Messaging app Telegram has announced plans to issue five-year bonds totaling $1.5 billion, following successful negotiations with both new and existing investors, according to sources close to the deal cited by the Wall Street Journal.

Key participants in the bond placement include major institutional investors such as asset manager BlackRock and the Abu Dhabi state investment fund Mubadala. Additionally, participation from one of the world’s leading hedge funds, Citadel, is expected, underscoring the market’s strong confidence in Telegram despite ongoing legal challenges.

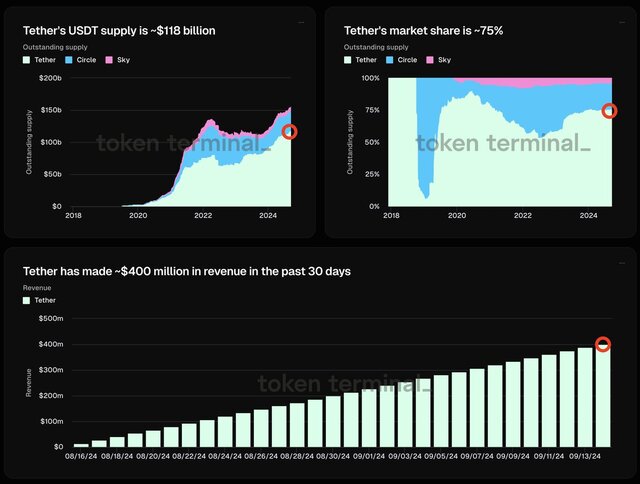

According to insiders, the bond yield will be set at approximately 9% annually—a rate comparable to other risk assets in the technology sector. The proceeds from the new bond issuance will be used by the company to partially repurchase outstanding debt from bonds issued in 2021 that mature in March 2026. Telegram has already repurchased around $400 million of these bonds in cash, aiming to optimize its debt load and reduce financial costs.

Investors will receive an option to convert their bonds into shares of the company at a discounted price if Telegram decides to go public through an IPO or direct listing. Telegram’s founder, Pavel Durov, has previously indicated that an IPO is not ruled out in the long term, suggesting that the company’s potential market valuation could reach approximately $30 billion—reflecting its status as one of the largest independent players in the communications and social platform space.

Telegram’s financial results for 2024 were record-breaking: total revenue exceeded $1 billion, and for the first time since monetization began—via advertising and paid subscriptions—the company posted a net profit of approximately $540 million. This financial breakthrough signals the sustainability of Telegram’s business model and promising growth prospects.

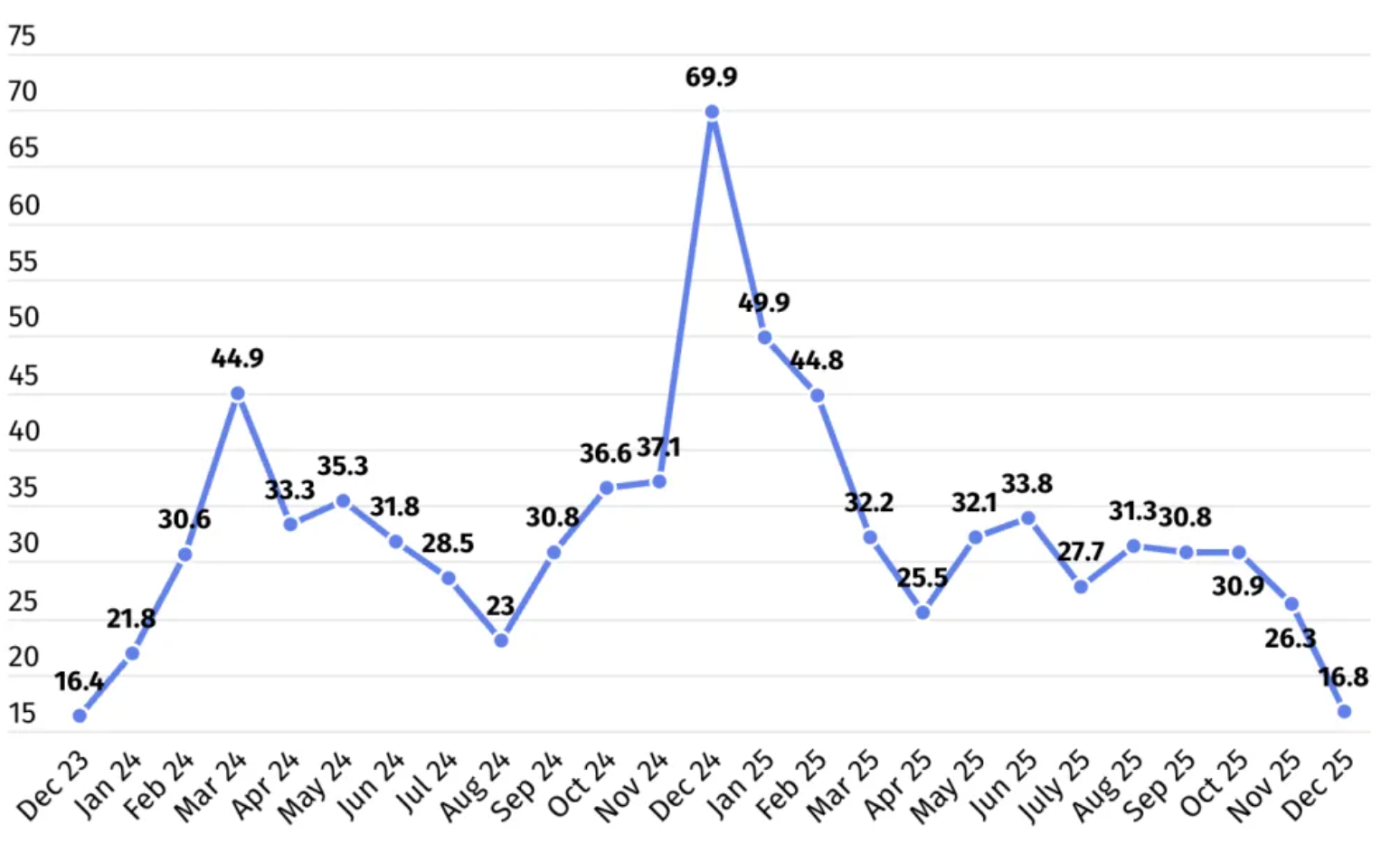

March 2025 marked a significant milestone as Telegram’s monthly active users surpassed 1 billion. Meanwhile, the number of Premium account subscribers, which offer enhanced features and capabilities, reached 15 million, greatly strengthening monetization potential and revenue stability.

Outlook for 2025 remains optimistic: the company expects to increase revenue to $2 billion and achieve profits exceeding $700 million, enabling substantial investments in new services, infrastructure, and improving user experience.

However, alongside this growth, Telegram has faced serious legal challenges. In August 2024, French authorities detained Pavel Durov on charges of complicity in the dissemination of illegal content, including drugs and child pornography, as well as for refusing to provide information requested by authorized bodies. After posting bail of €5 million, Durov was released and in March 2025 was allowed to leave France. The court proceedings are expected to begin no earlier than 2026, allowing Telegram and Durov to focus on business activities in the short term.

In response, Telegram has significantly strengthened its internal content moderation procedures and legal support to promptly address regulatory and law enforcement inquiries in Europe. The company has implemented new automated filtering technologies and expanded its legal team, helping reduce the risk of content blocks and fines.

Thus, despite legal hurdles, Telegram continues to solidify its position as one of the world’s leading messaging platforms, developing a sustainable business model and planning substantial capital raising to realize its ambitious strategic goals.