Despite a 3.45% drop in XRP’s price, large investors took advantage of the situation and acquired over 50 million tokens, amounting to approximately $29.5 million.

This dip was the smallest among the top 10 cryptocurrencies, indicating XRP’s relative stability amidst market volatility.

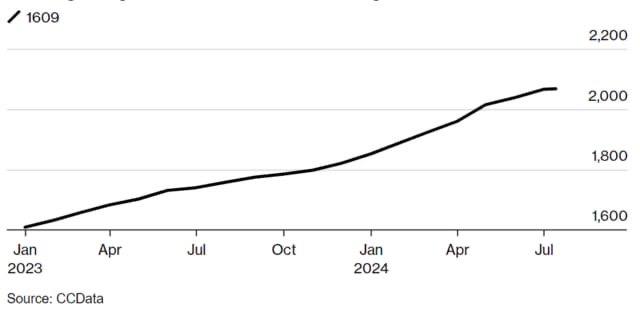

In the Ripple ecosystem, there’s an observed increase in transactions over $100,000, which may indicate that the asset has reached its bottom or is nearing it. This could also suggest the beginning of an accumulation phase, where investors view current price levels as favorable for long-term investments.

However, traders caution about the possibility of further declines if a bearish trend takes hold in the market. This scenario could be supported by overall negative sentiment in the cryptocurrency market, driven by macroeconomic factors or regulatory risks.

XRP has strong support in the $0.334–$0.387 range, which analysts see as a potential bottom for this altcoin. This range could become a key buying level if the price continues to decline, potentially attracting additional interest from large players.

In the near term, XRP’s performance will depend on the overall situation in the cryptocurrency market, as well as news and events related to Ripple, such as legal proceedings and partnerships with financial institutions.