The digital asset market is facing significant headwinds. In early February 2026, the price of the leading cryptocurrency saw a sharp decline, retreating to levels last seen 15 months ago. Amid macroeconomic instability in the U.S. and massive liquidations in the futures markets, analysts are beginning to signal a “capitulation” phase.

A Sharp Cooling After Record Highs

On February 3, Bitcoin (BTC) tumbled to $73,111, a level not seen since early November 2024. This painful retracement follows a triumphant period for the market, which saw BTC hit an all-time high of $126,080 in October 2025.

As of now, the asset is trading around $76,715. After a prolonged period of consolidation near the $80,000 mark earlier this year, bears have seized control, triggering a wave of sell-offs.

Key Bearish Indicators:

- Unrealized Losses: According to Glassnode, 44% of the total BTC supply is currently “underwater” (held at a loss).

- Liquidations: Over $704 million in positions were forcibly closed on the futures market within a single 24-hour window.

- RSI Indicator: The Relative Strength Index has dropped to 30 points, signaling oversold conditions.

“Investors who entered the market near the peaks are now realizing losses. The coming weeks will be a true test of conviction for the crypto community,” says Sean Rose, a manager at Glassnode.

Macroeconomic Headwinds and Altcoin Performance

The crypto market downturn is not occurring in a vacuum. Investor sentiment is being weighed down by U.S. economic uncertainty and the looming threat of a government shutdown. The tech sector is also struggling, with the Nasdaq Composite losing 2.2%.

Major altcoins are following Bitcoin’s lead, and shares in crypto-linked companies (such as Coinbase and MicroStrategy) have seen declines ranging from 6% to 8%.

Snapshot of Major Assets: | Asset | Price | 24h Change | | :— | :— | :— | | Ethereum (ETH) | $2,272 | -2.0% | | Solana (SOL) | $98 | -5.3% | | BNB | $761 | -2.1% | | XRP | $1.60 | -0.6% |

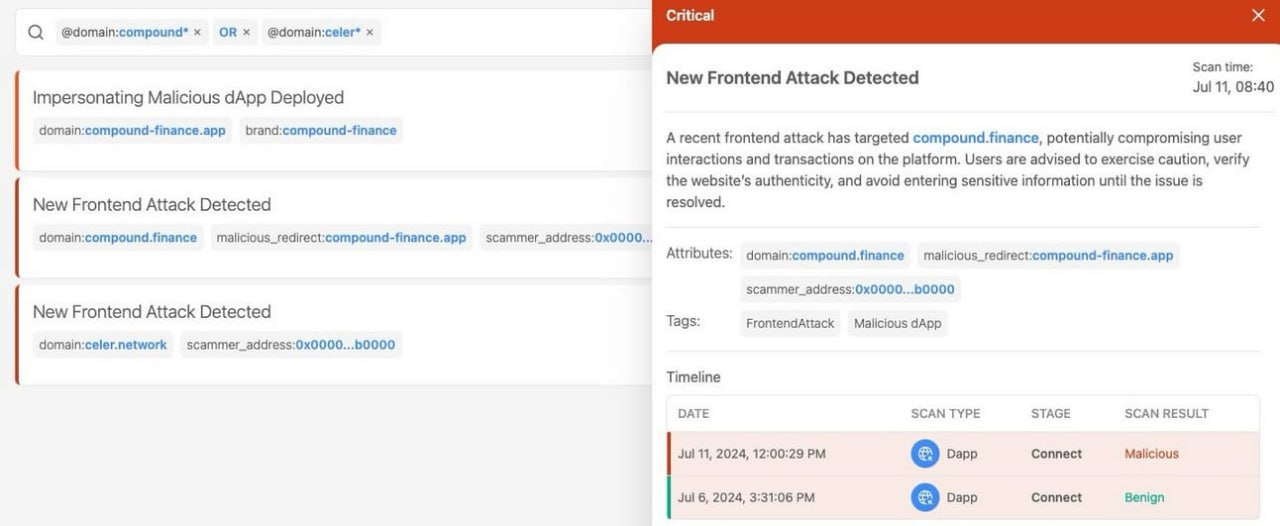

The ETF Paradox: Outflows in BTC, Inflows in Alts

Institutional investors are showing mixed behavior. On February 3, spot Bitcoin ETFs recorded a net outflow of $272 million, led by Fidelity’s FBTC fund.

Conversely, spot ETFs for Ethereum, XRP, and Solana saw positive capital inflows despite the general market trend. This may suggest a localized rotation of capital within the crypto ecosystem.

Searching for the Bottom: Historical Analogies

Data from CryptoQuant highlights a massive drop in profitable addresses: since November 2024, approximately 8 million BTC have shifted into the “unrealized loss” category. However, experts urge against panic.

An analyst known as RugaResearch believes the current situation is a classic “capitulation stage.” In his view, current on-chain metrics mirror the market bottoms of 2018, 2020, and 2022.

Historical Duration of the “Bottoming” Phase:

- 2018: 8 months of stagnation before a recovery.

- 2020: A lightning-fast rebound following the “Covid crash.”

- 2022: A 6-month base-building phase.

If the market follows the more pessimistic 2022 scenario, analysts at The Block suggest prices could drop another 20%, potentially reaching $60,000. Nevertheless, for long-term players, current levels may represent a superior risk-to-reward entry point.