After the bankruptcy of the cryptocurrency exchange FTX, its representatives filed a motion in court outlining a new payment plan for users from “problematic” jurisdictions. A court hearing to review this motion is scheduled for July 22, 2025.

Which Countries Are Included in the “Problematic” List?

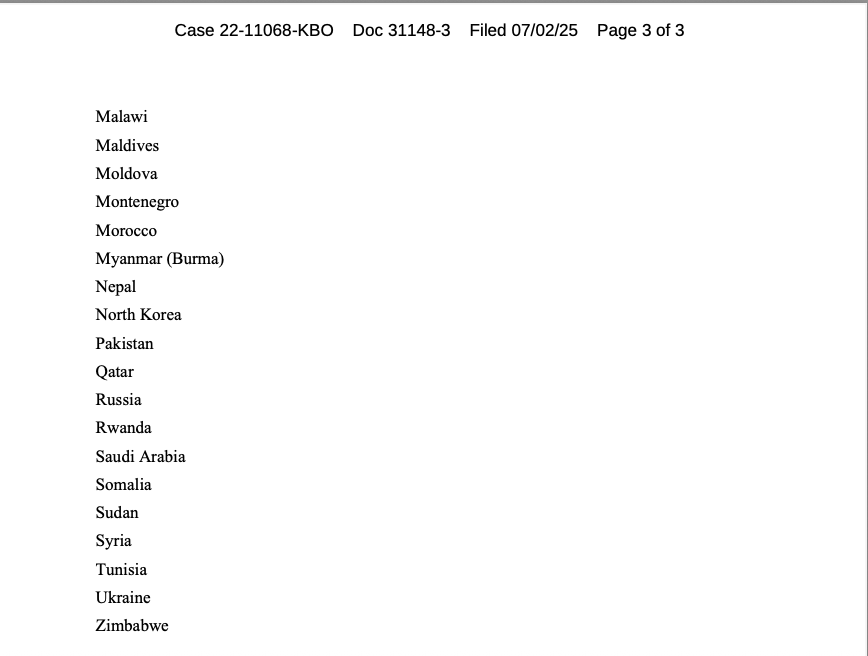

The list of “restricted jurisdictions” includes 49 countries, among them China, Russia, Ukraine, Pakistan, and Saudi Arabia. These countries account for only 5% of the total claims, which amount to $16 billion. Importantly, 82% of the value of the assets involved in the bankruptcy is concentrated in China. This is due to the large number of users from Asia, particularly China, who were registered on FTX.

The New Payment Plan

The plan proposed by the FTX team involves conducting a detailed legal review of each case by local lawyers. These experts will assess the legality of payments to users in each of the 49 countries. Their task is to determine whether the payment process complies with local laws.

If the lawyers confirm that the payment can be made according to the local legal framework, users will receive their funds through payment providers like Payoneer, who are capable of processing the transfer. It is important to note that funds will only be paid to users whose claims are in compliance with local regulations.

Restricted Jurisdictions

If the legal review establishes that transferring funds to a particular country violates laws or international norms, that country will be officially classified as a “restricted jurisdiction.” Users from these countries will be given a 45-day period to appeal the decision in court. If the ruling is not overturned, their claims will be canceled, and the funds that were to be paid to these users will return to the general bankruptcy pool and be redistributed among other creditors.

Issues with Users from China

One of the most vocal creditors who has expressed dissatisfaction with the proposed plan is a creditor from China, registered under the username zhetengji. This user stated that they would challenge the decision at every stage of the process. They called on other users from restricted jurisdictions to join in the challenge, describing the plan as “absolutely unjustified.” They specifically pointed out the potential legal and political hurdles that could affect the fairness of the fund distribution.

What About Other Claims?

As of April 2025, FTX’s liquidators had rejected almost 400,000 claims for compensation totaling $2.55 billion. This confirms that the compensation process has been delayed, and many users have not received their funds due to legal complications or the insufficiency of funds to meet all claims.

Risks for Users

For users in restricted jurisdictions who are unable to receive their funds due to legal barriers, this plan may represent another blow as they risk losing their money. On the other hand, redistributing funds among other creditors may lead to faster debt settlement for the remaining users, but it also leaves uncertainty regarding how legal issues arising from the new restrictions will be handled.

Conclusion

The FTX liquidation process remains complex and multi-stage. The newly proposed payment plan for users from “problematic” countries raises questions about compliance with international laws and fairness for all users, regardless of their location. The court hearing at the end of July may be a key moment in this process and could impact further decisions regarding payments and potential revision of the list of “restricted” jurisdictions.

For many FTX users, this process is their last chance to recover their funds, but as recent events have shown, a full recovery may take much longer than initially expected.