Coinbase, the leading U.S. cryptocurrency exchange, has released its financial results for the fourth quarter of 2025. The report reflects a period of significant industry turbulence: following the publication, the company’s stock (COIN) hit a two-year low in post-market trading, though it later showcased the high volatility characteristic of the sector.

Financial Performance: The Weight of the “Bearish” Trend

The end of 2025 proved challenging for the crypto industry, with total market capitalization dropping by 25% (approximately $1.1 trillion). This downturn directly impacted the exchange’s top line, with total revenue declining 5% quarter-over-quarter to $1.8 billion.

Key Figures from the Report:

- Net Loss: $667 million (primarily driven by negative revaluations of the crypto portfolio and strategic investments).

- Transaction Revenue: $983 million (down 6%).

- Subscription and Services Revenue: $727 million (down 3%).

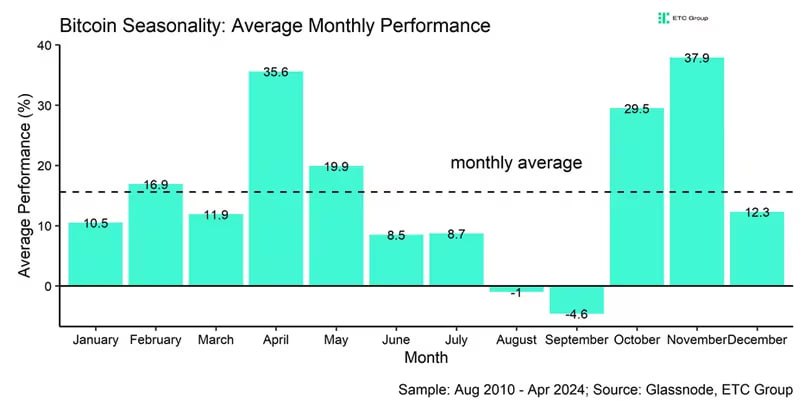

Analysts at Coinbase Institutional have characterized the current slump as a necessary “reset,” designed to stabilize the ecosystem before the start of a new growth cycle.

Tectonic Shifts in Revenue Structure

Despite the overall decline in volume, significant structural changes are occurring within Coinbase’s business model:

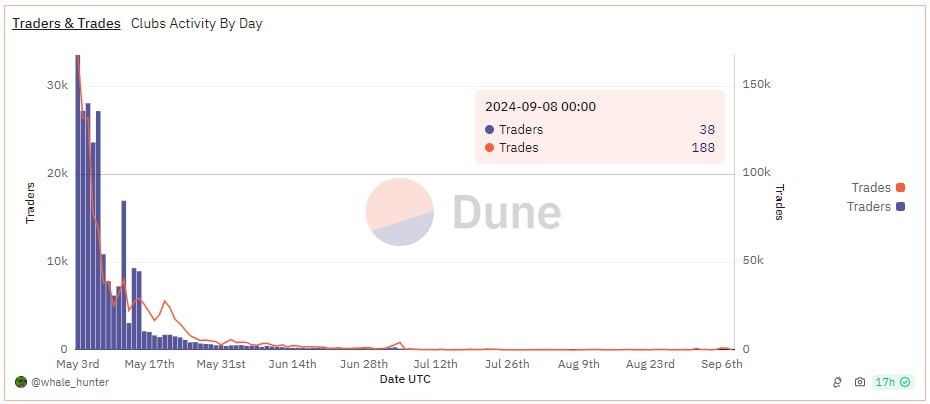

- Institutional Breakthrough: While retail transaction revenue dropped by 13%—partly due to users migrating to lower-fee “Advanced Trading” tools and the growing popularity of the Coinbase One subscription—the institutional segment saw growth. This was fueled by derivatives trading, bolstered by the integration of the recently acquired Deribit platform.

- Stablecoin Resilience: Revenue from the stablecoin segment grew by 3%, reaching $364 million. Record-high average USDC balances on the platform helped offset the impact of lower interest rates.

- Financial Cushion: Coinbase maintains a strong liquidity position with $11.3 billion in cash and equivalents. Demonstrating confidence in its valuation, the company continued its buyback program, purchasing approximately $1.7 billion of its own shares by early February 2026.

Wall Street Reaction and the “Armstrong Effect”

The market reacted sharply to the report. Initially, COIN shares tumbled 4% in post-market trading, hitting a two-year low of $135. However, the stock quickly recovered, finishing up 4%.

Recent pressure on the stock has been exacerbated by news of CEO Brian Armstrong selling $500 million worth of shares, alongside broader weakness across the entire tech and crypto sectors.

The Future: The “Everything Exchange” Concept

Coinbase is moving beyond being just a crypto exchange. The company’s strategic roadmap focuses on becoming a universal financial platform:

- Integration of traditional stocks and ETFs.

- Launch of prediction markets within the U.S.

- Expansion of derivatives and global payment infrastructure.

Q1 2026 Outlook: The start of the year shows signs of life, with transaction revenue already reaching approximately $420 million. However, management has cautioned investors against projecting these results linearly, as the $700 billion market drop in early 2026 keeps the outlook highly volatile.