Analysts at a16z crypto believe that in 2026 the digital-asset sector will shift its focus from purely “crypto-native” products to embedding its tools into traditional business and infrastructure. The main areas they highlight are prediction platforms and cryptographic proofs—technologies that are increasingly positioned not as add-ons for blockchains, but as broadly applicable building blocks for other industries.

According to the firm, crypto-native tools are steadily expanding into sectors far beyond decentralized finance. This momentum is being driven by advances in cryptography, rapid progress in AI, and the emergence of new economic systems and rule sets—trends that enable blockchains to function as foundational infrastructure rather than just end-user products.

Prediction Markets: Larger Scale, Tougher Questions of “Truth”

a16z expects prediction markets to become bigger, broader, and more sophisticated, largely due to the convergence of crypto technology and AI. Platforms will be able to support more topics, handle greater complexity, and attract wider participation.

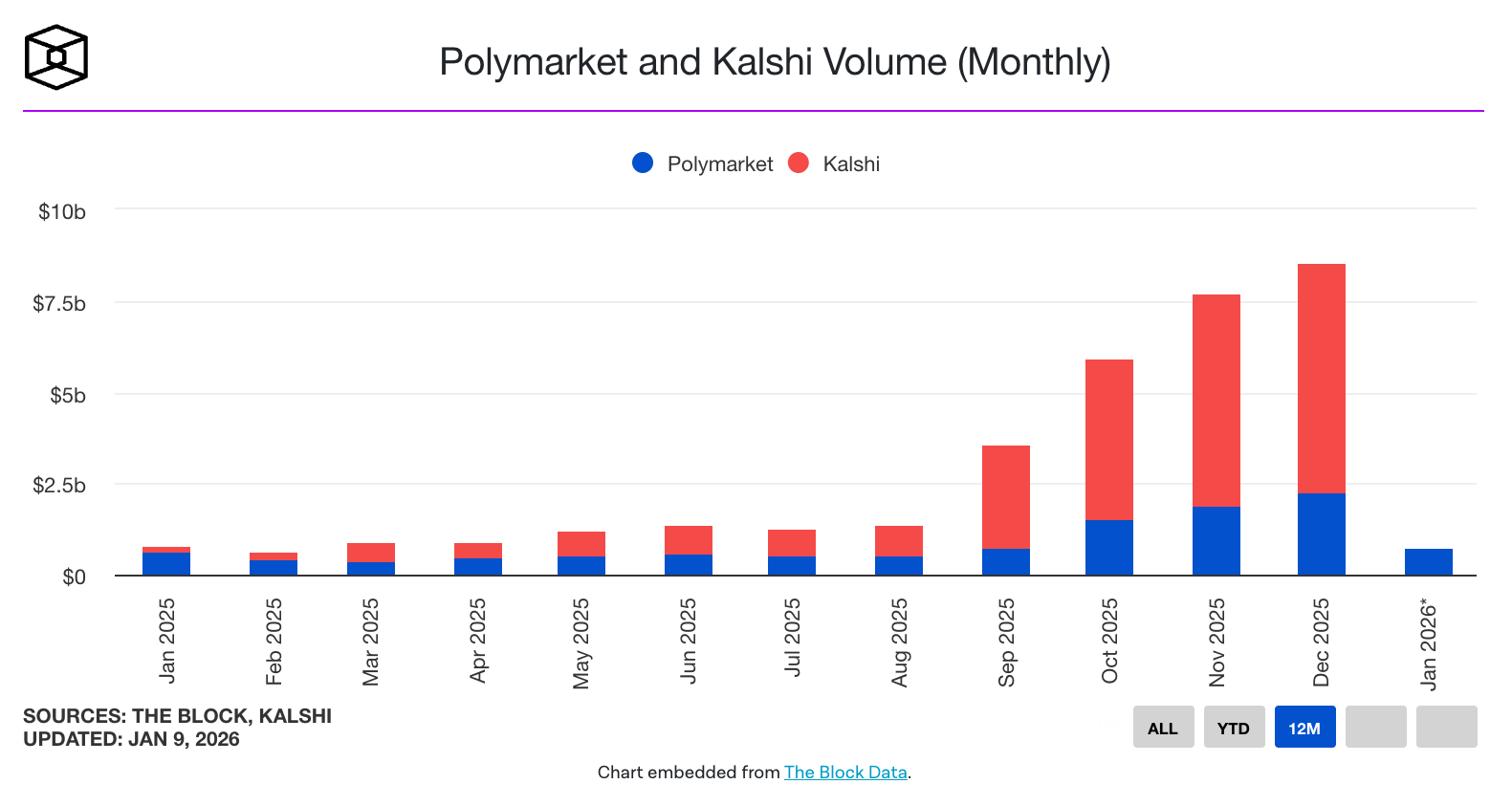

By the end of 2025, combined trading volume on the two largest venues—Polymarket and Kalshi—reached $28 billion, underscoring how quickly demand for these instruments is growing.

Andy Hall, a16z’s scientific advisor, notes that the next phase of growth will depend not only on the number of contracts available, but on improving how platforms determine the “truth” when outcomes are disputed. Recent controversies around political and geopolitical markets have shown that centralized arbitration mechanisms struggle to scale as volumes and stakes rise.

As a result, demand is increasing for decentralized governance models and more advanced oracle systems. In the longer term, AI-assisted oracles may help deliver more objective and transparent outcome resolution, reducing reliance on manual decisions and narrow points of control.

Cryptographic Proofs: ZK Tech Poised for Mainstream Adoption

a16z also argues that 2026 could be a turning point for zero-knowledge (ZK) proofs, with broader deployment in traditional industries not directly related to blockchain.

Justin Thaler, a member of the firm’s research team, emphasizes that progress in zkEVMs is sharply reducing the cost of proof generation. This changes the economics: verification becomes viable not only for specialized use cases, but even for ordinary cloud CPU workloads—and eventually for consumer devices.

This shift could unlock long-discussed applications such as verifiable cloud computing. Businesses would be able to obtain cryptographic guarantees that computations were performed correctly, without rerunning workloads or paying for expensive audits.

As proof-generation overhead continues to fall and hardware performance improves, cryptographic verification may stop being an “exotic” blockchain feature and instead become a standard component of digital infrastructure—similar in importance to encryption or digital signatures, but applied to computation.

A New Media Format: “Staked Media”

A third trend highlighted by a16z is the emergence of staked media. The idea is that content creators use tokens and smart contracts to make publicly verifiable commitments, directly tying their reputational incentives to the claims and forecasts they publish.

Robert Hackett from a16z’s editorial team argues that AI has made it cheap and easy to generate unlimited content—claiming anything, from any perspective, and even in the voice of any character, real or fictional. In that environment, simple trust in what people (or bots) say may no longer be enough.

Staked media aims to strengthen credibility by adding “skin in the game.” For example, when stating a position or making a forecast, an expert could lock up tokens to demonstrate they are not engaging in speculation or a pump-and-dump scheme. An analyst could also link forecasts to public markets, creating a verifiable track record over time.

Hackett stresses that this format will not replace traditional media, but is likely to become an important complement—especially where transparency of incentives and accountability for claims matter most.

What This Could Mean for the Industry

a16z’s outlook points to one core idea: crypto tools are maturing and integrating into the broader economy. Prediction markets may expand rapidly but will need better mechanisms for resolving disputed outcomes; ZK proofs are becoming cheaper and increasingly practical for mainstream computing; and staked media proposes a new model of trust where words are backed by measurable commitments.

If this trajectory holds, 2026 could be the year when cryptography and blockchain infrastructure are seen less as a standalone “crypto industry” and more as a foundational technology layer for business, government, and digital services.