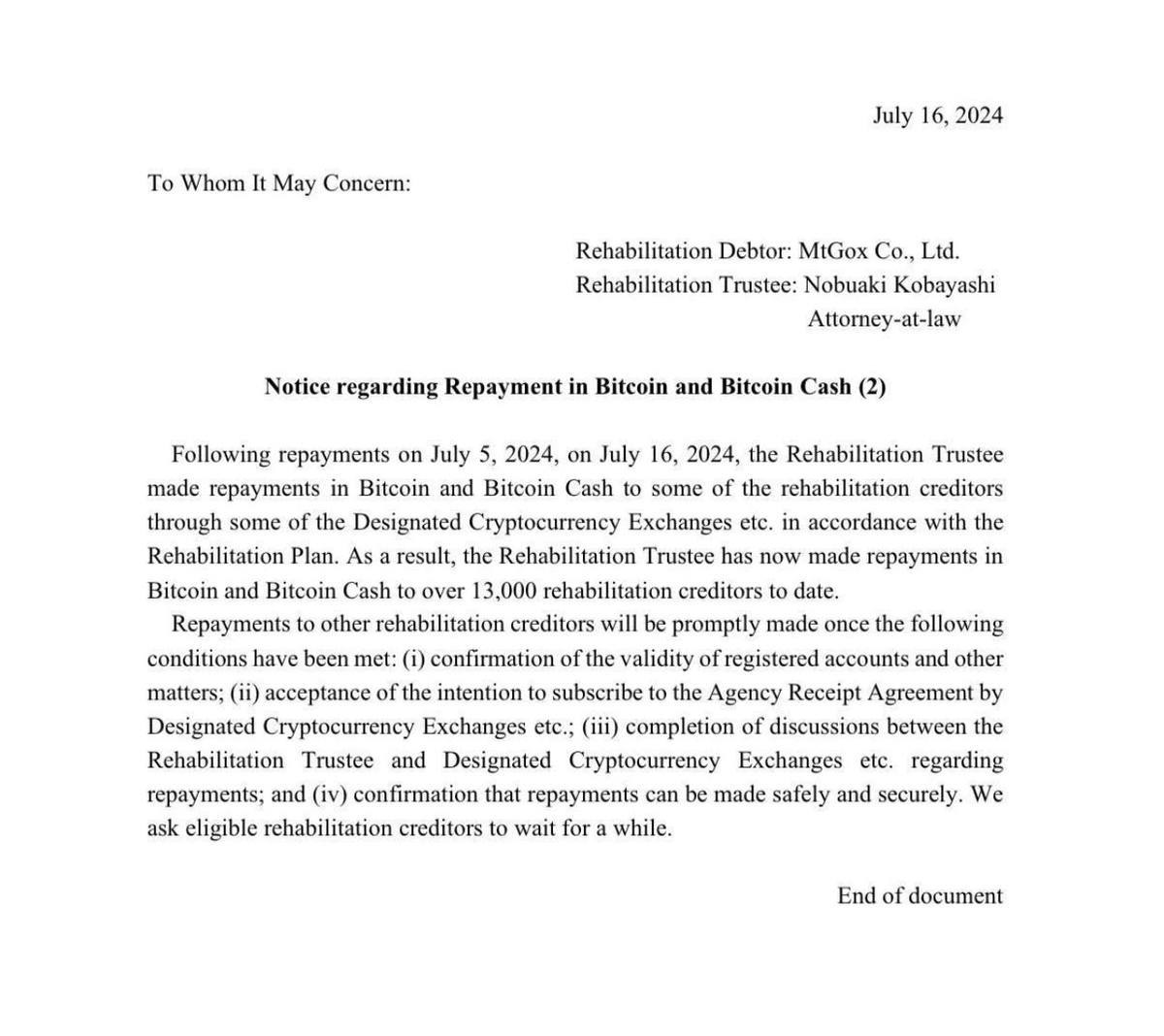

Currently, 65% of the affected users have received their payouts.

A survey conducted on Reddit among the affected users revealed that most recipients do not plan to sell their assets.

55% of respondents lean towards holding their assets.

The remaining 45% decided to partially lock in profits or sell their assets completely.

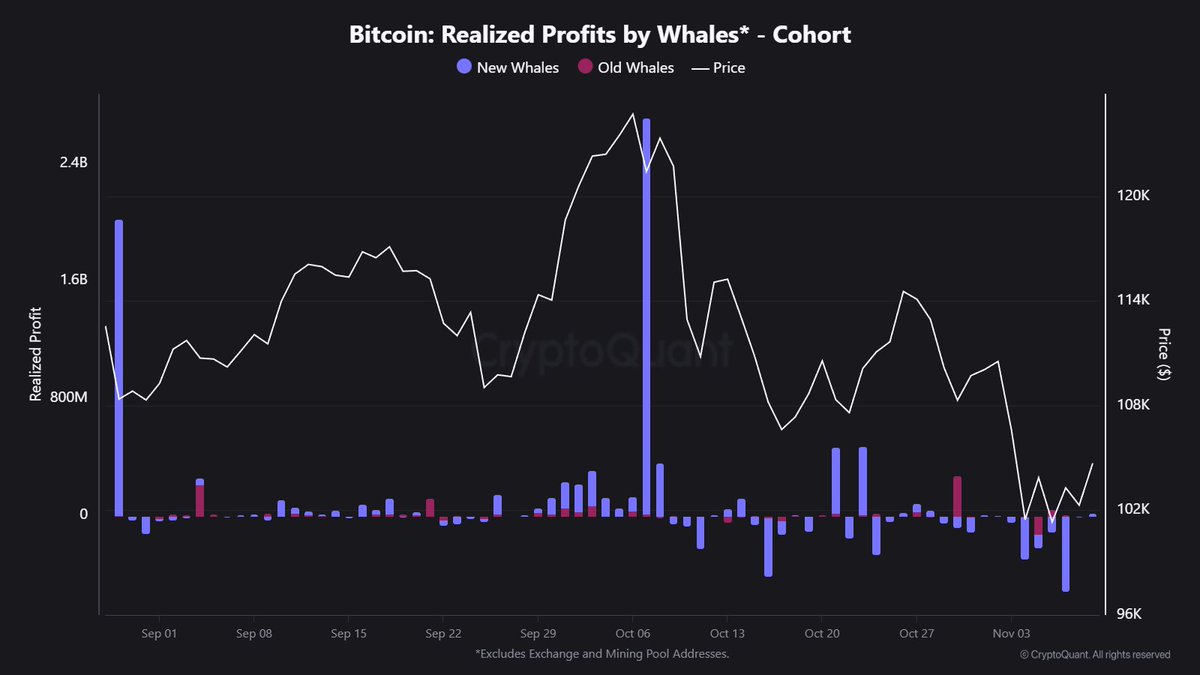

However, this has not exerted significant pressure on the market. Market participant panic has a much greater impact on the current situation.

According to experts, this payout situation indicates a high level of trust in cryptocurrencies among affected users. They prefer to hold their assets in the hope of further growth, despite the risks associated with market volatility.

Some analysts also note that most Mt.Gox holders may aim for long-term investments, which positively affects overall market stability. Instead of a mass sell-off, which could cause a sharp drop in prices, the market remains relatively calm.

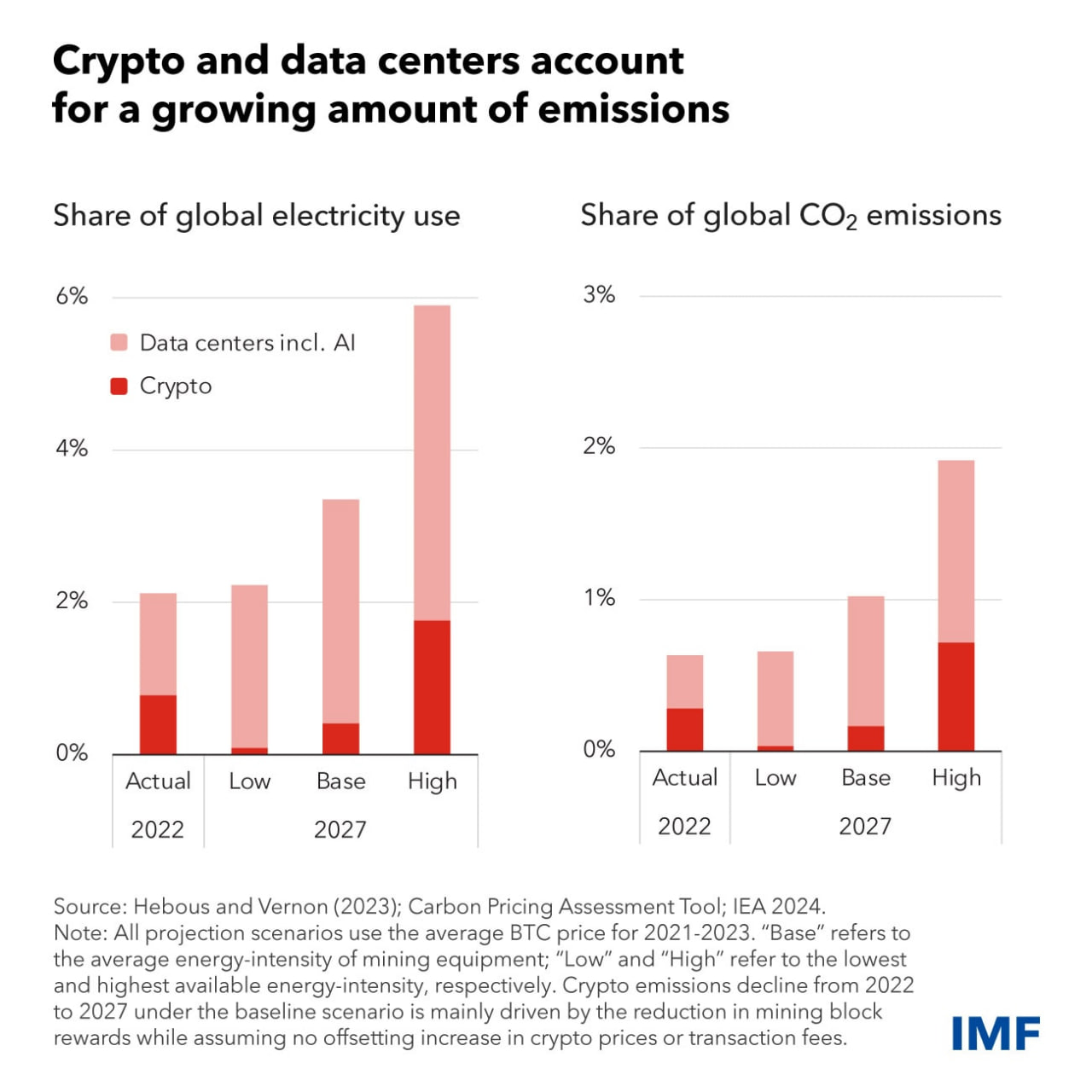

Additionally, it is worth noting that the cryptocurrency market infrastructure has significantly strengthened since the Mt.Gox collapse. New exchanges have emerged, security measures have improved, and institutional investor support has increased. All these factors contribute to maintaining market stability even amid significant events like the Mt.Gox payouts.

Thus, despite substantial payouts to Mt.Gox victims, the market demonstrates resilience due to user trust in cryptocurrencies and improved infrastructure. Market participant panic remains a more significant influence on the current situation than the actions of Mt.Gox holders.