These words from Jerome Powell came as a surprise to many.

Previously, Powell stated that rate cuts would require inflation to slow to 2%. Now, his stance has changed. The market may perceive this shift positively.

For the bullish trend to continue, especially in the stock market, further signs of decreasing inflation are needed.

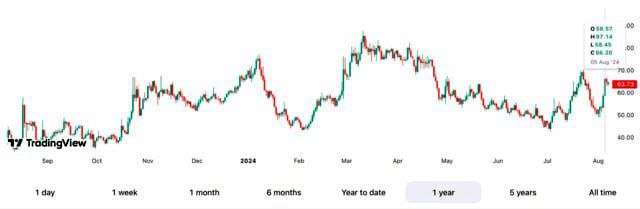

On one hand, we saw a cooling of the labor market in June, which is a deflationary factor. On the other hand, oil prices rose in the same month, causing inflationary concerns. Therefore, there is no absolute certainty about a decrease in inflation, but the market is still hoping for “magic” from the Fed.

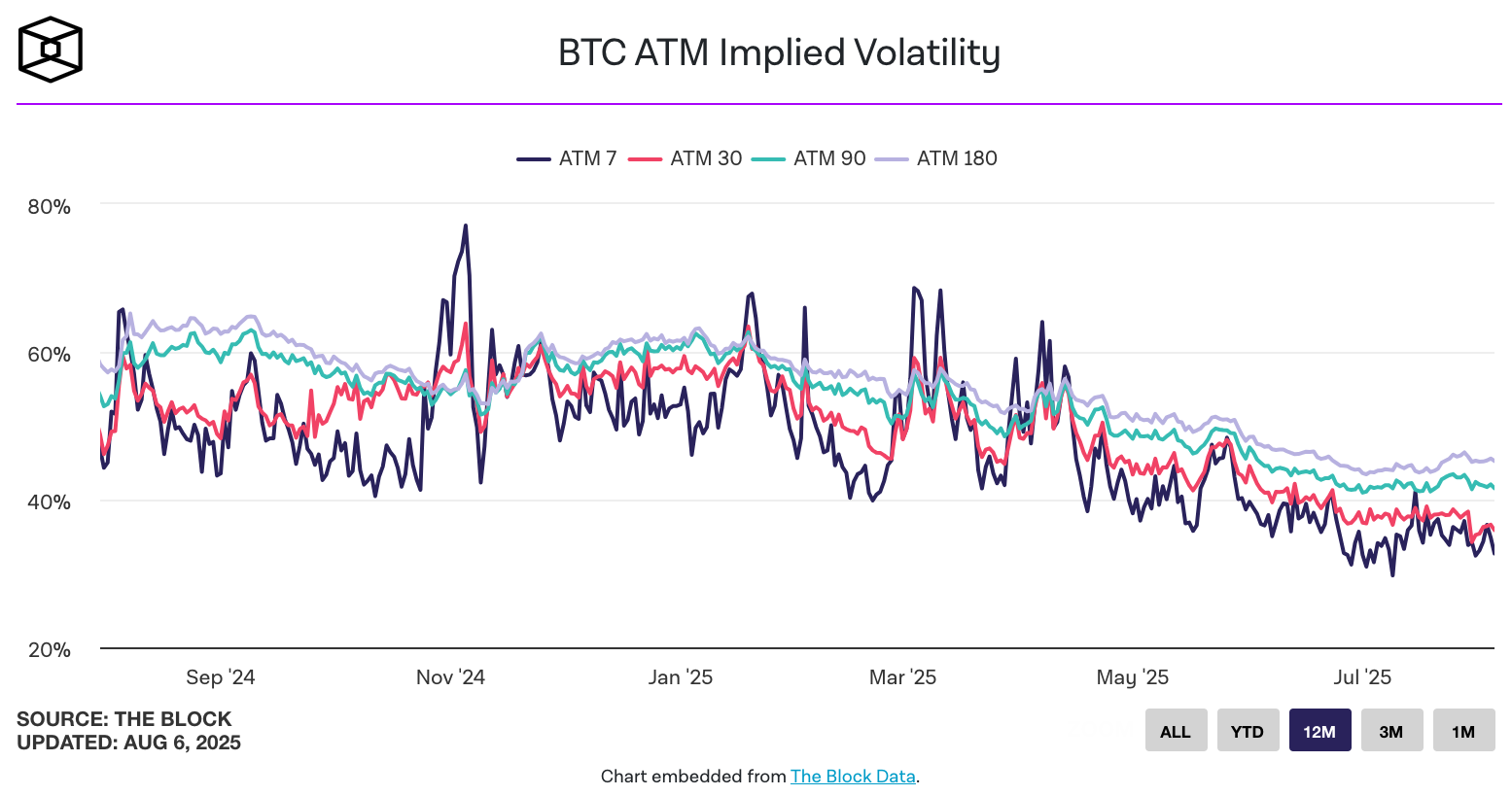

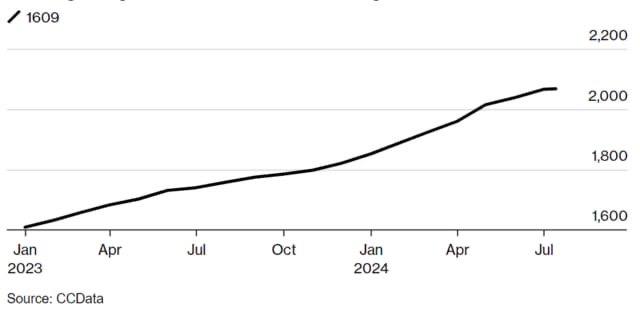

We are betting on the continuation of the bullish market ahead of the elections and hoping that cryptocurrencies will soon start catching up with the indices.