This indicates the ongoing activity of malicious actors in the digital asset sector.

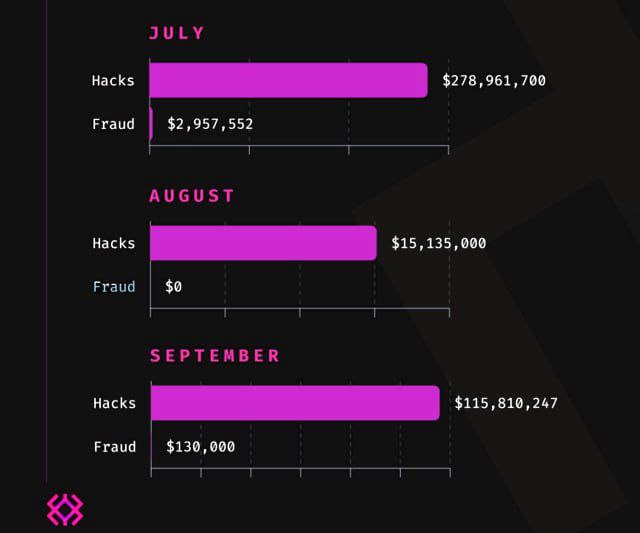

According to ImmuneFi, during this period, 34 successful attacks on cryptocurrency users were recorded, highlighting the vulnerability of the crypto asset ecosystem. Interestingly, despite the high amounts of losses, the volume of stolen funds has been decreasing each quarter. Compared to the previous second quarter, losses decreased by 28% — from $573 million to $413 million. And compared to the first quarter of 2024, when damages amounted to $686 million, the reduction reaches 40%.

Decentralized finance (DeFi) protocols continue to be the most vulnerable to attacks, due to the open nature of their architecture and the complexity of securing smart contracts. In contrast, centralized exchanges and financial services (CeFi) face the challenge of protecting user keys, making them prime targets for cybercriminals. In this quarter, the most affected CeFi platforms were the Indian exchange WazirX and Singapore-based BingX.

The largest attacks were recorded on the Ethereum, BNB Chain, Base, Blast, Solana, and Arbitrum blockchains, which remain key targets for malicious actors. This is due to their widespread popularity and high market capitalization, which attracts hackers seeking to exploit vulnerabilities to steal funds.

Experts emphasize the importance of strengthening security measures in both the DeFi and CeFi sectors to counter the growing threat of cyberattacks and ensure the protection of users’ assets.