The crypto industry is entering a new phase of structural transformation. While the Bitcoin network demonstrates unprecedented resilience by hitting new difficulty records, economic realities are forcing major players to seek refuge in AI infrastructure.

Difficulty Spike: The Largest Jump in Years

Following the latest adjustment, Bitcoin mining difficulty surged by 14.73%, reaching a staggering 144.4 T. This leap marks one of the most significant network events since 2021 (when volatility hit 22% following China’s mining ban).

The current spike serves as a “rebound” from a previous 11% drop caused by extreme weather. Winter storms in the U.S. forced many data centers to temporarily curtail operations, but as the weather stabilized, capacity returned to the grid with a vengeance.

Network Stats at a Glance:

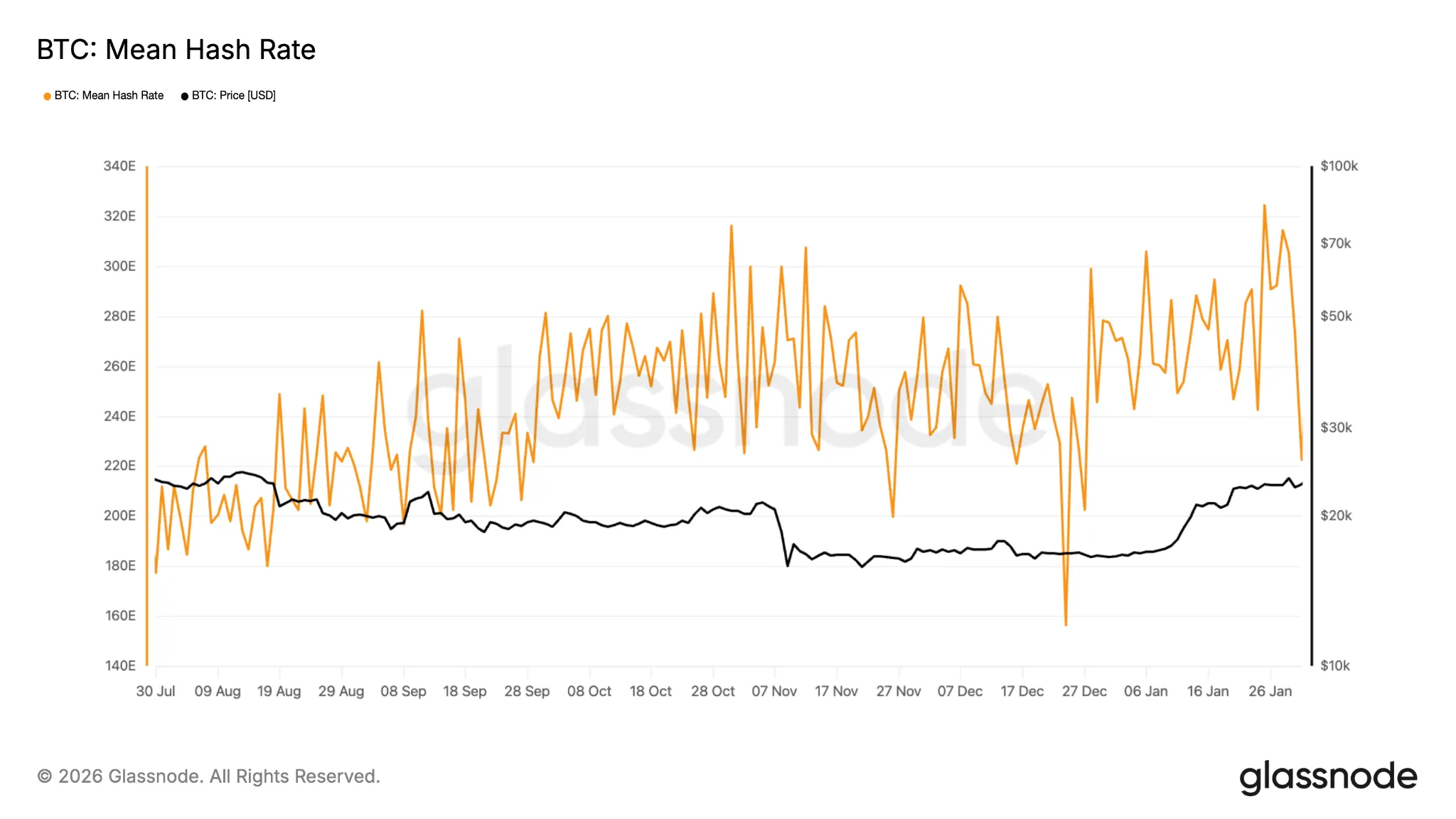

- Hashrate: Holding steady above 1 ZH/s (Zettahash per second).

- Hashprice: Dropped from $33.5 to $29.7 per PH/s over the last 24 hours.

- Market Leaders: Foundry USA maintains a dominant 33.62% share, followed by AntPool (14.35%) and ViaBTC (12.42%).

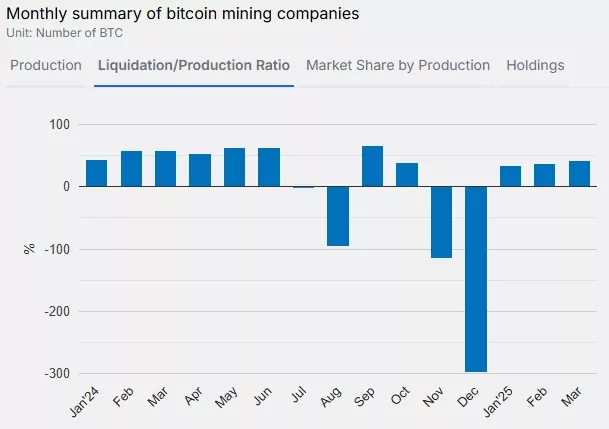

Profitability on the Edge: Survival of the Efficient

With the hashprice dipping below the $30 mark, many market participants find themselves in a tight spot. However, companies with access to ultra-cheap electricity and a modern fleet of ASIC miners continue to build momentum.

Success Story: The UAE’s unrealized profit from Bitcoin mining has reached $350 million. This reinforces the current market thesis: the winners are not necessarily those with the most hardware, but those who have optimized their energy costs and capital expenditures.

With Bitcoin trading around $67,900, only highly capitalized players capable of weathering periods of low profitability remain competitive.

The New Frontier: Expansion into AI

The season’s headline trend is the “Race for Megawatts.” According to analysts, 14 of the largest mining firms plan to deploy approximately 30 GW of new capacity. For perspective, this is nearly triple their current volume of 11 GW.

Why the pivot? The reason is simple: the hunt for higher margins. Access to power grids and ready-made data center infrastructure allows miners to diversify by leasing power to AI developers.

The Industry’s Structural Transformation

While a miner’s success used to depend primarily on chip efficiency, the key drivers today have shifted to:

- Access to Capital: To purchase expensive server-grade hardware.

- Grid Connectivity: Securing direct access and high power limits.

- Operational Speed: The ability to bring facilities online in record time.

Risks of the New Business Model

Transitioning to AI is more than just a hardware swap. Unlike mining, where monetization is automatic (find a block, get a reward), the AI market requires active sales. Computing power must be leased to clients, requiring high-quality service and the ability to compete with tech giants.

The Bottom Line: Miners are evolving from “extractors” into global infrastructure providers. However, success in this race is only guaranteed to those who can do more than just build walls and connect cables—they must find real-world demand for their teraflops in the era of the AI boom.