On December 16, Bitcoin briefly dipped below $86,000. Against this backdrop, Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, said the leading cryptocurrency could fall as low as $10,000 in 2026 under a bearish scenario.

At the time of writing, Bitcoin was trading around $86,464, down roughly 3.7% over the past 24 hours.

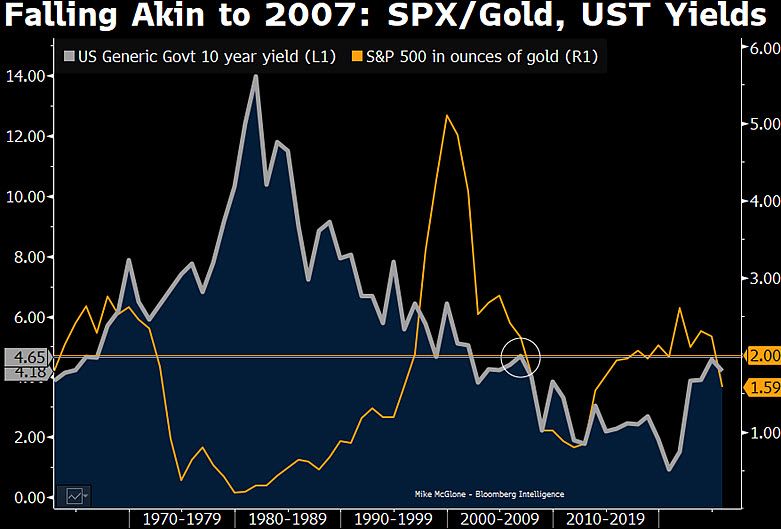

McGlone’s View: Deep Correction Risks in a Speculative Market

McGlone cautioned that the crypto market remains vulnerable to a sharp correction. He suggested that the next economic recession could be triggered by a collapse in highly speculative digital assets with an unlimited supply—projects he believes could accelerate broader risk-off moves.

According to the strategist, many of these assets lack fundamental value and “don’t track anything,” making them especially exposed when market sentiment turns.

At the same time, he pointed to Bitcoin’s relative resilience: as of December 14, BTC had declined by only about 5%, which is modest compared with the volatility seen in many altcoins.

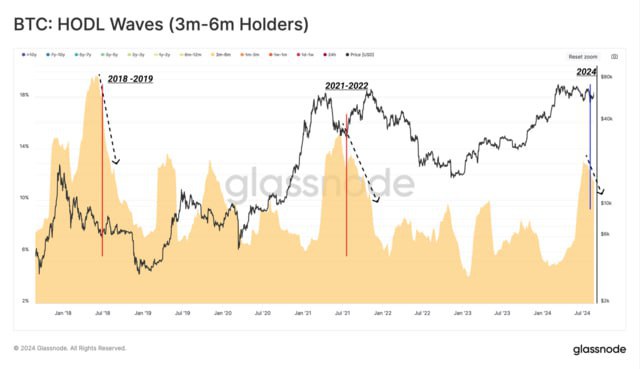

Peter Brandt’s Target: $25,240 in an 80% Drawdown Scenario

Veteran trader and technical analyst Peter Brandt also warned of a potential steep decline, citing a break in Bitcoin’s upward market structure. He noted that bull markets often fade exponentially and that Bitcoin rallies tend to develop in a parabolic pattern—when that trajectory breaks, history has sometimes been followed by declines of more than 80%.

Based on Brandt’s calculations, if an 80% drop from the cycle peak were to repeat, Bitcoin could fall to around $25,240.

Broader Market Weakness: Major Altcoins Slide Too

As Bitcoin moved lower, several major cryptocurrencies also posted notable losses:

- Ethereum fell to $2,941 (−6.3%)

- BNB dropped to $863 (−2.8%)

- XRP declined to $1.89 (−5.3%)

- Solana slipped to $127 (−4%)

What May Have Fueled the Sell-Off: U.S. Session and Year-End Liquidity

Rick Maeda, an analyst at Presto Research, told The Block he does not see strong reasons for a crash. In his view, the sell-off coincided with the U.S. stock market open: the S&P 500 and Nasdaq began the session lower, dragging risk assets—including crypto—down with them.

He added that thin year-end liquidity can amplify moves, making price swings sharper, especially during U.S. trading hours.

Risk-Off Move and Cascading Liquidations

Vincent Liu, Chief Investment Officer at Kronos Research, said the drop was driven by a rapid shift away from risk amid macroeconomic uncertainty. Low liquidity, he argued, turned routine pullbacks into a broader decline.

Liu also pointed to two factors that may have intensified the sell-off:

- mass unwinding of leveraged positions, and

- a seasonal liquidity squeeze at year-end.

Together, these conditions can trigger cascading selling, where forced liquidations accelerate downside momentum.

China Mining Angle: Alleged Shutdowns in Xinjiang

Some market participants linked the decline to developments in China. A trader known as NoLimit suggested the move may have been influenced by mining equipment being shut down in Xinjiang, a region associated with Bitcoin mining activity.

Jack Kong, founder of Nano Labs, said Bitcoin’s network hashrate fell by 8% (around 100 EH/s) from December 14 to 15, estimating that at least 400,000 devices may have gone offline.

Separately, in late November, the People’s Bank of China said it would crack down on illegal activity in the crypto sector.

Presto researcher Min Zhong explained that China’s share of Bitcoin mining had quietly rebounded to about 15% in recent months due to cheap electricity and available data-center capacity. The speed of regulatory action, he said, highlighted how fragile that recovery could be. He also emphasized that there is no direct evidence of mass Bitcoin selling by miners in Xinjiang.

Liu added that a hashrate drop could pressure prices in the short term, but argued that fundamentals remain unchanged and any impact from outages may be temporary.

Outlook: Forecasts for 2026 Vary Widely

Projections for 2026 remain far apart—from McGlone’s highly bearish $10,000 scenario to a more moderate level of around $40,000, which macro analyst Lucas Gromen has also suggested.

As the debate continues, Bitcoin’s trajectory appears tied to a mix of factors: equity-market sentiment, liquidity conditions, regulatory headlines, and the behavior of large market participants.