Crypto exchange Binance delivered record results in 2025: according to CryptoQuant, total inflows to the platform reached $1.17 trillion, the highest figure among crypto exchanges in the industry’s history.

Compared with 2024, incoming transfers to the platform rose by 31%. At the same time, this metric reflects gross inflows rather than net inflows, since it does not account for withdrawals.

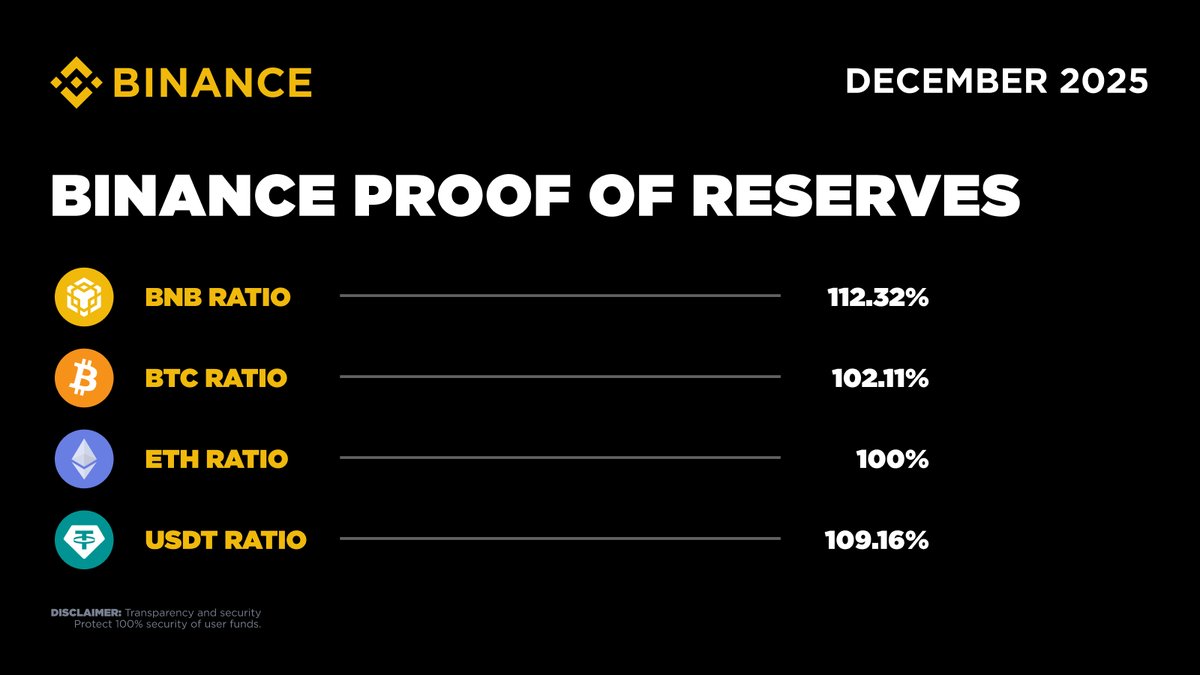

Reserves and Client Assets

Binance holds more than $160 billion in total assets. Of this amount, around $130 billion represents client funds. By total assets held, Binance outpaces its closest competitor, OKX, by nearly eight times.

How Binance Compares to Major Competitors

Binance also led Coinbase in inflows: users sent $946 billion to the U.S.-based platform, which is 31% less than Binance’s figure.

Perpetual Futures Hit a New High

Another record was set in perpetual futures trading volume. Binance posted $24.6 trillion in perpetual futures turnover. For comparison, OKX users traded a total of $10.9 trillion, more than two times lower.

Transactions and Trader Activity

Traders executed 49.6 billion transactions on Binance—33% more than in 2024—highlighting a strong rise in overall user activity.

Spot Market Volume Nears an All-Time High

Spot trading on Binance is also approaching record levels: at the time of writing, spot volume stands at $6.82 trillion, nearing $7 trillion. This is almost five times higher than the closest competitor, Bybit.

The total number of spot trades on the platform reached 24.1 billion, which is 4% higher than last year’s record (23.1 billion).

What These Numbers Mean for the Market

These figures point to the crypto industry’s continued growth and underscore Binance’s significant influence across the sector—from inflows to derivatives and spot market trading.