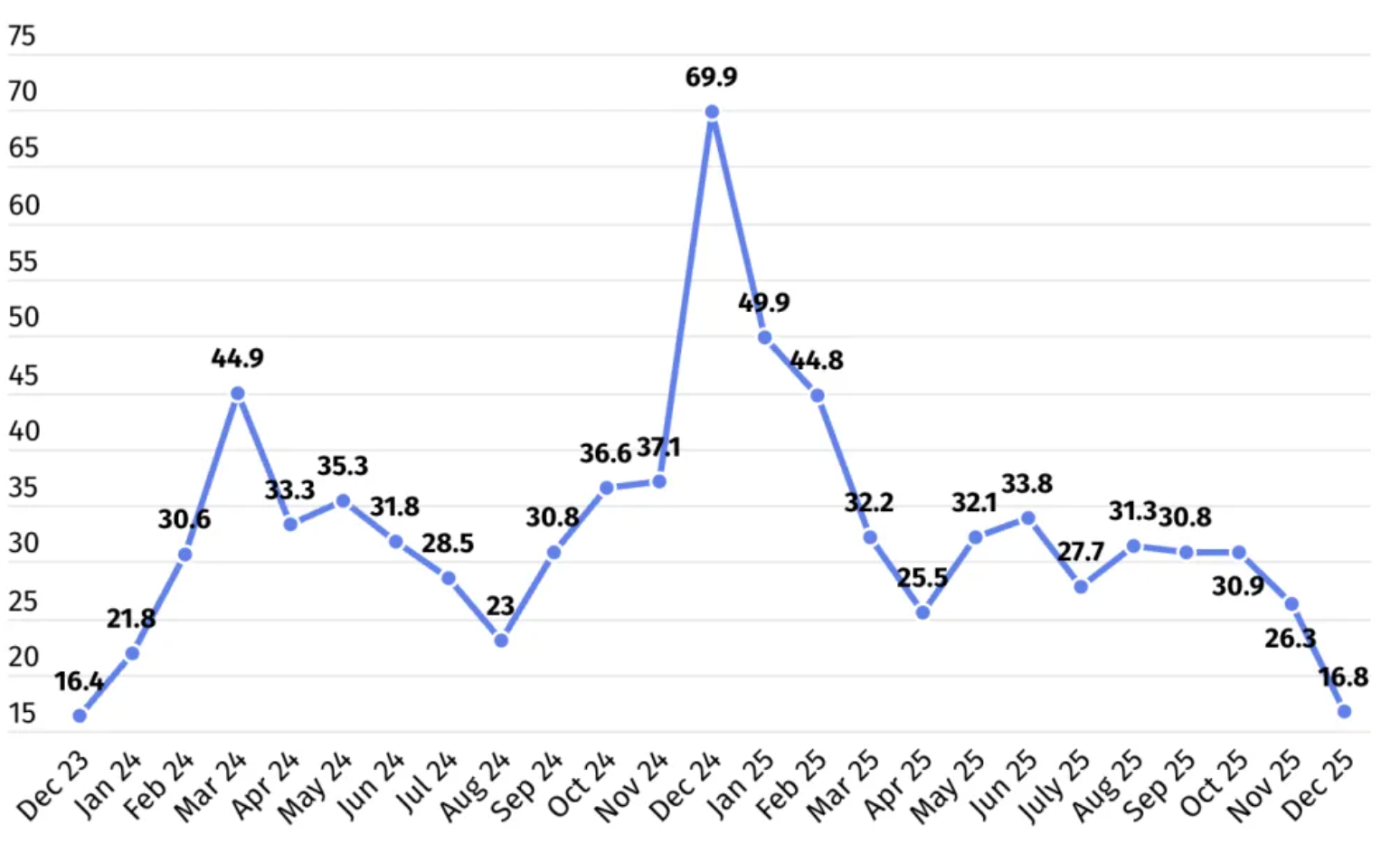

The market capitalization of AI-related tokens has seen a sharp downturn: since December 2024, the sector has lost more than $53 billion in value. The figures were shared by analytics platform CryptoPresales.

After posting triple- and even quadruple-digit gains in previous years, many AI assets have returned to a deep correction. The steepest decline came at year-end: combined across November and December, total market cap fell by another $14 billion.

Estimates of the sector’s current size vary by data aggregator. CoinMarketCap puts the market at about $16.8 billion—roughly four times lower than a year ago. CoinGecko reports a higher figure of around $25.4 billion.

From Record Highs to a Major Sell-Off

AI token market cap hit an all-time high of $69.9 billion in December 2024, driven by a surge of interest in neural networks and AI projects. However, sentiment shifted in Q1 2025: by April, the sector had shed 63% of its value, or approximately $44 billion.

In the second half of the year, the market attempted to stabilize around the $30 billion level, but the broader correction in Q4 erased most of those gains.

Sector Leaders Took the Biggest Hit

The sell-off also affected the segment’s top assets: eight of the top 10 coins dropped more than 70% from their December peaks.

The worst performer was Artificial Superintelligence Alliance (ASI), down 84%. Render (RNDR) and The Graph (GRT) followed, each falling about 82%.

Virtuals Protocol (VIRTUAL) also saw a steep pullback: after surging 3,500% in 2024, it has fallen 73% over the past 12 months. Similar declines were recorded for Injective (INJ), Filecoin (FIL), Internet Computer (ICP), and NEAR Protocol (NEAR).