The cryptocurrency market is facing a severe stress test. A convergence of macroeconomic pressures, shifts in U.S. monetary policy, and the capitulation of long-term investors are casting doubt on the continuation of the current bull cycle. Below, we break down the causes of the recent downturn and identify the key support levels to watch.

Holders in the Red: A Structural Trend Shift

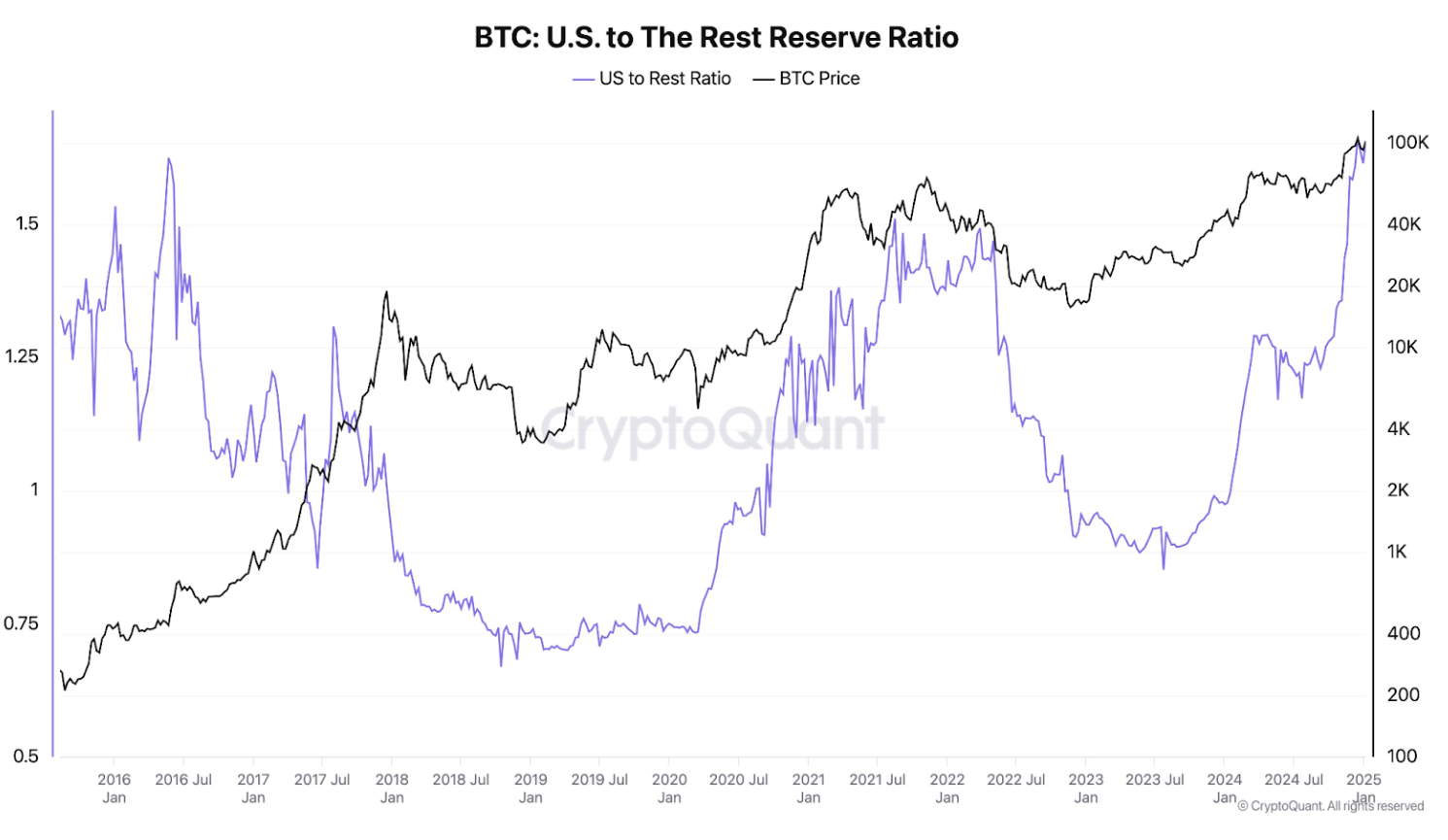

According to CryptoQuant analyst Crazzyblockk, the market is at risk of entering a prolonged depressive phase. The primary indicator is the behavior of investors who have held Bitcoin for 12 to 18 months.

Currently, Bitcoin is trading below the “realized price” (the average acquisition cost) for this group. Historically, this is a major warning sign: when the asset remains below this level for an extended period, a standard correction often evolves into a structural bearish trend.

Key Accumulation Issues:

- Waning Buy Pressure: Although total balances are technically growing, the pace of accumulation has slowed significantly.

- Sell-Side Pressure: The realized price has flipped from support to heavy resistance. Investors are now using local price bounces as opportunities to “break even,” effectively capping any recovery efforts.

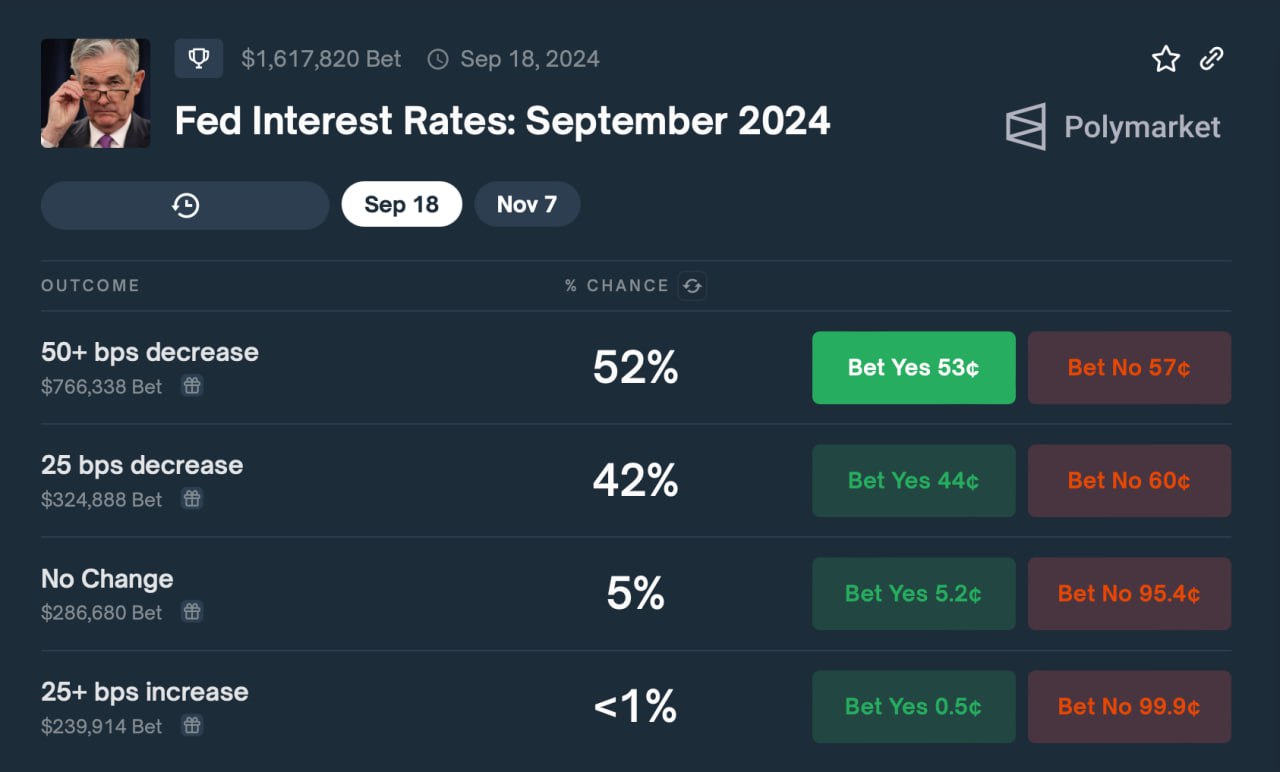

The “Fed Factor” and Political Shifts

Bitcoin’s sharp drop below the psychological $80,000 mark is being linked to administrative changes within the U.S. financial system. The nomination of Kevin Warsh as the next Fed Chair was interpreted by markets as a hawkish signal, suggesting a move toward tighter monetary policy.

Market Consequences:

- Cascading Liquidations: The sell-off triggered a massive deleveraging event, with forced liquidations of long positions exceeding $2.5 billion.

- Global Risk-Off Sentiment: Investors are retreating not just from crypto, but also from ETFs, gold, and silver.

- Liquidity Crisis: Analyst Darkfost highlights a dangerous reversal—after two years of growth in stablecoin capitalization, a massive outflow from exchanges has begun (over $4 billion in the last month).

Technical Analysis: Where is the Bottom?

Analysts from QCP Capital and CryptoQuant have identified several critical zones that will determine Bitcoin’s fate in the coming months:

| Level | Significance | Scenario |

| $80,000 | Psychological Barrier | Reclaiming this level would provide a “breather” and potential bullish momentum. |

| $76,000 | Institutional Entry Point | A vital support zone where large-scale buying (e.g., Binance SAFU fund) has been spotted. |

| $74,500 | 2025 Yearly Lows | A technically critical point. Holding below this opens the door to 2024 trading ranges. |

Expert Insight: Analyst Arab Chain warns of a spike in the volatility indicator (z30). Historically, such anomalies on Binance precede a powerful move. The question remains: is this a final “flush” before a recovery, or the start of a deeper crash?

The Bottom Line

Bitcoin is currently in a state of high uncertainty. The lack of fresh stablecoin inflows, combined with fears surrounding Federal Reserve policy, has created a “perfect storm” for bears. Until the price stabilizes above the cost basis of long-term holders, any rallies should be viewed as temporary corrections within a broader downtrend.