TrueCoin and TrustToken have reached a settlement with the U.S. Securities and Exchange Commission (SEC) over charges of fraud and unregistered sales of investment contracts related to the TrueUSD (TUSD) stablecoin.

According to the SEC complaint, TrueCoin was the issuer of TUSD, while TrustToken managed the TrueFi lending protocol. Between November 2020 and April 2023, the companies offered investors the opportunity to purchase TUSD and earn profits through the lending platform. They claimed that TUSD was 100% backed by U.S. dollars and promoted their products as safe and risk-free.

However, it was later revealed that a significant portion of the assets backing the stablecoin had been invested in speculative offshore funds. By fall 2022, TrueCoin and TrustToken became aware of the liquidity issues faced by these funds but continued to promote TUSD as a secure investment. As of September 2024, 99% of the stablecoin’s reserves were controlled by the troubled fund.

“TrueCoin and TrustToken deliberately misled investors by concealing substantial risks and portraying their products as safe investments. This case highlights the importance of complying with registration requirements, as users were deprived of critical information necessary for making fully informed decisions,” stated Jorge Tenreiro, Acting Chief of the SEC’s Crypto Assets and Cyber Unit.

Without admitting or denying the charges, the companies agreed to a settlement, which includes compliance with a court ruling. The settlement terms require them to:

- Refrain from violating securities laws;

- Pay a civil penalty of $163,766 each;

- TrueCoin must also return $340,930 in illegally obtained profits and pay $31,538 as compensation for pre-trial settlement costs.

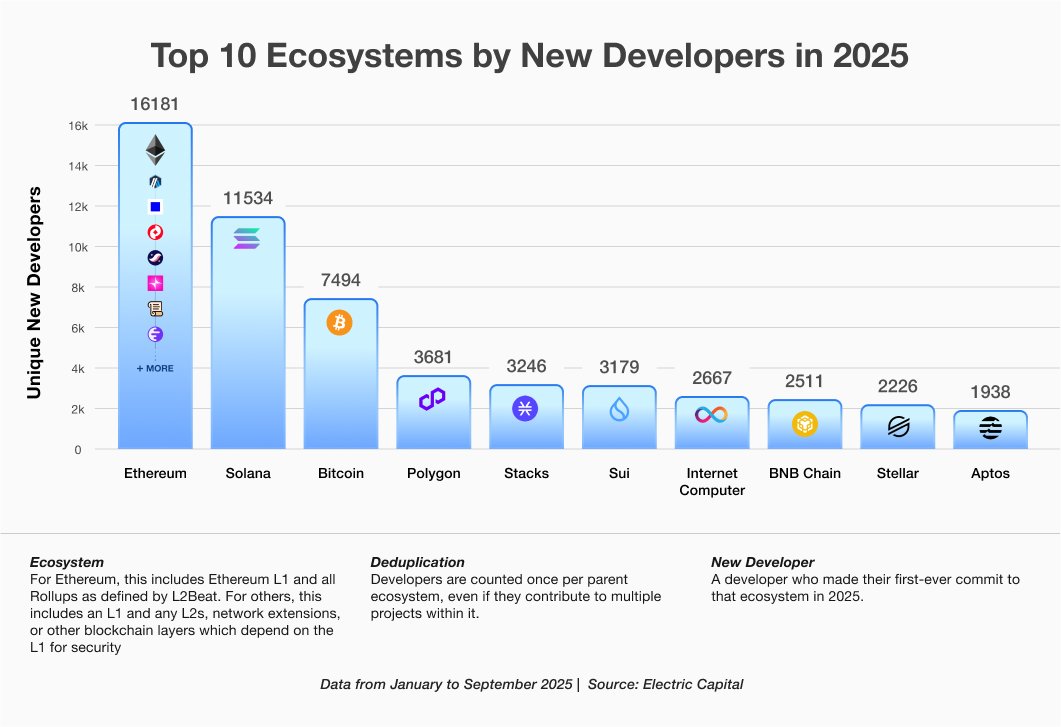

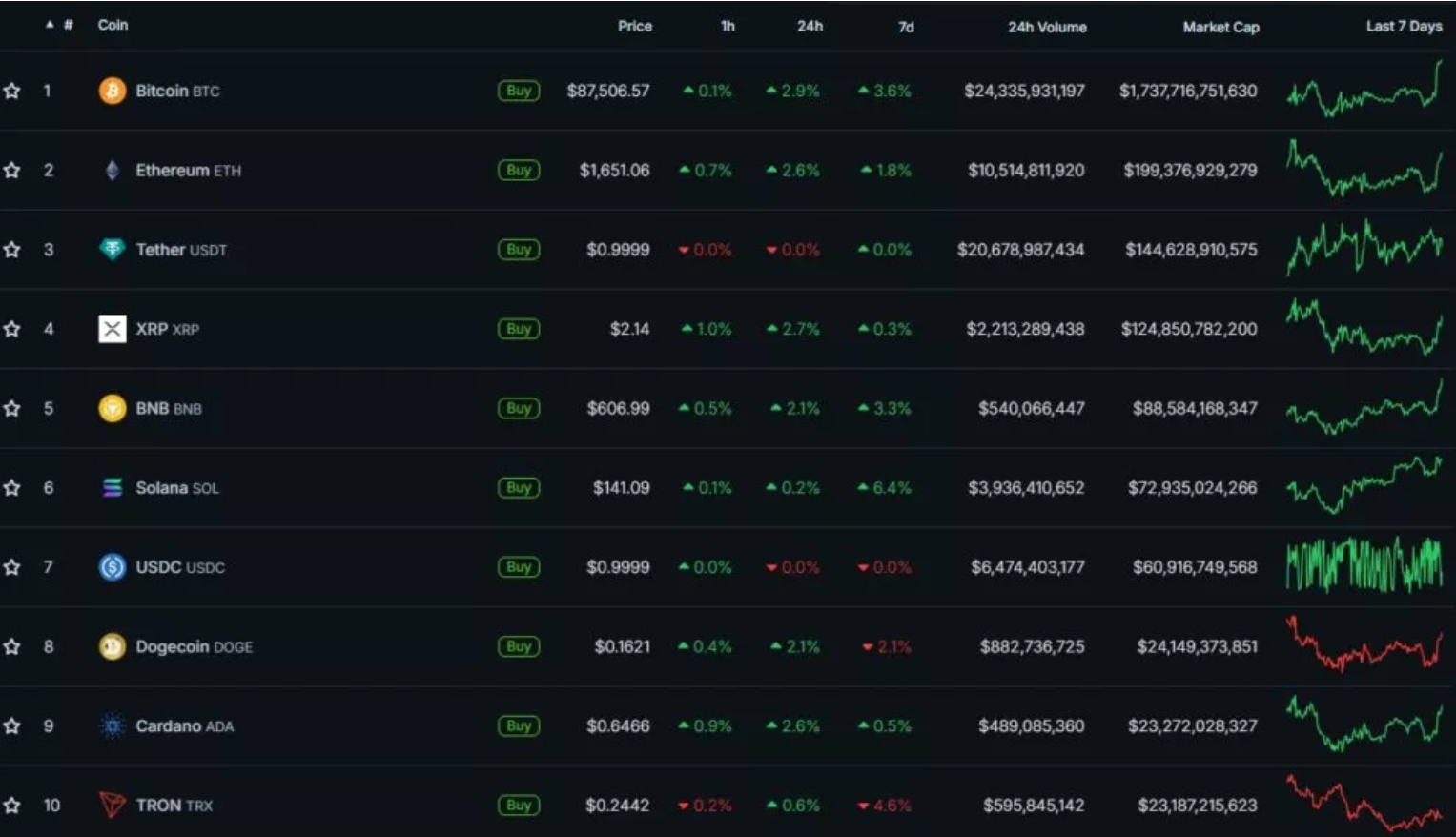

According to CoinGecko, the market capitalization of TUSD is currently $495 million, ranking it as the 11th largest stablecoin in a market with a total value of over $173.3 billion. The market leaders remain Tether’s USDT, with a capitalization of $119.2 billion, and Circle’s USDC, with $35.9 billion.

Notably, in the 2024 fiscal year, the SEC collected a record $4.7 billion in fines and penalties from crypto companies, signaling increased regulatory oversight in the industry.

This case could set a precedent for further SEC actions against other stablecoin issuers and crypto firms, indicating a tightening of regulations around transparency and the safety of crypto investments.