Circle, the issuer of the leading stablecoin USDC, is preparing to deepen its collaboration with Hyperliquid, a decentralized exchange specializing in perpetual futures.

Early Signs of Integration

Blockchain researcher MLM reported test transactions of USDC on HyperEVM, the main network of Hyperliquid, which may indicate the imminent launch of a native version of the stablecoin. Another signal came when a Circle-linked wallet purchased HYPE tokens worth $4.6 million.

These moves followed a statement from Circle co-founder and CEO Jeremy Allaire, who promised a “grand entrance” into the Hyperliquid ecosystem.

“We intend to become a major player and contribute to it. […] Ultra-fast native USDC with deep and nearly instant cross-chain interoperability will be well received,” Allaire noted.

Technical Aspects

According to the company’s blog, in addition to USDC, the CCTP V2 protocol will be integrated into the Hyperliquid blockchain, enabling seamless cross-network transfers of the stablecoin. This upgrade is aimed at improving speed and convenience of interoperability across different blockchains.

Competition for Native Stablecoin Status

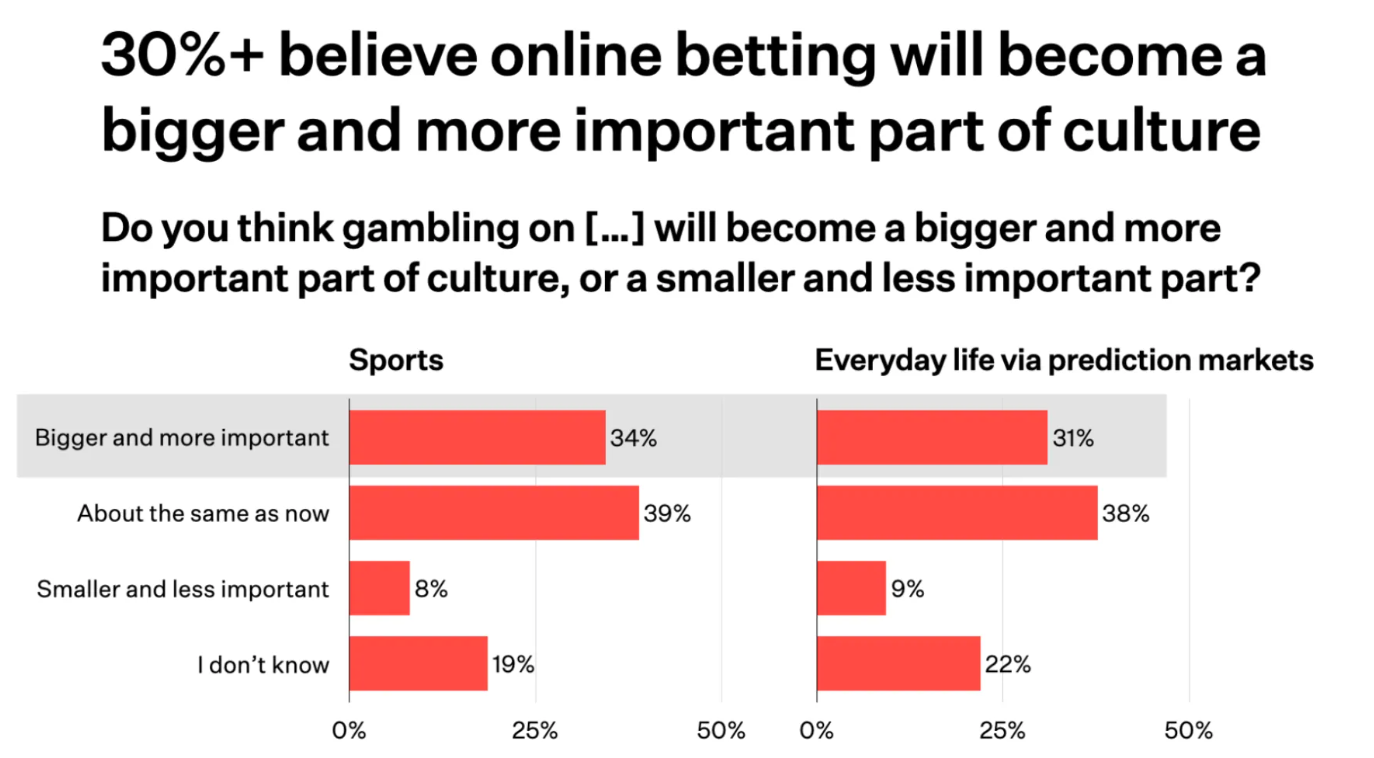

Circle’s increased interest in Hyperliquid comes as the exchange’s community votes on the choice of issuer for its native stablecoin USDH. Prediction market Polymarket currently estimates a 96.8% chance of approval for the Native Market proposal, while Paxos lags at 1.8%. Proposals from Ethena and Frax Finance have virtually no support.

USDC’s Position on Hyperliquid

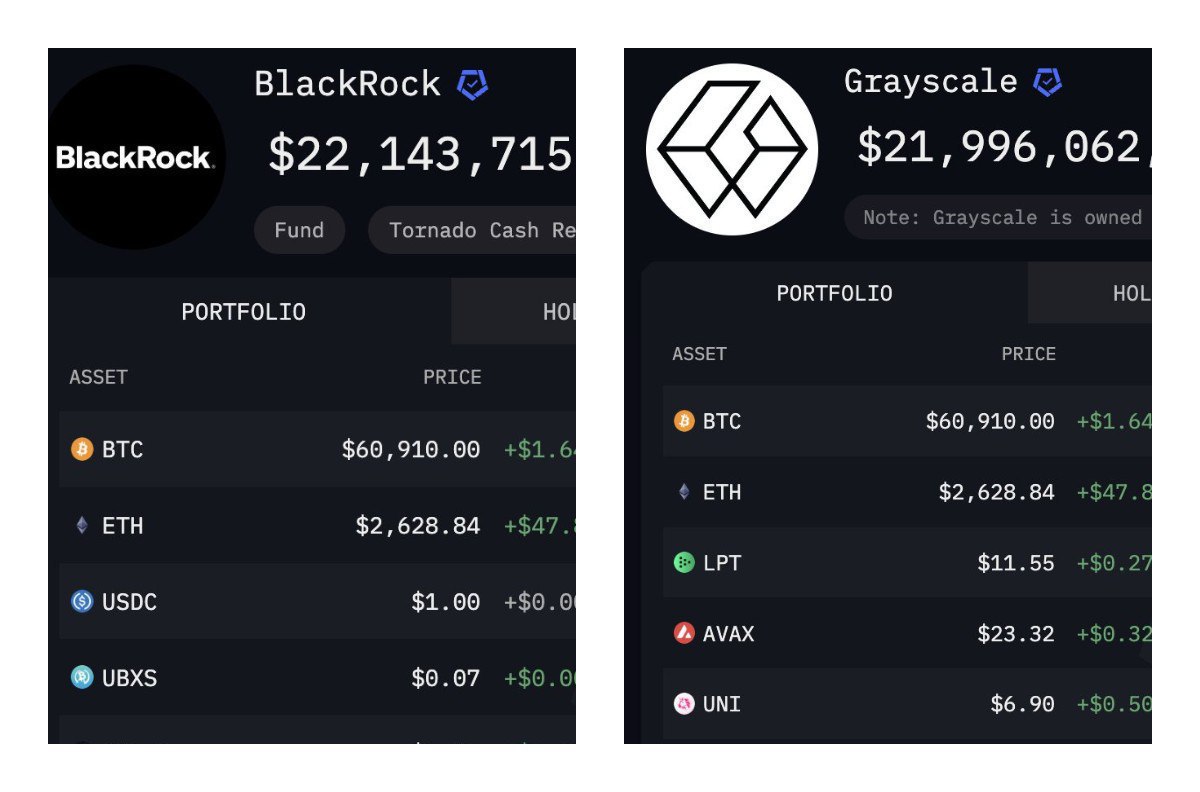

According to DeFi Llama, the total stablecoin volume on Hyperliquid reached $6.1 billion over the past 24 hours. USDC dominates with a 95.6% share, accounting for $5.85 billion.

Overall, USDC’s market capitalization stands at $73.1 billion, with Hyperliquid representing around 8% of total issuance.

Exchange Performance

Hyperliquid continues its rapid growth. In August, the platform posted record revenue of $106 million, while perpetual contract trading volumes approached $400 billion. The exchange’s market share in the segment rose to 70%, solidifying its leadership position.