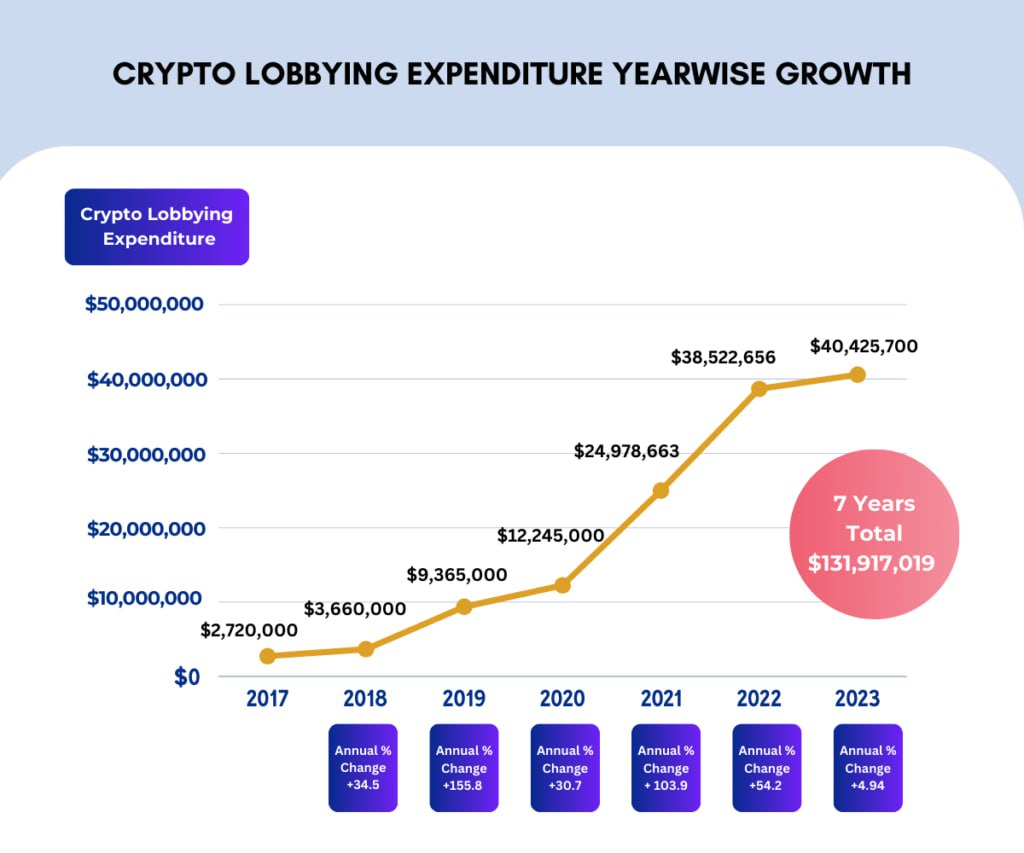

This reflects a significant rise in interest in regulating and promoting the crypto industry at the governmental level.

According to a Social Capital Markets study, from 2017 to 2023, cryptocurrency lobbying expenditures surged by 1386%, reaching $40.42 million compared to $2.72 million at the beginning of the period. This points to the rapid development of the sector and the need for companies to protect their interests amid increasingly stringent regulations.

The largest spending peak occurred in 2022 and 2023, accounting for nearly 60% of the total ($78.94 million out of $131.91 million). This is driven by growing discussions around laws and regulations aimed at controlling cryptocurrency operations and protecting users.

The top 5 companies investing the most in lobbying since 2017 include the industry’s major players:

1) Apollo Global Management — $28.71 million, making it the leader in lobbying expenditures, likely due to its investments in blockchain assets and crypto projects.

2) Managed Funds Assn — $21.96 million, representing hedge funds’ interests, which are actively involved in the crypto market.

3) CME Group — $10.19 million, a leading trading platform offering cryptocurrency futures and derivatives, explaining its regulatory interest.

4) Coinbase — $8.45 million, one of the world’s largest crypto exchanges, aiming to ensure favorable conditions for operations across various markets.

5) Block Inc (Square Inc) — $6.37 million, actively developing solutions for payments and cryptocurrencies, requiring constant engagement with regulators.

The rise in lobbying investments highlights the importance of regulation for the long-term development of the crypto industry and companies’ efforts to create a favorable environment for innovation and trade in the sector.