFs. Institutional demand in the US has yet to become the primary driver for growth,” the expert explains.

Finding the Bottom: Long-Term Holder Metrics

Zhao Wedson, founder and CEO of Alphractal, suggests looking for answers in the behavior of Long-Term Holders (LTH). He utilizes the LTH Realized Price metric to identify cycle capitulation points.

| Market Condition | Price to LTH Ratio | Result |

| Historical Bottom | -0.2 Standard Deviation | Ideal buying opportunity |

| Current Situation | Failing to hold above +1 | Aggressive “bear” selling continues |

According to Wedson, current market behavior differs from previous cycles: bears are actively resisting in zones that were previously considered areas of guaranteed growth.

The Silent Surge: Whales are Accumulating

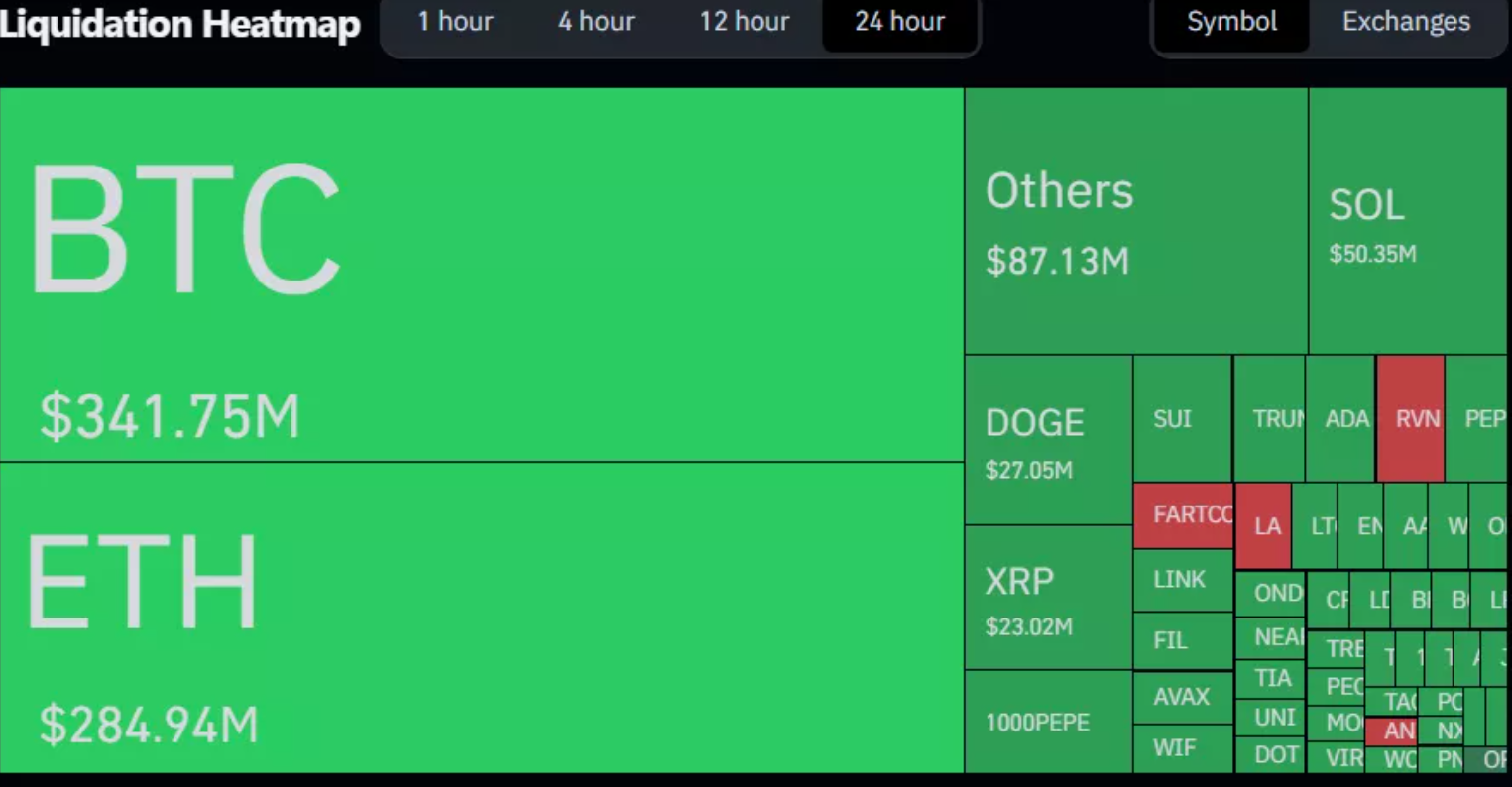

While the retail sector remains hesitant, large players (“whales”) are acting aggressively. Analyst Satoxis points to a record outflow of coins from trading platforms.

- The Stats: On average, 3.2% of the BTC supply has been withdrawn from exchanges over the last 30 days.

- The Impact: Reducing exchange liquidity creates a “supply crunch.” Once demand fully recovers, this could lead to an explosive price surge.

Summary: At the time of writing, Bitcoin is trading around $70,300 (+1.5% in 24 hours). The market is in a state of fragile equilibrium: technical patterns and whale accumulation signal “up,” while ETF pressure and institutional caution continue to weigh on the price.