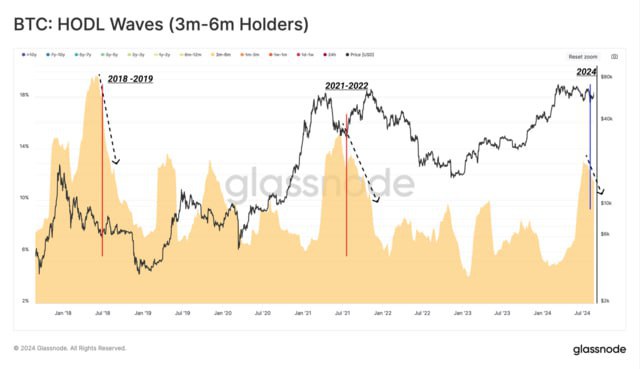

Glassnode noted that the biggest losses are being incurred by traders who purchased coins between 3 and 6 months ago.

The losses began in early July, with the peak occurring in the first half of August. This capitulation has become one of the most significant.

Long-term investors have suffered much smaller losses and, moreover, have taken advantage of the situation by purchasing more than 480,000 BTC from speculators.

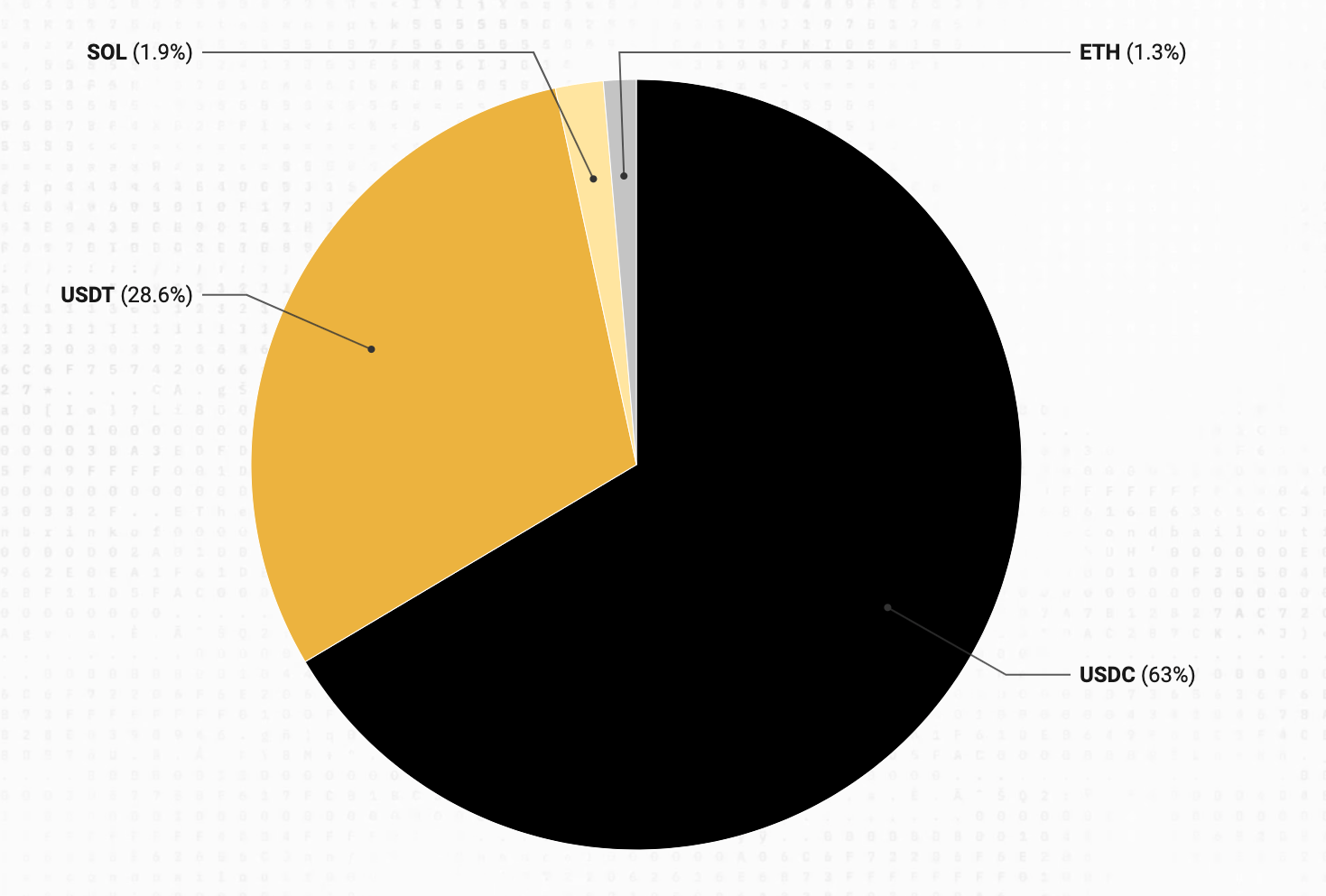

Speculation using perpetual swaps has significantly decreased, and investors have shifted to the spot market. Funding rates for most coins remain neutral.

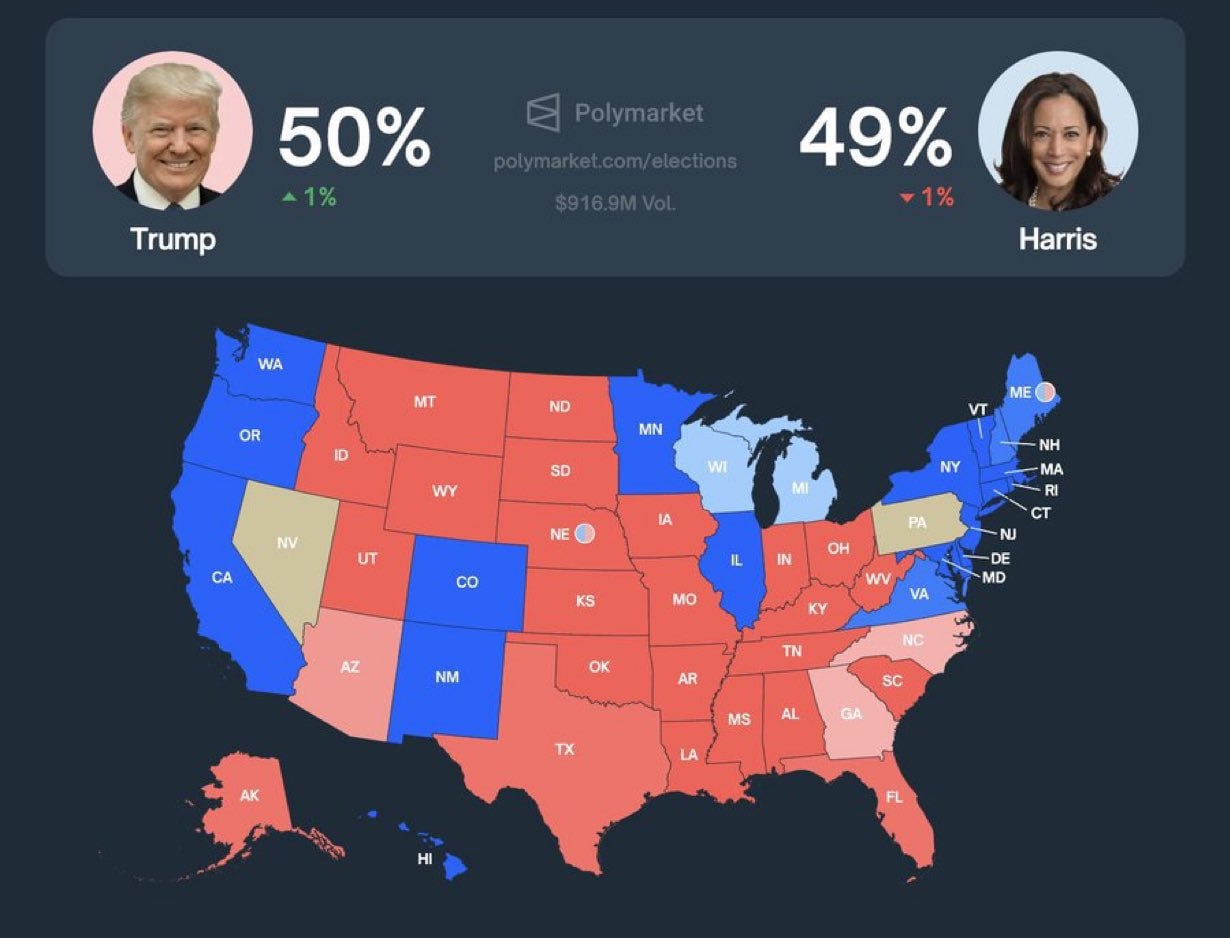

In the near future, traders will focus on spot operations rather than futures. The calm continues, and investors are preparing for a phase of turbulence. However, as this phase approaches, an increase in volatility and trading volumes can be expected, which may lead to new opportunities for those who are ready to take risks.