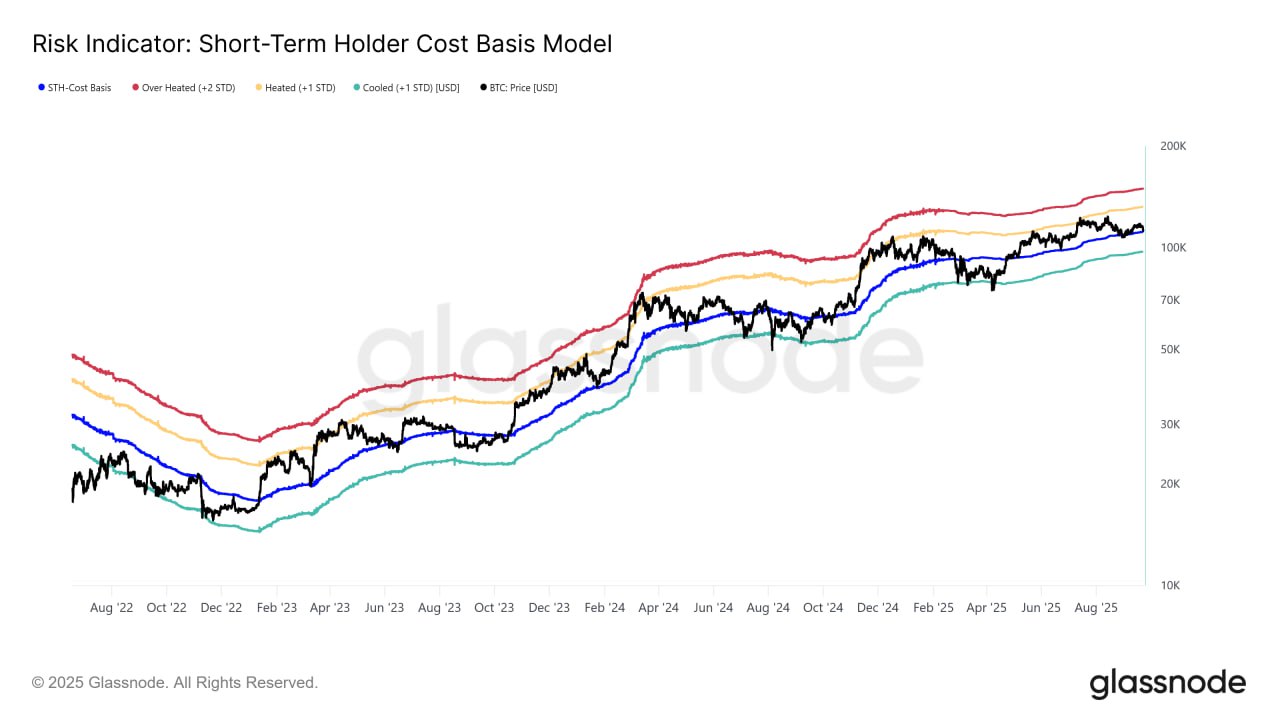

Glassnode analysts have noted a decline in demand for Bitcoin in the spot market. They highlight the cost basis of short-term holders, currently around $111,400, as a key support level. A breakdown below this threshold could indicate a shift toward a bearish trend in the medium term.

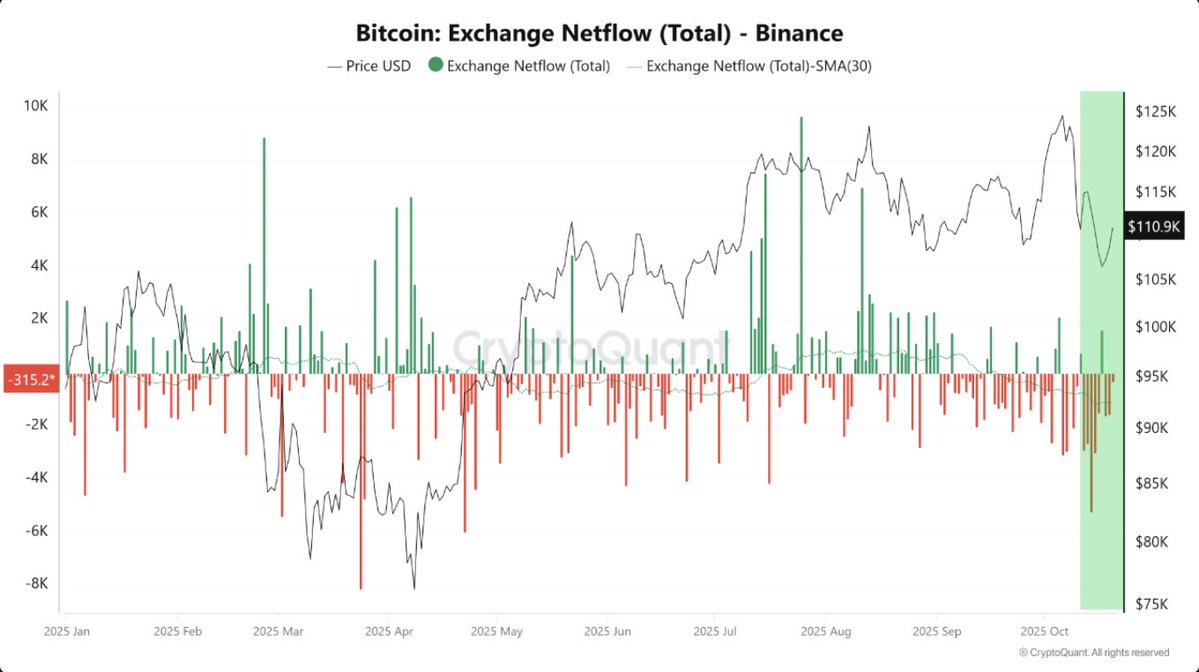

RSI and CVD indicators on the spot market have weakened, while trading volumes have declined. Experts see this as a sign of reduced demand and limited market activity, despite previous price growth.

Mixed Dynamics in Futures and ETFs

The futures market is showing a mixed picture: open interest remains high, but the cumulative delta of perpetual contracts has sharply moved into negative territory, driven by aggressive selling with leverage.

After strong inflows, demand for U.S. spot Bitcoin ETFs has weakened. Net inflows have turned into outflows, signaling caution from institutional investors and a temporary pause in accumulation.

On-Chain Activity Without Overheating

Despite weakness in spot and futures markets, on-chain metrics show growth: the number of active addresses and transaction volumes have increased. At the same time, fees have declined, suggesting broader user participation without signs of speculative frenzy.

According to analysts, the overall market structure resembles the pattern of “buy the rumor, sell the news,” with weaker spot demand, futures selling, and slowing ETF inflows putting pressure on the price.

After the Liquidations

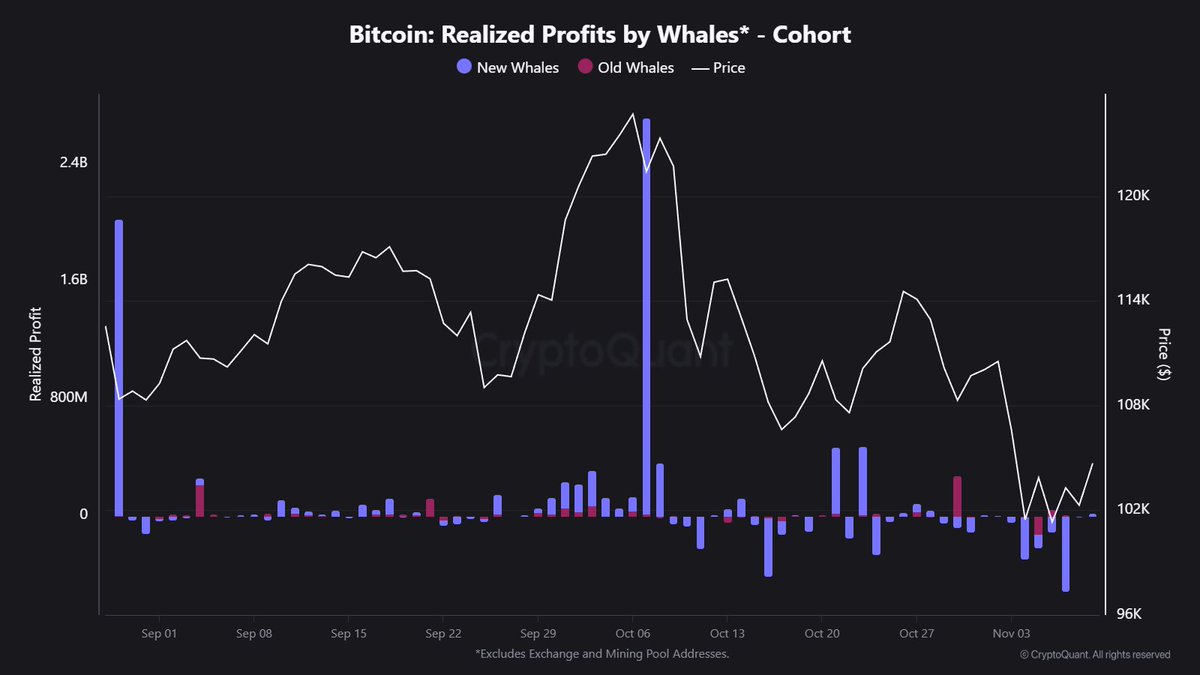

According to QCP Capital, the crypto market stabilized after forced liquidations totaling more than $1.7 billion. Bitcoin is holding above $112,000, while Ethereum trades near $4,100. Despite the sharp drop, equity markets continued to grow on the back of Fed rate cuts, and gold reached a new all-time high.

The crash followed an overheated rally in altcoins ASTER, HYPE, and PUMP. The Altseason Index dropped from nearly 100 to 65 points, while Bitcoin dominance rose to 57%. Ethereum’s share fell to 12%.

Institutional Support and Outlook

Analysts emphasize that institutional support remains strong. Companies such as Strategy and Metaplanet continue to accumulate Bitcoin, while recent ETF inflows confirm interest in buying the dip.

Notably, Bitcoin posted a 4% gain in September, which is historically a weak month for the crypto market. Traders are now preparing for October, traditionally a bullish period. There is growing demand for call options with strike prices in the $120,000–125,000 range.

Macro Factors and Expectations

Key events this week include Fed Chair Jerome Powell’s speech on September 24 and U.S. inflation data on September 26. If macroeconomic conditions remain under control, markets may anticipate further rate cuts, opening new liquidity flows.

Experts believe that macro factors could become the catalyst for Bitcoin to break out of the $110,000–120,000 range and shift market focus back to the leading cryptocurrency.