Solana (SOL) continues to strengthen its position amid growing on-chain activity and increased institutional inflows. Over the past two days, SOL’s price has surged more than 18%, breaking through the psychological threshold of $205. Despite a brief pullback below this level, the asset’s performance is significantly outpacing most altcoins.

On-Chain Metrics at Multi-Month Highs

In the past 30 days, Solana’s network has shown remarkable growth in key on-chain indicators:

- Transaction count increased by 45%;

- Network fees also rose by 45%.

This steady uptick in activity highlights Solana’s growing demand as a platform for decentralized applications, DeFi, and NFTs. In contrast, BNB Chain recorded a 36% decline in monthly transaction activity over the same period.

Futures Market: Cautious Optimism

Derivatives data reflects a measured yet positive market sentiment.

The funding rate for perpetual futures on SOL stands at 12% annually, a level that indicates mildly bullish positioning without excessive risk-taking.

This moderate leverage environment could help sustain the trend, reducing the likelihood of sharp liquidations that often accompany overheated markets.

DEX Trading Volumes Down for Third Week

Despite stronger on-chain metrics, trading activity on decentralized exchanges (DEXs) within the Solana ecosystem has been declining for three consecutive weeks. According to Defi Llama, monthly DEX volumes reached $113.14 billion, suggesting either a temporary shift toward centralized exchanges or reduced speculative activity on-chain.

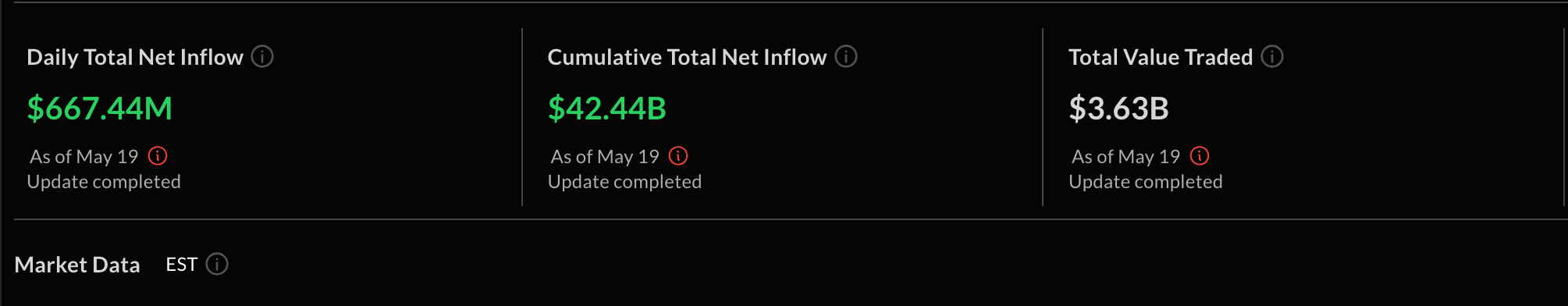

Institutional Interest: Solana Staking ETF

July saw the launch of the REX-Osprey Solana Staking ETF, a fund enabling investors to earn staking rewards without directly purchasing SOL. It has already attracted $161 million in assets under management.

For comparison, spot Ethereum ETFs recorded a monthly inflow of $5.4 billion in July — a record for the asset class. While the numbers differ greatly, the launch of a staking ETF represents a milestone in Solana’s adoption by institutional players.

Current Price and Path to All-Time High

At the time of writing, CoinGecko data shows SOL trading at $204.59, up 3.1% in 24 hours and 28.1% over the past month.

The asset is still roughly 43% below its all-time high (ATH) of $293.31, reached on January 19. Bridging this gap will likely require:

- Continued inflows from both retail and institutional investors;

- Sustained on-chain activity growth;

- A stable derivatives market without excessive leverage.

Outlook and Risks

Bullish factors:

- Rising transaction count and network fees;

- Launch of the staking ETF and institutional adoption;

- Moderate leverage levels in the futures market.

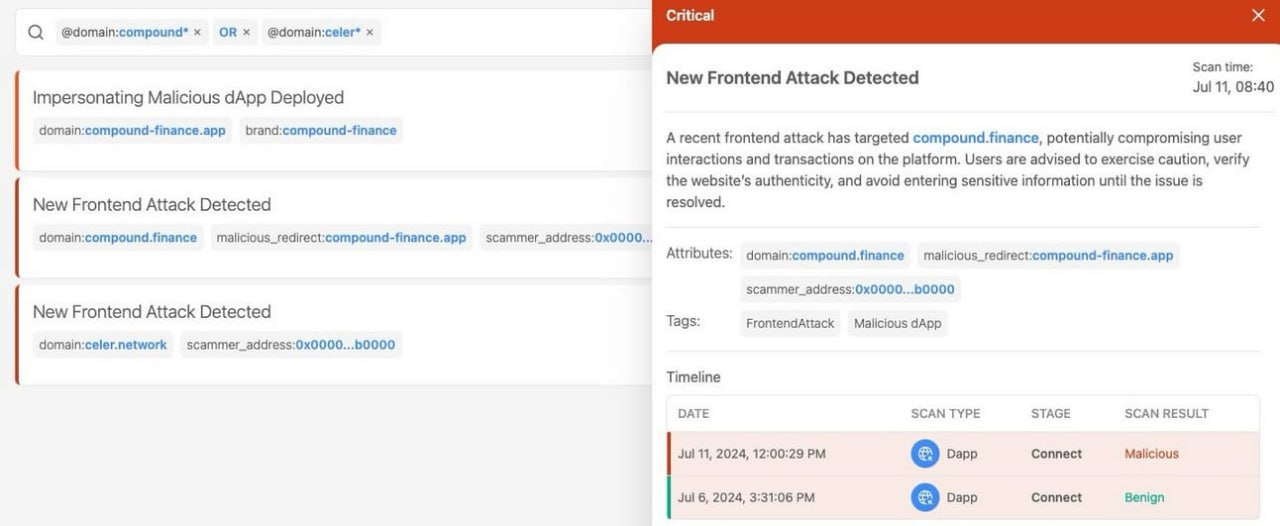

Bearish factors:

- Declining DEX trading activity;

- Potential profit-taking after recent gains;

- Broader market volatility.

If these positive fundamentals persist, Solana could test the $220–$230 range in the short term. A retest of the ATH will depend on sustained capital inflows and continued growth of the ecosystem.

💡 On August 13, SOL broke above $200 for the first time since July — a key psychological milestone for traders and investors.