The Ethena protocol plans to launch a new stablecoin, iUSDe, for institutional players and introduce a payment application based on Telegram. This was announced by the project’s founder, known as G.

These plans are scheduled to be implemented in the first quarter of 2025, marking a key step in Ethena’s evolution into a “neobank.”

“The next stage of our growth will focus on entering traditional finance. We already have the necessary infrastructure, a clear understanding of the regulatory landscape in TradFi, and the scale of opportunities far exceeds anything we’ve seen in cryptocurrency so far,” said G.

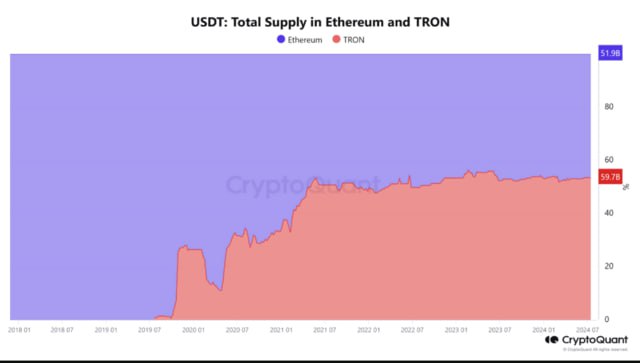

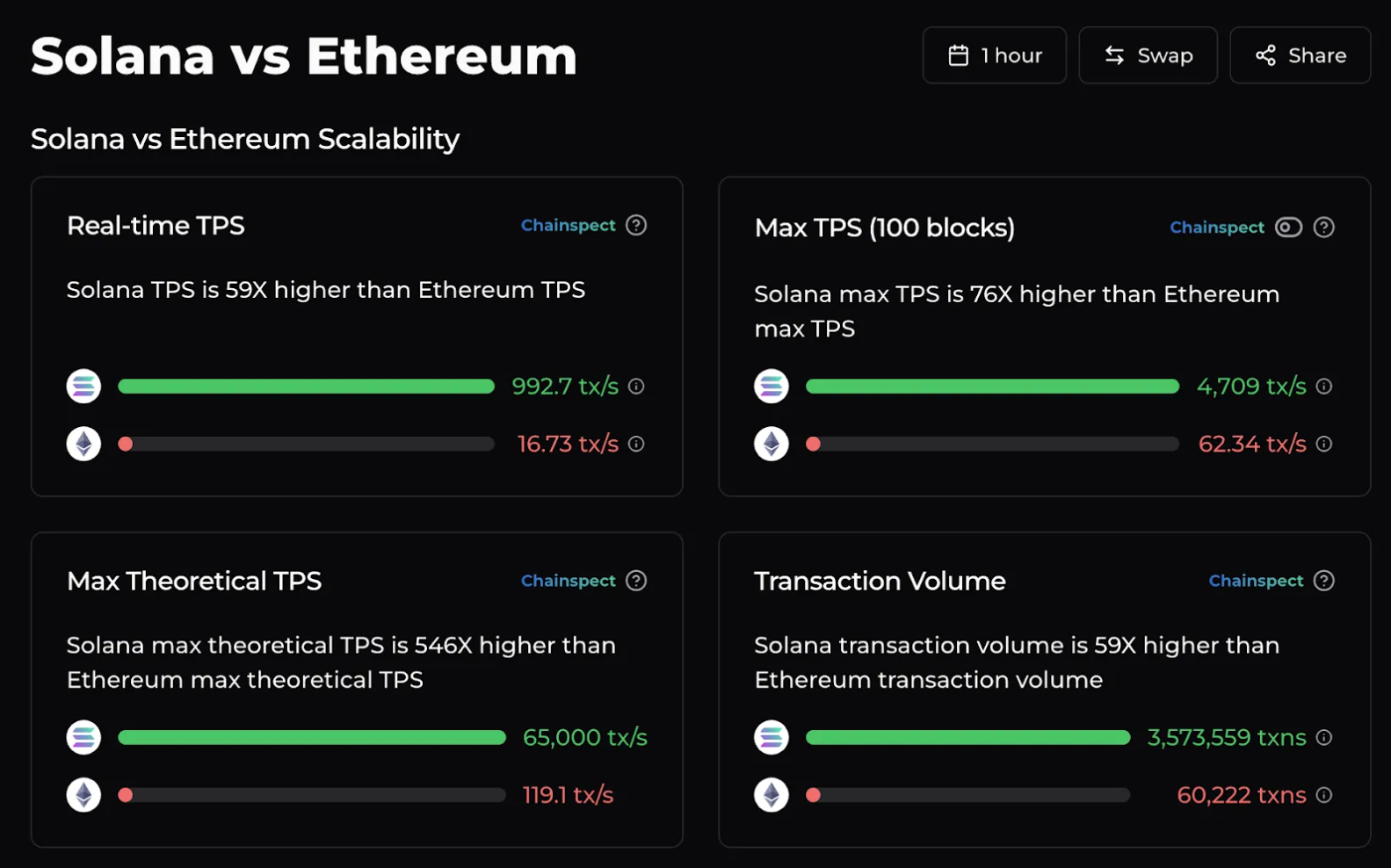

According to the team, Ethena accounted for approximately 85% of the growth in dollar-denominated digital assets on the Ethereum network in 2024 (excluding USDT and USDC). Additionally, in December 2024, Ethena’s annualized rate surpassed $1.2 billion, making it the second-fastest crypto startup to reach $100 million in revenue, after Pump.fun on Solana.

The new synthetic stablecoin, iUSDe, is designed for the traditional financial market. G expects it to be adopted by asset managers, ETF issuers, brokers, credit funds, and investment trusts.

According to the founder, iUSDe is “identical” to the sUSDe token, which users earn as staking rewards for USDe. The mechanism of the new token allows for programmable transfer restrictions to maintain trust within financial institutions.

Organizations will be able to acquire iUSDe without engaging directly with cryptocurrency infrastructure—through the purchase of shares in special-purpose companies.

Since USDe is pegged to the US dollar, financial institutions can evaluate iUSDe as a spread over risk-free rates. G also highlighted that the asset’s yield negatively correlates with real interest rates, offering an additional advantage to investors.

The upcoming Telegram-based application will utilize the TON blockchain and integrate with Apple Pay, enabling users to make direct mobile payments.

Additionally, Ethena’s founder announced two new products:

- Ethereal — a cryptocurrency exchange supporting both spot and futures trading.

- Derive — a protocol offering on-chain options and structured products collateralized with sUSDe.

It’s worth noting that in December 2024, Ethena launched the USDtb stablecoin in collaboration with Securitize, a platform specializing in RWA.