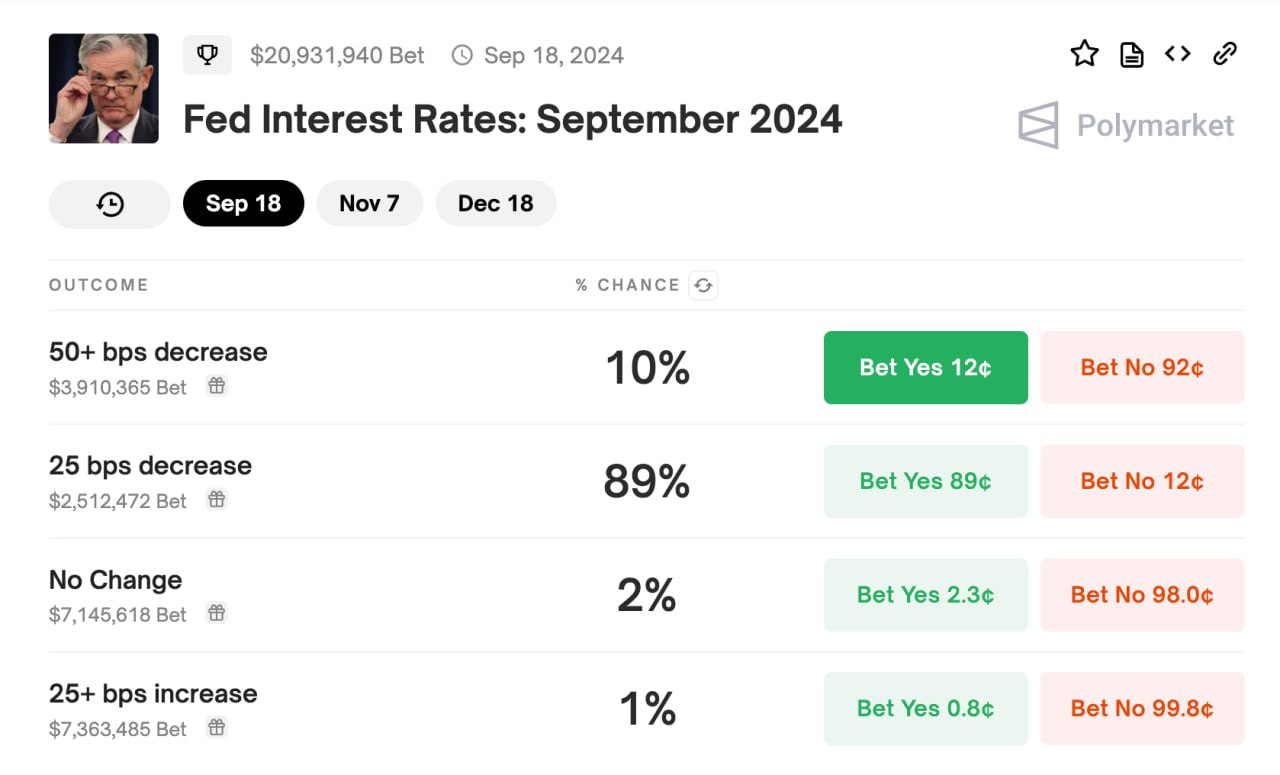

According to Polymarket, the probability that the Fed will lower the interest rate by 25 basis points is estimated at 89%. Before the inflation data was published, this figure was 74%, indicating increased investor confidence in a dovish monetary policy.

A 50 basis point rate cut is estimated at 10%, but this scenario is considered unlikely given current macroeconomic indicators and signals from regulators.

According to forecasts from the CME exchange, the likelihood of a 25 basis point cut is 71%, while a 50 basis point cut is 29%. This discrepancy with Polymarket’s forecasts may indicate varying degrees of confidence among market participants in the Fed’s policy easing.

Earlier, experts from 10x Research warned that a 50 basis point rate cut could negatively impact the cryptocurrency market, causing capital outflows and increased volatility. This is because significant monetary easing could undermine investor confidence in digital assets, which are considered high-risk instruments.

Furthermore, a rate cut could influence other financial markets, such as stocks and bonds, by increasing the attractiveness of more conservative assets for investors, potentially leading to reduced interest in cryptocurrencies.