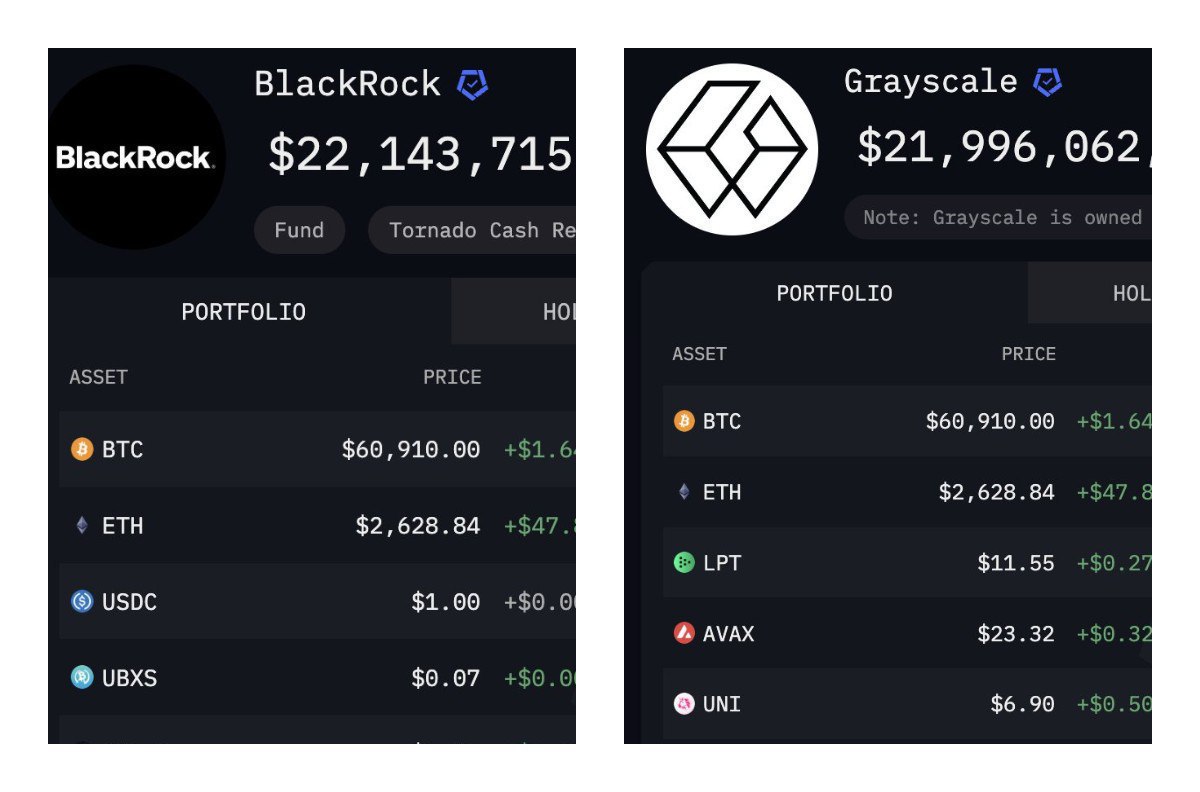

BlackRock: $22.143 billion

Grayscale: $21.996 billion

This is a significant event for the market, as Grayscale continues to sell off its assets, putting pressure on the market. For example, the spot ETF for ETH has been unable to show significant results due to large-scale sell-offs. Such sales create uncertainty and deter investors from making substantial market investments.

It is estimated that it will take Grayscale between 3 to 9 months to fully liquidate its remaining assets. During this period, the market may continue to experience volatility, particularly with the assets that Grayscale is actively selling. However, as BlackRock strengthens its position, the market could see changes in dynamics, especially with increasing institutional interest in cryptocurrencies and growing trust in major players like BlackRock.