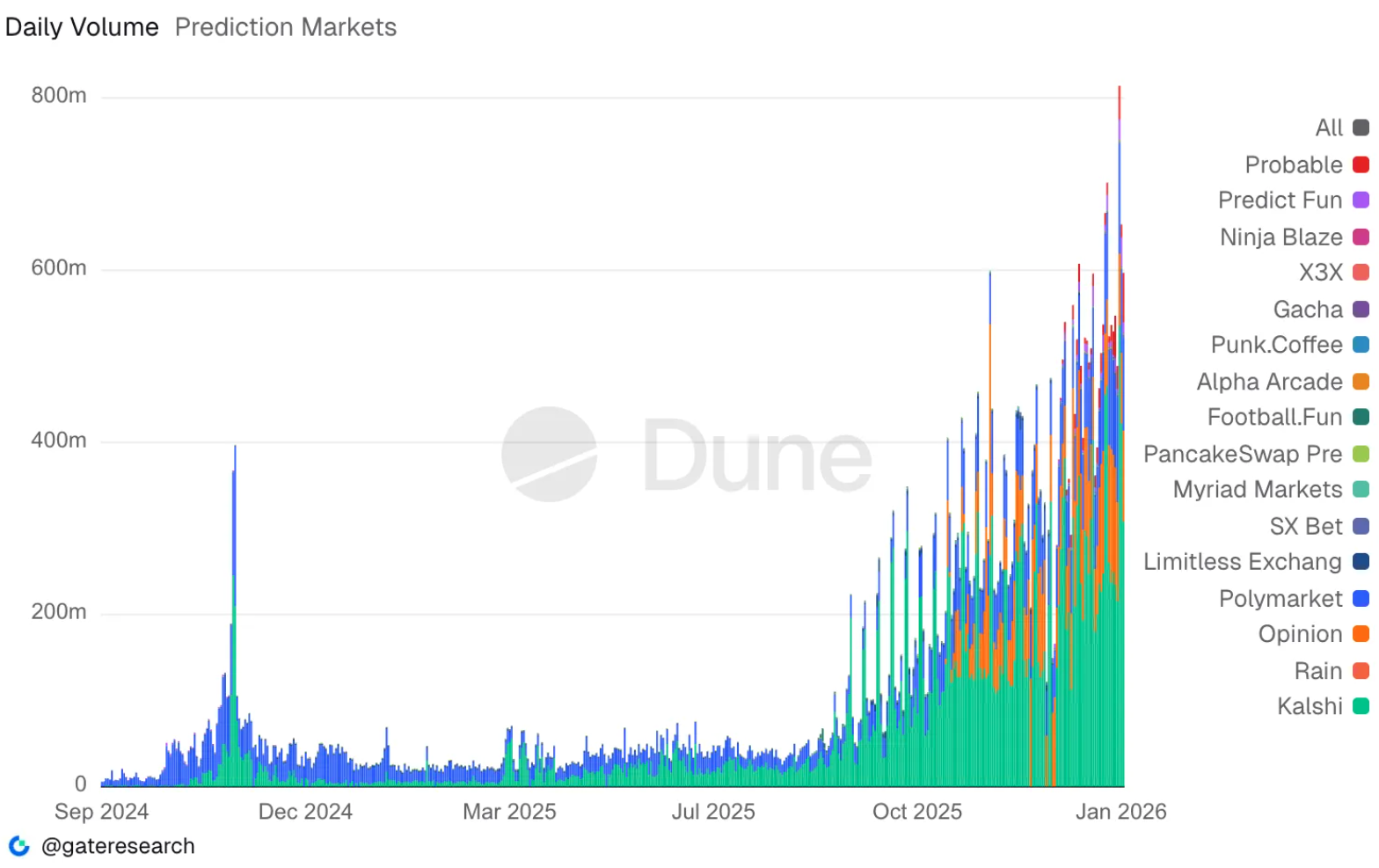

The prediction market industry is experiencing an unprecedented surge. According to the latest data from Dune, the daily trading volume across leading platforms has reached a historic milestone of $814 million.

This spike confirms a long-term trend: decentralized and regulated platforms for event-based betting are evolving from a niche tool for crypto enthusiasts into a significant segment of the global financial market.

Market Dynamics in Numbers

January 2026 is on track to become the most successful month in the sector’s history. In less than three weeks, the total turnover reached $10.9 billion, nearly matching the record-setting $11.5 billion seen in December.

A critical milestone for the industry was reached this month as the prediction market sector’s share of the total crypto spot trading volume exceeded 1% for the first time in history.

Industry Leaders

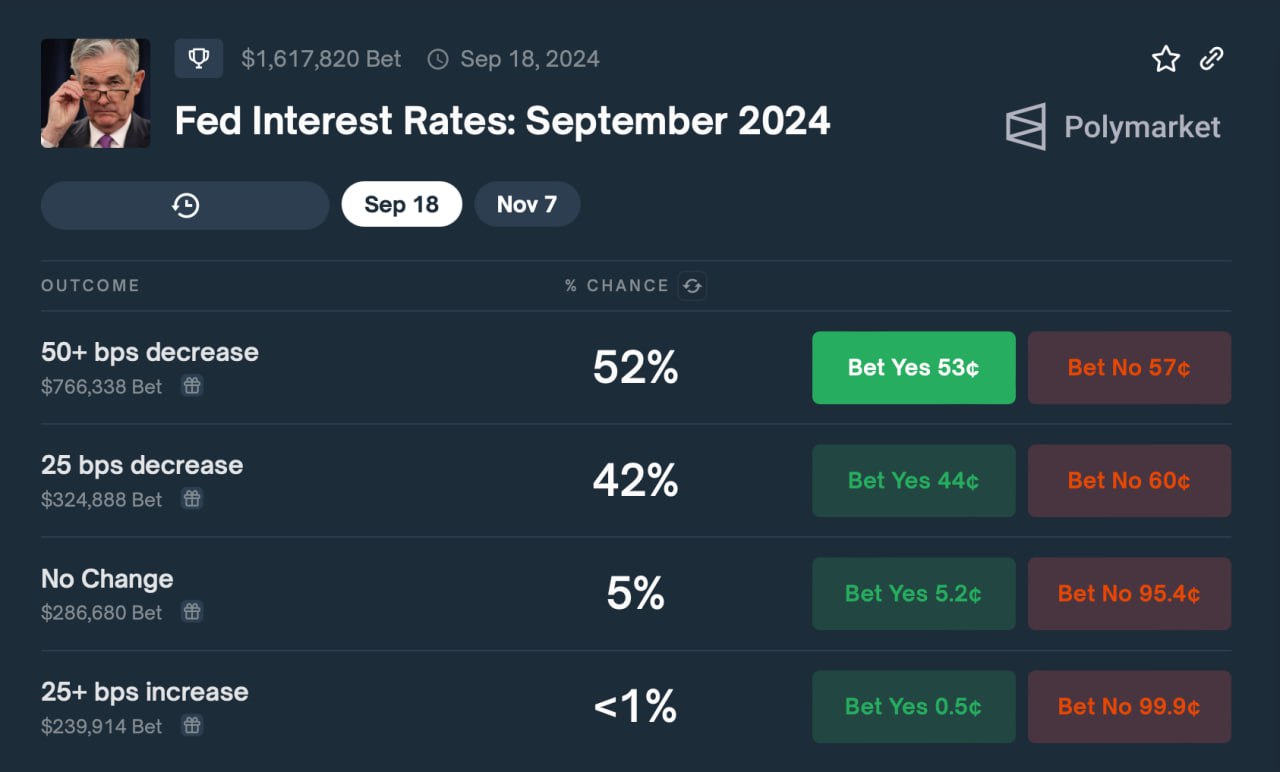

The market is currently dominated by a “triumvirate” of platforms competing fiercely for liquidity and users:

| Platform | Jan Trading Volume | Share of Open Interest | Key Highlight |

| Kalshi | > $6 billion | 38.1% ($334M) | The absolute leader in volume for the first 21 days of Jan. |

| Opinion | $2.1 billion | — | Backed by YZi Labs and CZ; leader in commission fees. |

| Polymarket | $2 billion | 41.1% ($391M) | Maintains the lead in total open positions held. |

A New Phase of Growth and “Bottlenecks”

Analysts at Galaxy Research state that the prediction market has entered the stage of mass adoption and active capital attraction. This momentum is driven by the rapid growth of Polymarket and Kalshi, as well as a wave of startups testing innovative product solutions.

However, despite the current euphoria, experts highlight a key fundamental risk:

“The sector’s primary weakness remains a liquidity deficit. Even with record capital inflows, the market still struggles to provide deep order books for less popular categories, creating risks of high volatility.”

Record user activity has also resulted in record revenues for these platforms. Last week, commission fees exceeded $2.7 million—an absolute maximum. Revenue distribution reveals interesting trends:

- Opinion captured over half the market (54%), earning $1.5 million.

- Polymarket earned approximately $787,000, largely driven by high-frequency “15-minute” short-term markets.

Regulatory Strike: The Portugal Case

The downside of success has been increased scrutiny from authorities. Portugal has become one of the first European nations to take decisive action against unlicensed platforms.

The Gambling Regulation and Inspection Service (SRIJ) has initiated an ISP-level block of Polymarket. The crackdown was triggered by an “anomalous” volume of bets on the country’s presidential elections:

- Volume: Turnover for the election market reached €110 million, with €4 million wagered in the final hours before the results.

- Suspicions: Regulators fear the use of non-public information, such as exit poll leaks.

- Legality: SRIJ determined that Polymarket lacks a local license and violates laws prohibiting political betting in Portugal.

The project was given a 48-hour ultimatum on January 16th to cease operations. After the deadline passed and the site remained accessible, authorities moved to block the resource at the provider level.

Conclusion

Prediction markets have proven their viability as a source of alternative data and a tool for risk hedging. However, the situation in Portugal demonstrates that as their influence grows, these platforms must find a middle ground with national regulators to maintain access to a global audience.