Indicating growing interest in this stablecoin and increasing activity in the cryptocurrency market.

USDT continues to maintain its undisputed leadership among stablecoins, accumulating $117 billion in assets, while the total market capitalization of all stablecoins is rapidly approaching $169 billion. This reflects ongoing trust in stablecoins as a tool for capital preservation in times of market volatility.

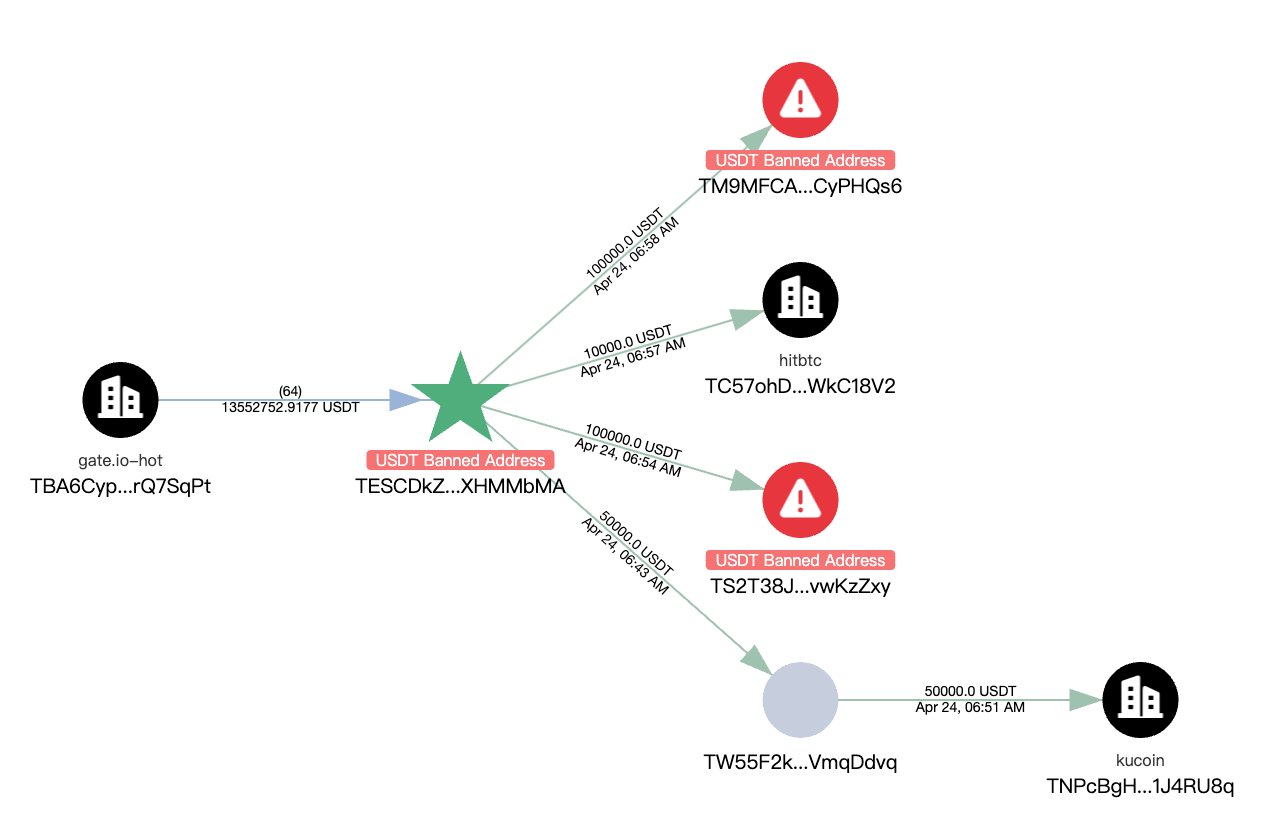

The primary networks for USDT remain Tron and Ethereum, where the supply has reached an impressive $58.68 billion and $46.18 billion, respectively. These platforms offer high transaction speed and low fees, making them preferred choices for USDT users.

In addition to Tron and Ethereum, USDT is actively used across other networks such as BNB Chain, Arbitrum, Avalanche, Optimism, Polygon, Solana, TON, and Near. This demonstrates the broad integration of USDT into the blockchain ecosystem, enhancing its accessibility and functionality for users worldwide.

More than 31,300 new wallets are created daily, indicating a steady influx of new participants into the market. The registration rate of USDT addresses has reached its highest level since March 25, which may be linked to increased demand for stable assets during periods of market uncertainty.

Dai is also showing significant growth, with its market capitalization surpassing $5.364 billion. Approximately 732 new DAI addresses are registered daily, highlighting the interest in decentralized stablecoins backed by cryptocurrency assets.

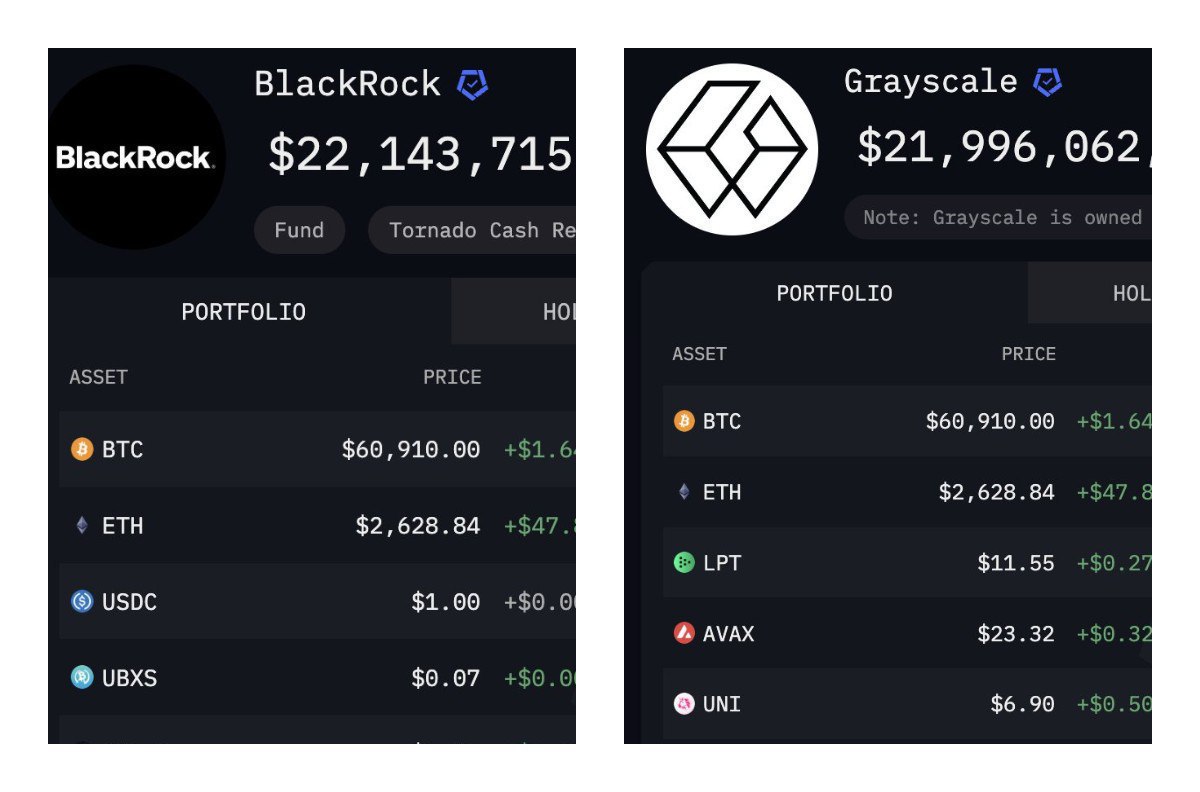

The flow of capital into stablecoins signals that traders remain optimistic and are ready to convert their stablecoins into Bitcoin and Ethereum at any moment, awaiting favorable market conditions. These trends underscore the strategic importance of stablecoins in risk management and maintaining liquidity in the cryptocurrency space.