The SEC claims that the platform violated rules governing securities trading, which drew the regulator’s attention and led to the start of legal proceedings.

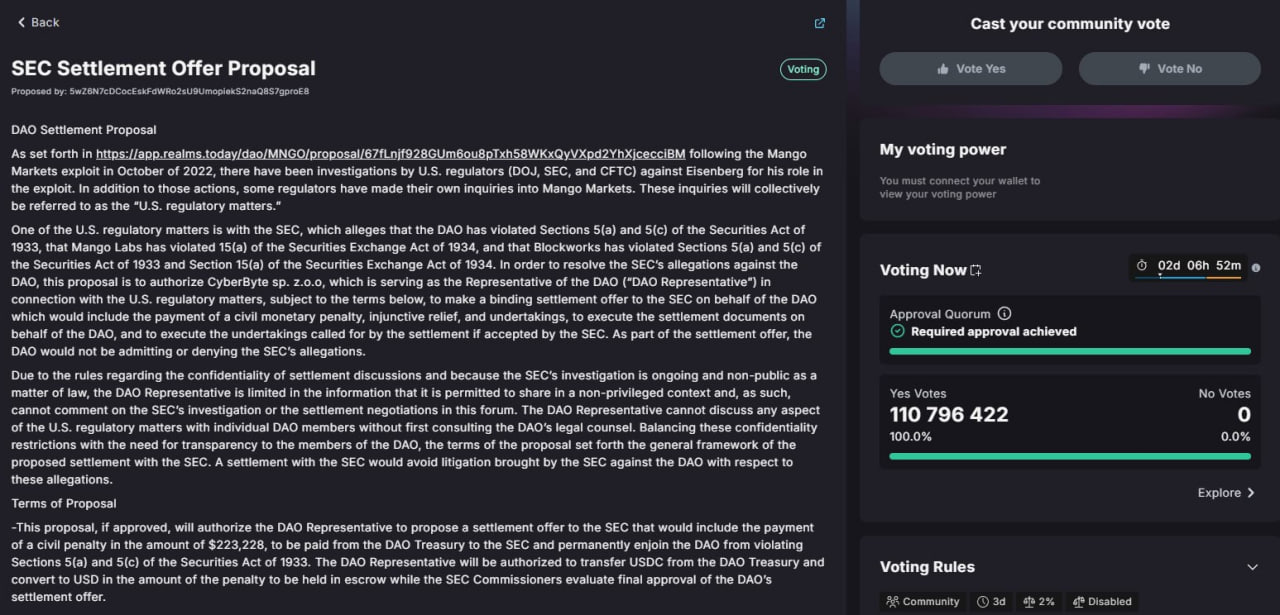

In response, the governing body of Mango DAO initiated a community vote to discuss and approve the settlement terms with the SEC. The Mango DAO community is actively involved in decision-making, emphasizing the decentralized nature of the project.

According to the proposed terms, Mango Markets is required to pay a fine of $223,228 and destroy all of its existing MNGO tokens to prevent further use. Additionally, the company must initiate the delisting process of MNGO from trading platforms, which may impact the availability of the asset for traders and investors.

This settlement underscores the importance of regulatory compliance in the cryptocurrency industry, where decentralized projects are increasingly facing demands from regulators. In the future, this precedent could influence other cryptocurrency platforms seeking to comply with legal requirements.