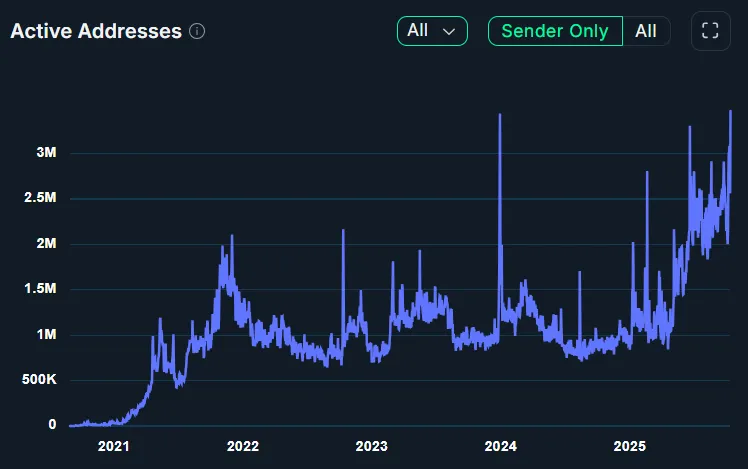

On October 13, the BNB Chain network reached a historic milestone — 3.46 million active addresses, marking the highest number of active users in its history. This achievement coincided with a new price record for the network’s native token, BNB.

New Milestone and Network Dynamics

The previous peak of 3.44 million active users was recorded in December 2023. As of now, the network maintains around 3.1 million active users.

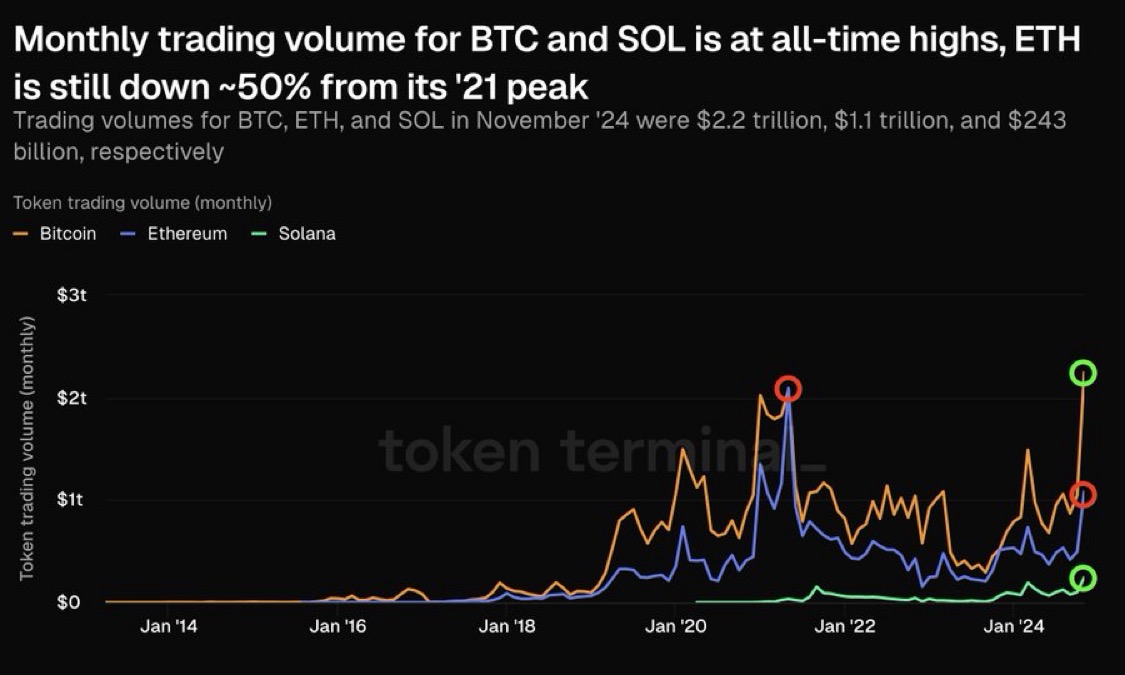

Over the past 30 days, network activity has surged significantly: the number of transactions exceeded 500 million, representing a 151% increase compared to the previous period. By this metric, BNB Chain trails only Solana, which recorded about 1.8 billion transactions.

Market Context: Reaction to Global Events

The surge in activity came as the crypto market rebounded from a sharp decline on October 11, triggered by U.S. President Donald Trump’s announcement of 100% tariffs on goods imported from China. While the news briefly rattled markets, BNB Chain quickly recovered and saw renewed on-chain engagement.

BNB Price Performance

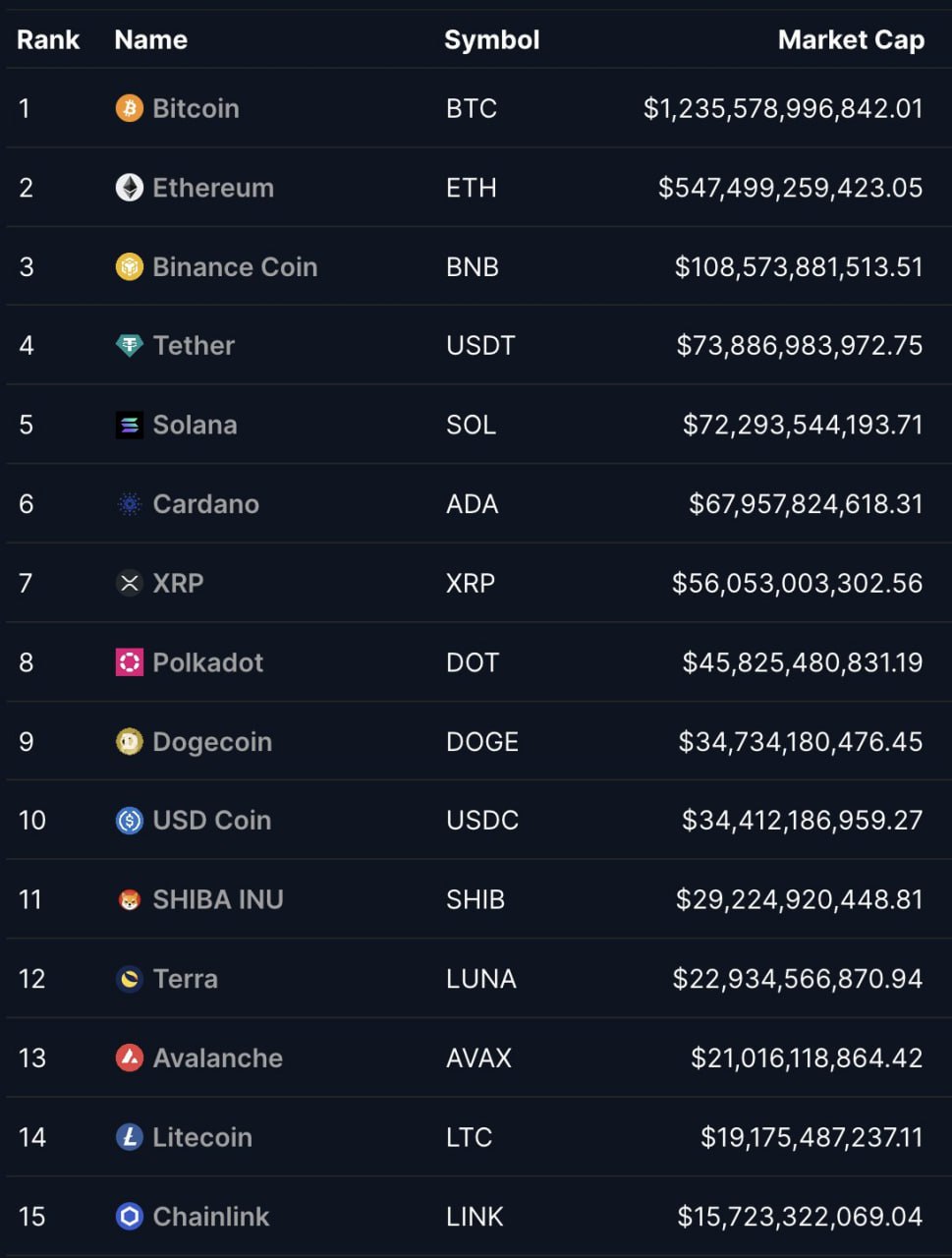

Despite the rise in network activity, the BNB token fell by 9.7% over the past 24 hours, dropping to $1,158. From its recent peak, the asset has corrected by approximately 16%, according to CoinGecko data.

Technical indicators suggest that the correction may not be over yet. The weekly Relative Strength Index (RSI) recently hit 81 points, signaling overbought conditions, and has since dropped to 71. Historically, such high RSI readings have preceded significant pullbacks — with declines of 70% in 2021 and 44% in July 2024.

An analyst known as Saint noted that RSI remains in the overbought zone across multiple timeframes, indicating “a potential for price correction.” On the four-hour chart, a “double top” pattern has formed, suggesting a possible decline toward the $1,000 neckline level.

Growth Potential Remains

Despite short-term technical risks, some experts remain bullish on BNB’s long-term outlook. They argue that a $2,000 target is “not out of reach,” citing strong on-chain activity and Binance’s recent decision to compensate users with $283 million as key positive factors.