Analysts at Swiss crypto bank Sygnum are forecasting the arrival of a new altcoin season. In their Q3 report, published by Cointelegraph, the experts point to a combination of factors that are creating ideal conditions for altcoin growth: increased liquidity, improving regulatory clarity, and a surge in on-chain activity.

Geopolitical Tensions Ease, Altcoin Interest Rises

The first half of 2025 was marked by widespread sell-offs driven by global political tensions and uncertainty around U.S. economic policy. However, the landscape appears to be shifting.

“As the regulatory status of altcoins becomes clearer, capital may flow into projects with real-world utility and sustainable tokenomics. Some signs suggest that this transition is already underway,” Sygnum analysts stated.

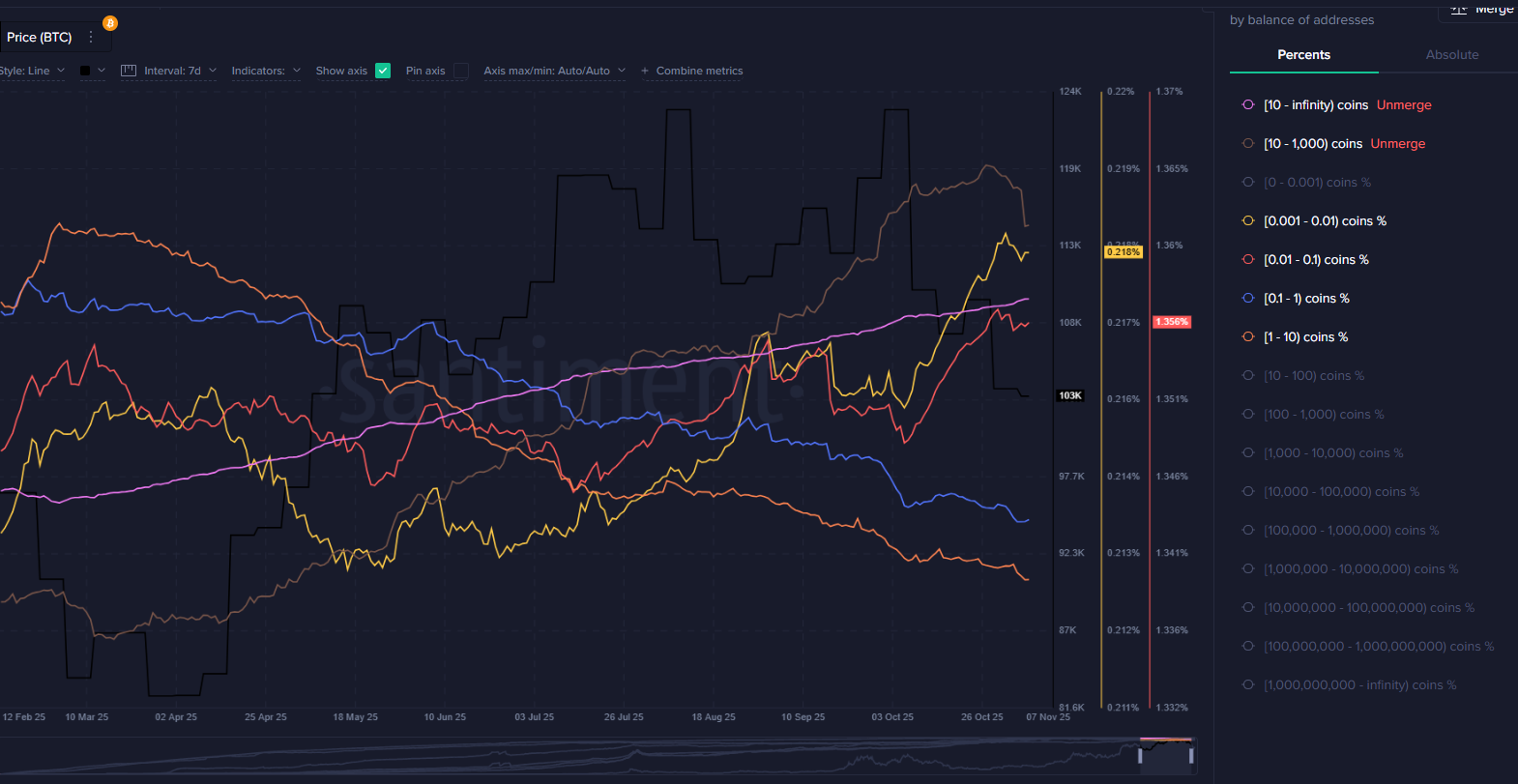

One key indicator is the decline in Bitcoin’s market dominance, which dropped by 6% over the past month—moving away from its 2021 peak. This signals growing investor interest in alternative digital assets.

Bitcoin and Ethereum Maintain Leadership

Despite the rising momentum in the altcoin space, Bitcoin continues to show a strong bullish trend. Demand continues to outstrip supply, pushing prices to new highs — on July 14, BTC surged past a record $123,000.

The bullish momentum is further supported by capital inflows into crypto ETFs. The total assets under management in crypto funds now exceed $160 billion, with over 110,000 BTC accumulated just in the last quarter.

Ethereum is following a similar trajectory:

- ETH balances on centralized exchanges continue to decline;

- Ethereum-based ETFs are reporting record inflows.

The recent Pectra network upgrade, coupled with increased institutional interest—such as Sharplink’s plan to invest $1 billion in ETH—has reinforced confidence in Ethereum’s future. Meanwhile, financial giants like BNY Mellon and Societe Generale are showing growing interest in Ethereum-based stablecoins.

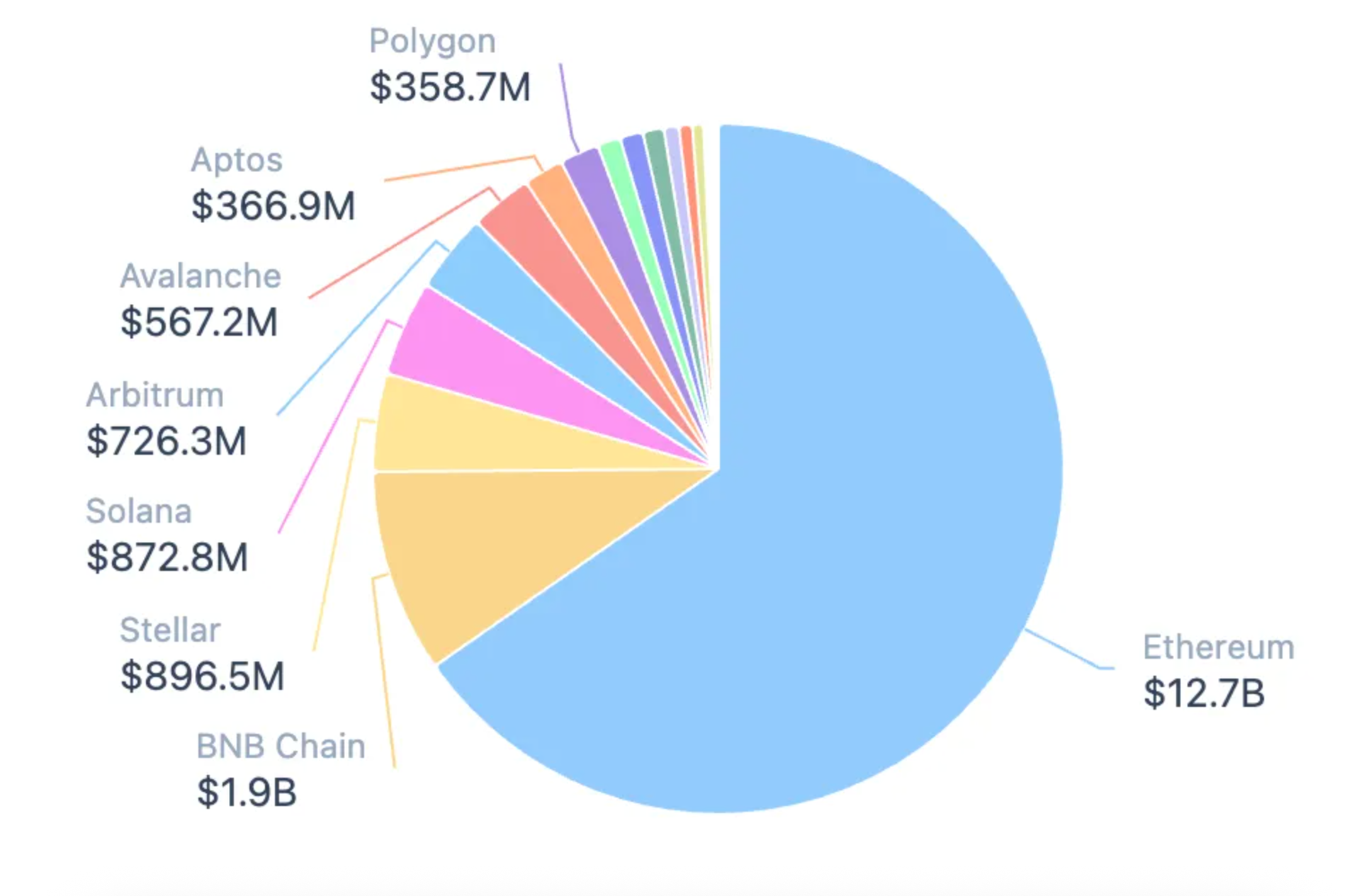

DeFi Surges to New Heights

The decentralized finance (DeFi) sector continues to gain traction. According to Sygnum, decentralized exchanges (DEXs) now account for 30% of all spot crypto trading volume. On BNB Chain, PancakeSwap has taken the lead, while PumpSwap—built on Pump.fun—has surpassed Raydium in the Solana ecosystem.

DeFi lending volume has reached an all-time high of $70 billion, while 30% of Ethereum’s liquid supply is now locked in staking. Analysts identify these as key drivers behind the current crypto market rally.

A Word of Caution

Nevertheless, Sygnum urges caution amid the altcoin frenzy. The sharp rally bears resemblance to the 2021 cycle, which was followed by a major correction. Of particular concern are meme coins — assets with no fundamental value that could amplify volatility and lead to widespread sell-offs.

Conclusion:

The cryptocurrency market is entering a phase of strong growth, with investor focus gradually shifting toward altcoins and decentralized technologies. However, Sygnum advises maintaining a balanced approach and steering clear of overhyped assets lacking solid fundamentals.