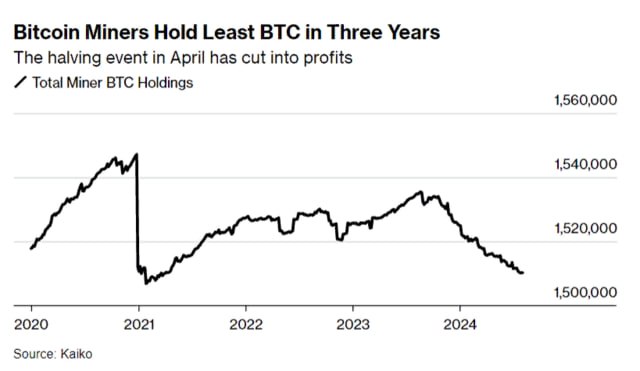

Currently, miners’ bitcoin reserves have reached a three-year low. As of August 3rd, they held 1,510,300 BTC, with a total value of around $86 billion. This decline may indicate growing financial difficulties within the crypto mining industry.

Today, miners control only 8% of the total bitcoin supply, marking the lowest level in recent years. At the end of last year, they were forced to sell off their reserves as they had to adapt their business models ahead of the April halving, which significantly reduced the reward for mining each block.

Although a temporary increase in transaction fees helped partially offset miners’ losses, fees sharply dropped below $2 in the summer. In comparison, they peaked at $143 in April. This decline has added further financial pressure on market participants.

However, not all miners decided to sell off their assets. Large companies chose to hold onto their reserves, despite challenging market conditions, continuing to accumulate bitcoins in anticipation of a market turnaround. According to Bloomberg, this strategy could pay off in the long term if market conditions improve in their favor.