The Trump administration’s recent decision to raise import tariffs on mining equipment from Southeast Asia is expected to slow the growth of the U.S. crypto mining industry. The new trade measures have sparked concern among market participants.

Tariffs Raised to 21.6%

On July 31, the White House imposed new tariffs under the “Day of Liberation” trade reform. The new duties include a 19% tariff on ASIC miners imported from Malaysia, Indonesia, and Thailand, bringing the total levy to 21.6%. Meanwhile, tariffs on Chinese imports remain at 57.6%, despite earlier proposals to raise them to 145%.

Previously, mining hardware from Southeast Asia was subject to a standard 2.6% import duty, while Chinese ASICs faced an additional 25% on top of the base rate.

Industry Shifting to New Regions

According to Ethan Vera, COO of Luxor Technology, these new tariffs make the U.S. one of the least attractive countries for importing mining devices. Vera noted a growing trend of companies relocating their equipment to other countries with more favorable import conditions.

“We expect a slowdown in growth within the U.S., leading to the movement of hardware to markets with more favorable tariffs,” Vera told The Block.

He listed Canada, Northern Europe, Russia, Brazil, Argentina, Chile, Paraguay, and Ethiopia as attractive alternatives thanks to lower duties and affordable energy.

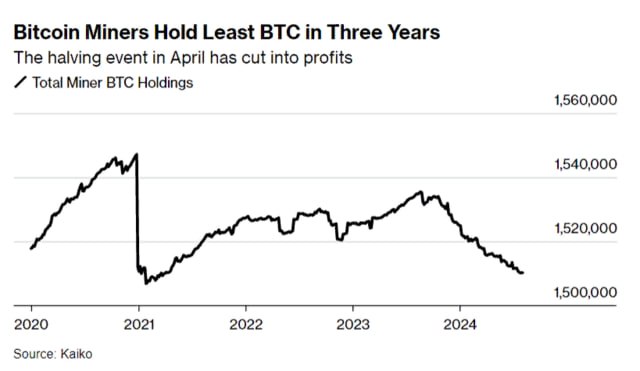

Market and Manufacturer Impact

The majority of ASIC devices are manufactured outside the United States, with Chinese giant Bitmain—maker of the Antminer product line—remaining a dominant player. The increased tariffs will directly raise hardware costs, impacting the profitability of American mining firms and possibly affecting the stock prices of publicly traded miners.

In response, some Chinese manufacturers have begun relocating part of their production to the U.S. to avoid the additional costs. Canaan and MicroBT are among the first to make this move.

Long-Term Outlook: Domestic Production

In the long run, the U.S. may develop its own ASIC manufacturing capabilities. However, according to Vera, this won’t happen overnight.

“Final assembly in the U.S. is already possible, and many manufacturers are doing it. But raw materials still come from Asia, so the overall cost remains high. It will take several years to establish a fully U.S.-based supply chain,” he explained.

Luxor Technology is actively lobbying for bitcoin mining equipment to be excluded from the new tariff policy. The company is working with industry groups to ensure fair treatment for domestic miners, citing the administration’s campaign promises to support local crypto infrastructure.