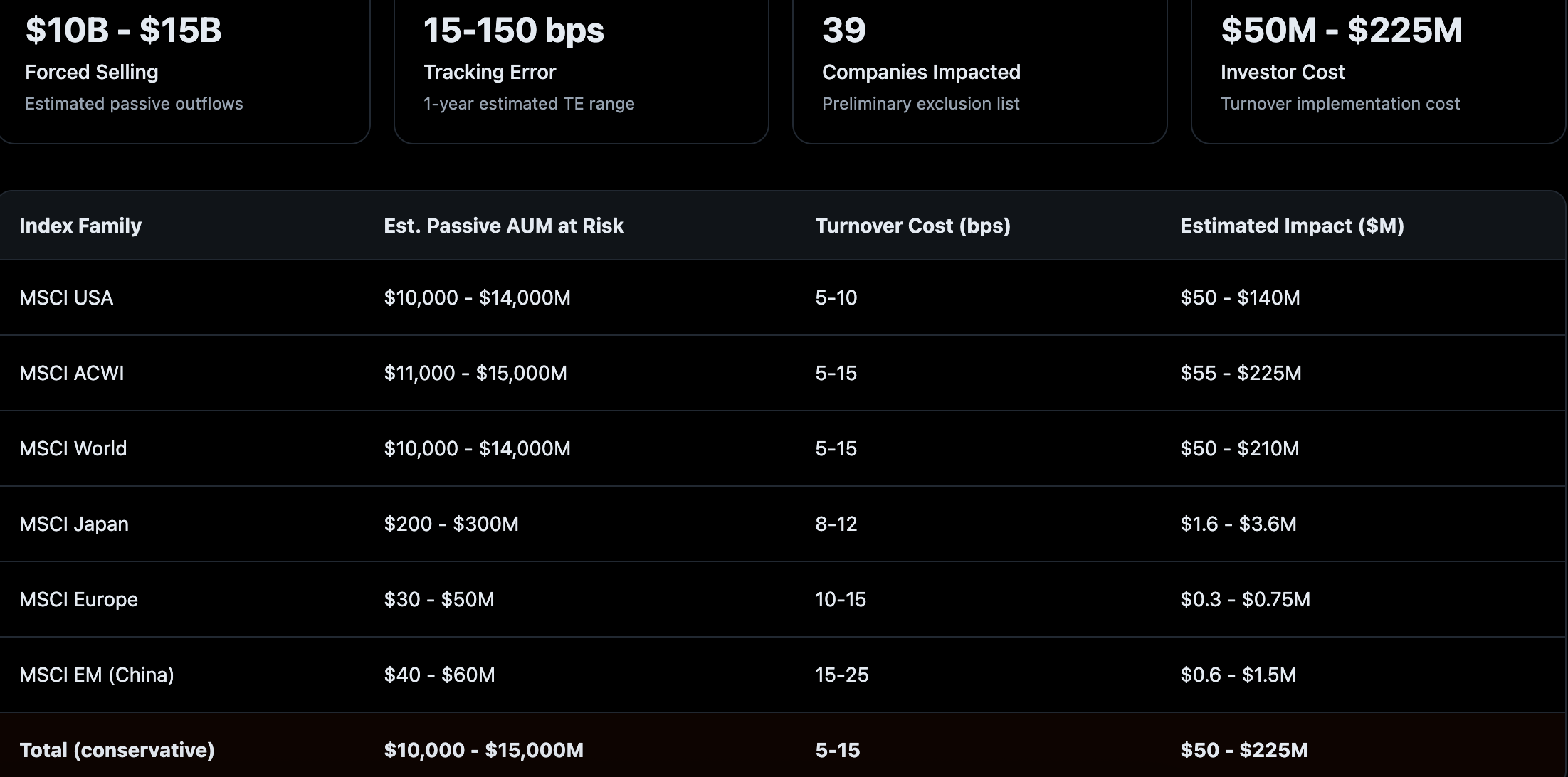

The BitcoinForCorporations organization has warned that up to $15 billion could flow out of public companies with crypto treasuries if index provider MSCI decides to remove them from its indexes.

The analysis is based on a list of 39 companies with a combined market capitalization of $113 billion (calculated using free-float—shares available for public trading).

According to the group, 18 firms worth $98 billion face the risk of immediate exclusion. Another 21 companies totaling $15 billion are not currently in the index, but may be hit with a permanent ban on future inclusion.

Experts also highlighted a JPMorgan report that estimates potential outflows of $2.8 billion from Strategy. Michael Saylor’s company is said to account for 74.5% of the total market value of all firms potentially affected.

BitcoinForCorporations has opposed MSCI’s initiative, and says its petition has already been backed by more than 1,200 industry participants.

“An unfair criterion”

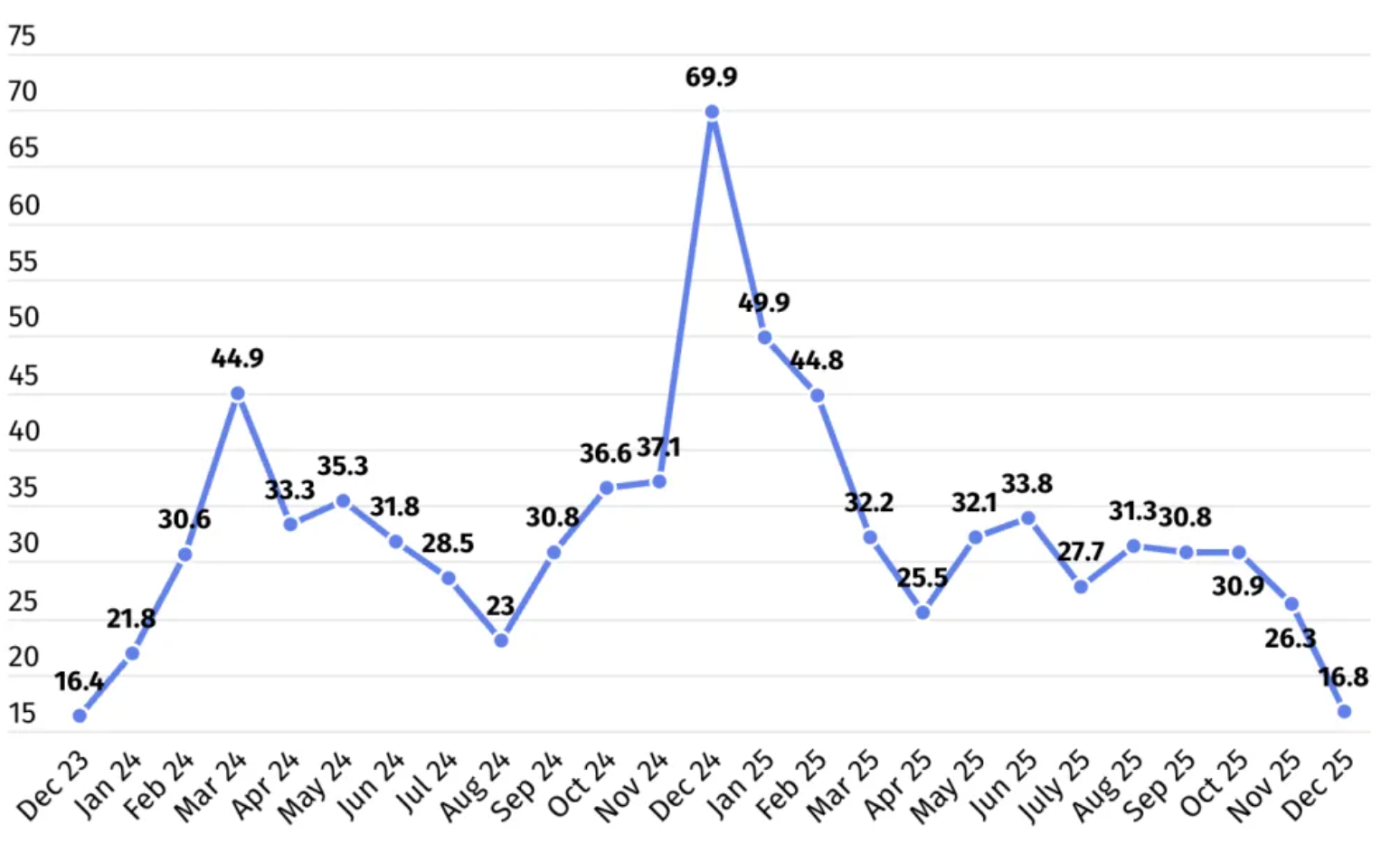

In October, MSCI began discussing with investors the possibility of excluding companies whose assets consist of more than 50% cryptocurrencies.

The provider’s decision is far from a formality. MSCI indexes are widely used as benchmarks for many passive funds.

Being included in an MSCI index often helps attract institutional capital; removal can trigger large-scale selling and directly affect a stock’s price and liquidity.

BitcoinForCorporations criticized the proposal, arguing that judging companies solely by their balance-sheet composition is unfair.

“A single balance-sheet metric does not determine whether a firm is an operating business. This rule would lead to issuers being excluded even when their customer base, revenue, operations, and business model remain unchanged,” the petition authors said.

The organization urged MSCI to abandon the initiative and keep its current classification approach. In their view, companies should be assessed based on their actual business model, financial performance, and operational characteristics.

A final decision is expected by January 15. If approved, the new rules would take effect during the scheduled index review in February 2026.

Growing pushback

A number of industry figures have spoken out against the proposal. Saylor said:

“Strategy is not a fund, trust, or holding company. We are a public operating company with a $500 million software business and a unique treasury strategy that uses bitcoin as productive capital.”

He and Strategy CEO Phong Le also sent a letter to MSCI.

Asset manager Bitwise joined the criticism, calling the provider’s criteria subjective and warning that excluding crypto-treasury firms could harm investors’ interests.

“We strongly urge MSCI to uphold the high standard that has made its indexes a global benchmark, and to allow its indexes— as Strategy put it— to ‘neutrality and accurately reflect the next era of financial technology,’” Bitwise said.

In early December, Nasdaq-listed Strive also argued that MSCI should “let the market decide” whether bitcoin-related firms belong in index compositions.