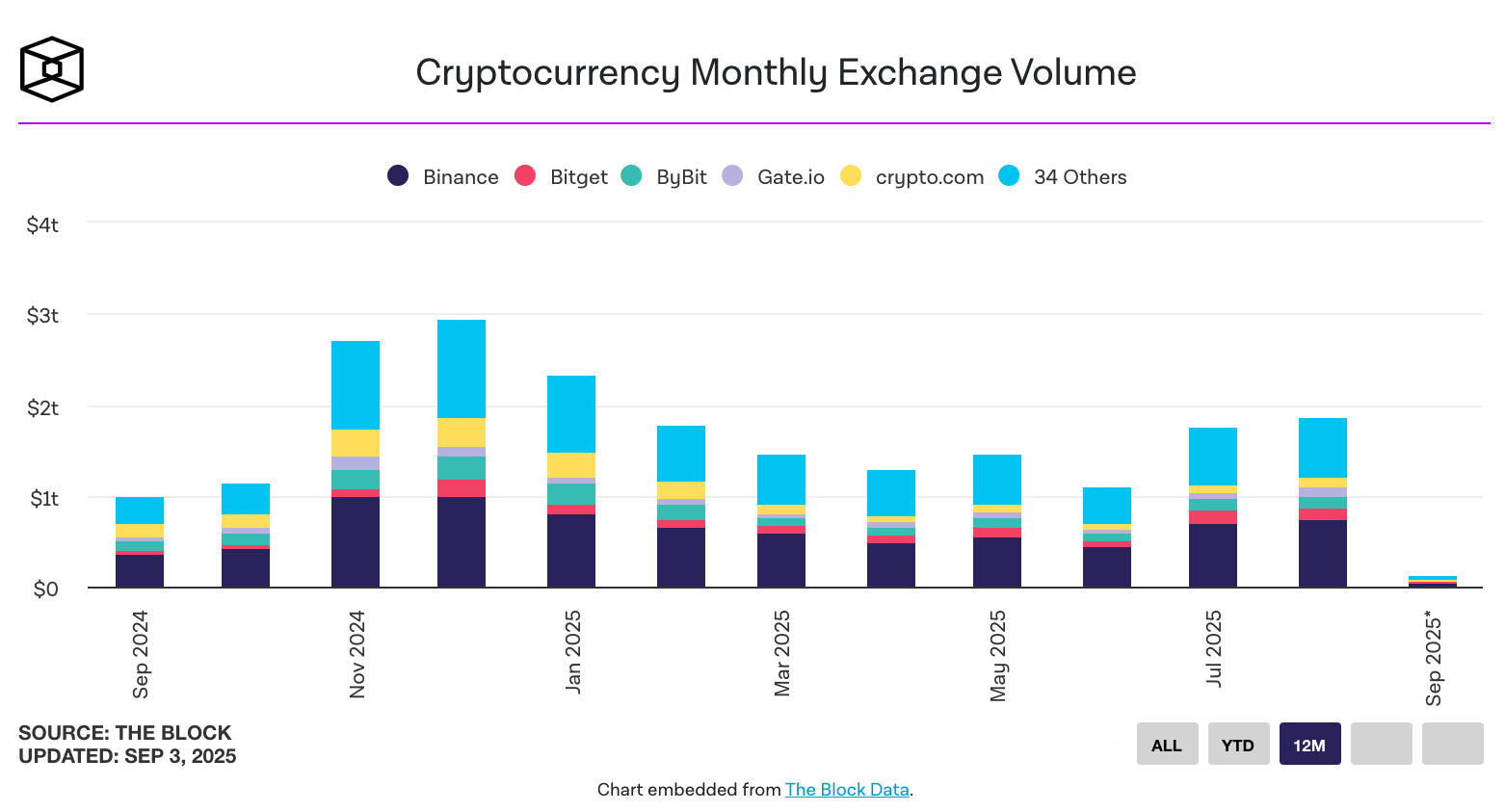

In August 2025, cryptocurrency market activity showed a notable increase. The total trading volume on centralized exchanges (CEX) reached $1.86 trillion, the highest level since January of this year. This figure indicates a renewed interest from market participants in active trading and growing trust in major trading platforms.

Compared to July, the volume grew by 5%, which can be attributed to market revival, increased volatility, and stronger investor interest amid expectations of new regulatory developments and macroeconomic shifts.

Centralized Exchanges: Binance Strengthens Its Lead

Centralized platforms continue to dominate the crypto trading landscape.

- Binance remains the leader with a market share far ahead of competitors. Its spot trading volume rose from $706.1 billion to $737.1 billion, showing stable liquidity inflows and strong user activity.

- Bybit took second place with $126.5 billion in trading volume.

- Close behind was Bitget, posting $126.1 billion, underscoring the intensifying competition among Asian exchanges.

Overall, the picture reflects the dominance of top-tier players but also highlights growing pressure from second-tier platforms.

Decentralized Exchanges: Surge in DEX Activity

Significant developments were also seen in the decentralized exchange (DEX) market. In August, trading volume reached $368 billion, setting a new yearly high.

- Uniswap firmly held the top spot with $143 billion, demonstrating the protocol’s strong relevance and resilience.

- PancakeSwap followed in second place with $58 billion, maintaining its influence within the BNB Chain ecosystem.

The rise of DEX volumes reflects increased trader interest in decentralized platforms, where not only liquidity and fees matter but also security advantages tied to the absence of centralized control.

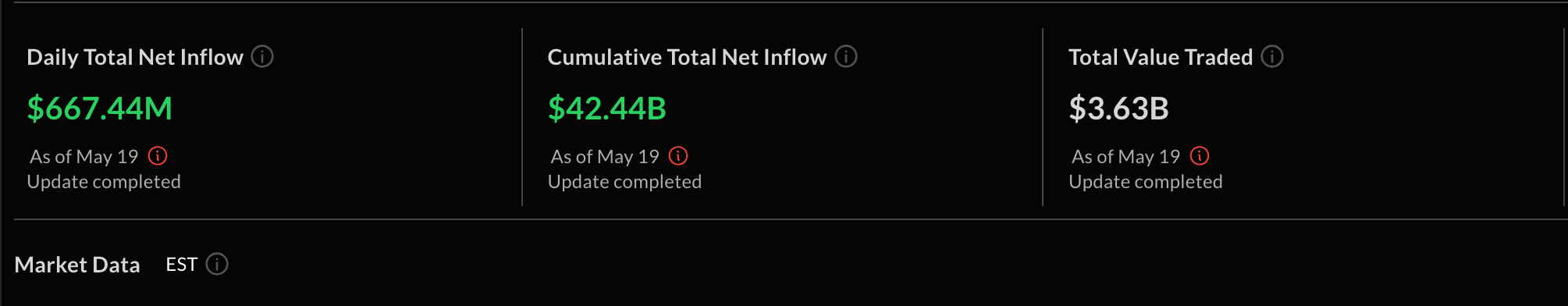

ETFs: Contrasting Trends

Institutional markets showed mixed results.

- U.S. spot Bitcoin ETFs recorded net outflows of $751 million, pointing to temporary investor caution. Likely drivers include profit-taking after BTC’s summer rally and uncertainty ahead of potential Federal Reserve and SEC announcements.

- The leading product remains BlackRock’s IBIT, managing $82.79 billion in assets.

- In second place is Fidelity’s FBTC with $22.2 billion in assets.

- In contrast, Ethereum ETFs posted strong inflows totaling $3.87 billion in August.

- The leader is BlackRock’s ETHA, managing $16.16 billion.

- Next is Grayscale’s ETHE, with $4.58 billion.

This divergence suggests that while institutional demand for Bitcoin is cooling in the short term, Ethereum is gaining traction, supported by expectations around ecosystem growth and second-layer solutions.

Market Outlook

The surge in activity across CEX and DEX, alongside the mixed ETF dynamics, underscores a key trend: the crypto market remains highly volatile, yet is increasingly integrated with the traditional financial system.

Bitcoin and Ethereum ETFs are already approaching the trading volumes of the largest centralized exchanges like Binance. On active days, their turnover reaches $5–10 billion, a milestone that would have seemed improbable just a few years ago.

Looking ahead, experts expect strong interest in digital assets to continue, driven by:

- upcoming regulatory developments in the U.S. and Europe,

- expectations of Federal Reserve rate cuts,

- growing institutional exposure to Ethereum and DeFi-related tokens.

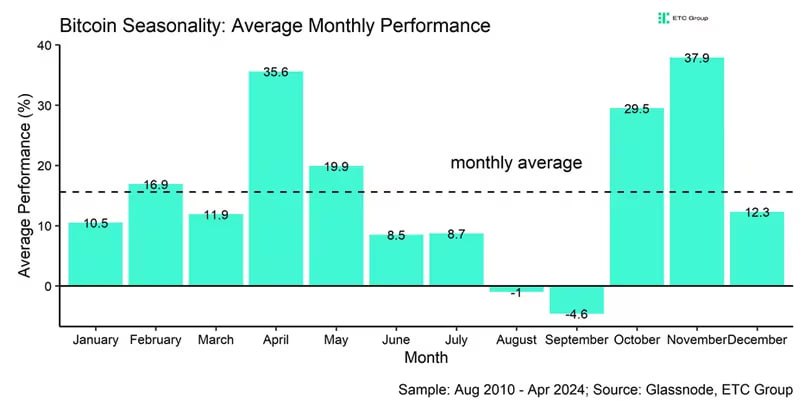

Thus, August can be considered a turning point, once again proving the resilience and attractiveness of the crypto market for both retail traders and institutional players.