Decentralized exchange Hyperliquid has taken another step in expanding its ecosystem by adding support for the USDH stablecoin, issued by Native Markets. Right after the launch, trading opened in the USDH/USDC pair, with the initial trading volume reaching around $2.1 million.

The First Stablecoin in the Hyperliquid Ecosystem

USDH became the first stablecoin to be approved and issued following a validator vote on Hyperliquid. This milestone highlights the successful implementation of a decentralized selection mechanism for new projects on the platform.

The token operates on HyperEVM, an Ethereum-compatible environment created specifically for Hyperliquid’s scalable solutions. Thanks to this, USDH was immediately integrated into the exchange’s infrastructure and became part of its trading ecosystem.

Competition and Selection of the Issuer

In early September, Hyperliquid held a competition to determine which company would launch its first stablecoin. Several well-known firms participated, including Paxos, Frax, Agora, and others. Native Markets emerged as the winner, offering the most reliable and transparent collateralization model.

The result demonstrated the community’s trust in the new issuer and highlighted the growing interest in alternative solutions within the stablecoin sector.

Collateral and Transparency of Reserves

According to the issuer, USDH is fully backed by real-world assets, including:

- cash reserves,

- short-term U.S. Treasury bonds.

The transparency of these reserves is ensured through an oracle system, which allows participants to verify collateral data in real time.

Additionally, part of the revenue generated from managing the reserves will be directed toward buybacks and burns of HYPE tokens, the native asset of the Hyperliquid ecosystem. This mechanism could indirectly increase the value of HYPE and support market demand.

Context: Stablecoin Market Growth

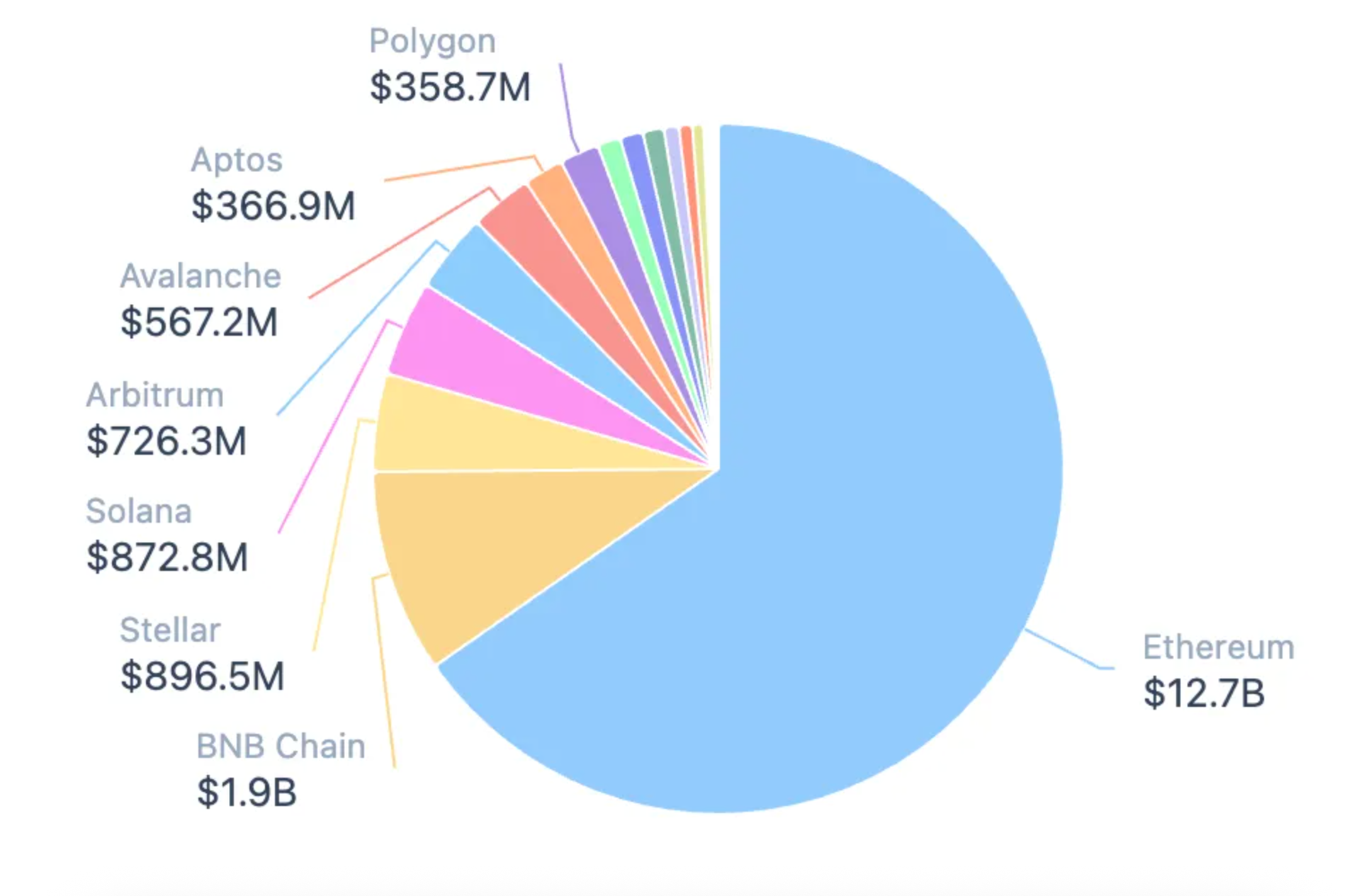

The launch of USDH coincided with the rapid growth of the stablecoin sector. According to CoinGecko, the total market capitalization of stablecoins has exceeded $299 billion, underlining their importance for the entire crypto industry.

At the same time, Hyperliquid’s ecosystem has been gaining momentum thanks to additional developments. In mid-September, a blockchain researcher known as MLM reported test transactions of USDC on the HyperEVM network. These experiments suggest that the platform is becoming increasingly attractive for stablecoin projects and DeFi solutions.

Significance for the Hyperliquid Ecosystem

The addition of USDH strengthens Hyperliquid’s position as a decentralized exchange focused on innovation and transparency. For traders, it opens new hedging opportunities, while developers gain an additional tool for integrating stable assets into DeFi products.

Thus, USDH can be seen not only as a new stablecoin but also as a strategic step toward expanding Hyperliquid’s capabilities and building a more resilient ecosystem.