Starting January 1, 2025, all custodial platforms, such as Coinbase and Kraken, must collect and report clients’ transaction data to tax authorities, similar to how brokerage firms currently do.

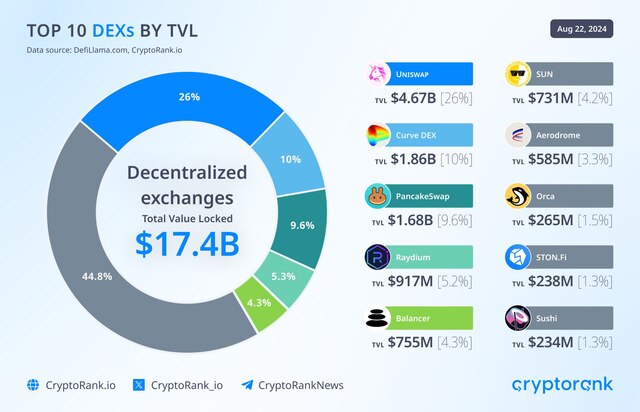

For decentralized exchanges (DEX) and DeFi, similar rules are planned, but it is not yet clear how this will be implemented, so this matter has been postponed for now 😄.

In 2025, the responsibility for declaring and paying taxes on cryptocurrencies remains with the clients of the exchanges. However, starting in 2026, the tax authorities will begin issuing tax bills based on the data received.

The tax will apply to anyone who cashes out stablecoins in amounts of $10,000 or more or sells NFTs worth at least $600.

American cryptocurrency users now have another reason to vote for Trump.

4o