Castle Island Ventures conducted a study on the pace of stablecoin adoption.

A survey of 2,541 participants revealed that 50% of respondents prefer using stablecoins to pay for goods and services.

A ranking of countries with the highest interest in stablecoins was also compiled, with Nigeria, India, Indonesia, Turkey, and Brazil making the list.

USDT remains the most popular stablecoin, while Ethereum leads among blockchains hosting stablecoins, followed by Solana and Tron.

Additionally, analysts pointed out that users store their stablecoins not only on exchanges but also in autonomous wallets.

The study further showed that the main reasons people in these countries prefer stablecoins are the high volatility of local currencies, difficulties accessing banking services, and the need for international transfers.

Analysts noted that stablecoins play a crucial role in e-commerce and cross-border transactions, especially in emerging markets where cryptocurrencies are becoming a vital financial tool.

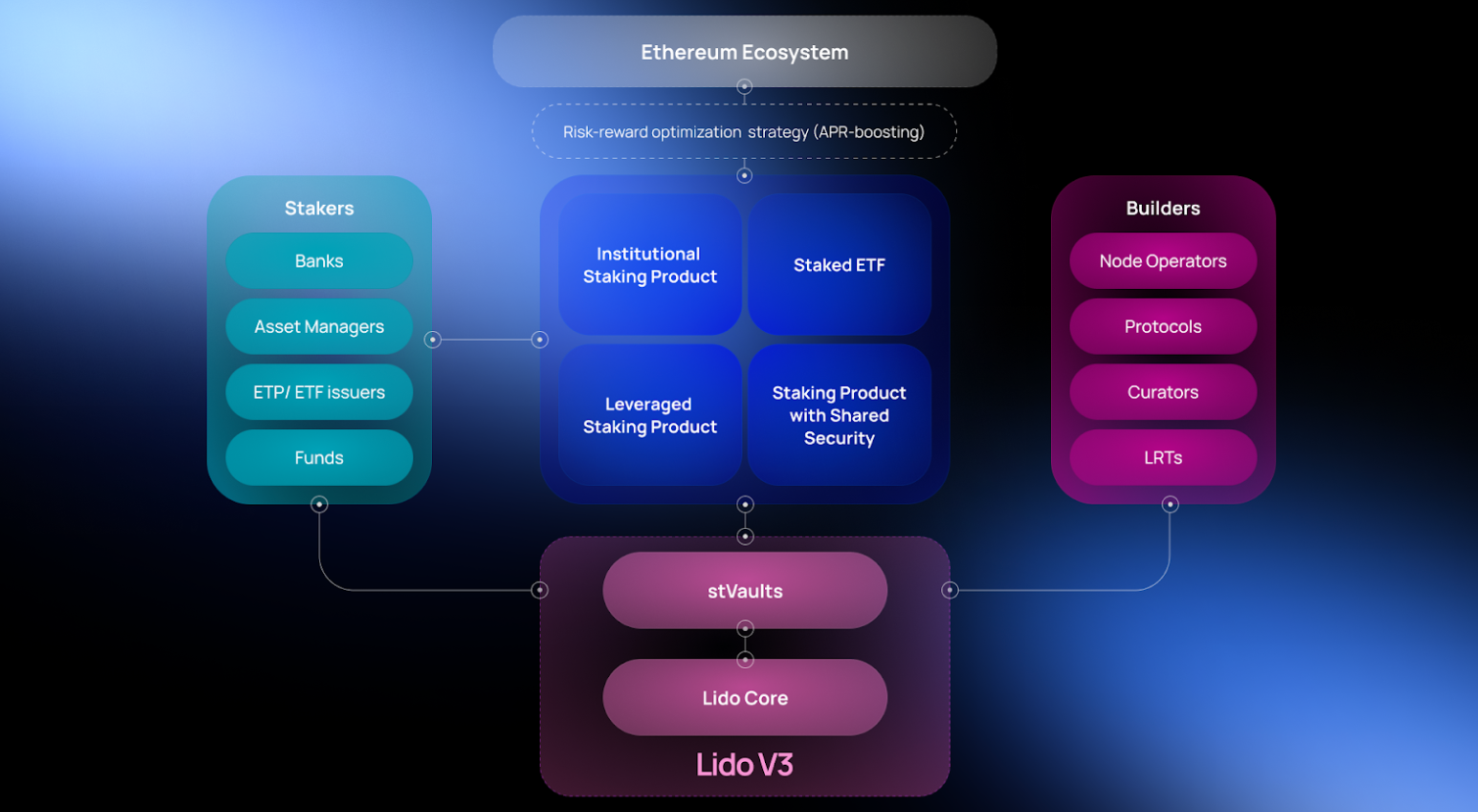

Moreover, CIV highlighted the growing interest in decentralized finance (DeFi), where stablecoins are used for savings and investments. The trend of using autonomous wallets reflects people’s desire for greater security and control over their assets, particularly in times of economic instability.

This phenomenon indicates that stablecoins could become a key link in the global financial system, providing access to stable and efficient transactions even in countries with limited traditional banking services.