BNB’s surge above $1,300 isn’t a flash-in-the-pan speculation but a result of Binance’s structural recovery and deeper integration with TradFi. That’s supported by on-chain metrics, growing stablecoin liquidity on Binance, and improving market sentiment.

“This creates a solid foundation for BNB’s strength by stimulating real demand in trading, staking, and launchpad participation,” note analysts at XWIN Research Japan.

Growth Drivers

- Structural recovery at Binance. Analysts see a return to sustainable ecosystem growth and stronger links with traditional finance.

- Strong buying momentum. Since late September, both spot and futures indicators (including CVD) have trended higher, reflecting steady demand.

- Stablecoin liquidity concentration. Binance’s share of ERC-20 stablecoin reserves has reached ~70%, reinforcing the exchange’s role as a key liquidity hub.

Sentiment and Tokenomics

- Improved sentiment. Mood brightened after Changpeng Zhao (CZ) restored a mention of the exchange he founded to his bio on X.

- Quarterly burn. Binance burns about 2 million BNB per quarter (around $1 billion), reducing circulating supply and tying the token’s scarcity to platform growth and volumes.

TradFi Partnerships and Infrastructure Moves

- RWA initiatives. Binance announced a collaboration with Franklin Templeton to build real-world asset (RWA) tokenization solutions.

- Oracles and data. In early October, BNB Chain partnered with Chainlink to put official U.S. Department of Commerce statistics on-chain—another step toward institutional-grade infrastructure.

Network & Market Metrics: A Burst of Activity

- Price. At the time of writing, BNB trades around $1,300; +28% over 7 days and +49% over a month.

- Unique addresses. Over the last 24 hours, more than 2.5 million—the highest among L1 blockchains.

- Fee revenue. A record $7.8 million in one day; by comparison, Ethereum—$777,626, Solana—$758,169.

- DEX volumes. Daily trading volume on BNB Chain exceeded $6 billion (second-highest this year), with $4.29 billion on PancakeSwap.

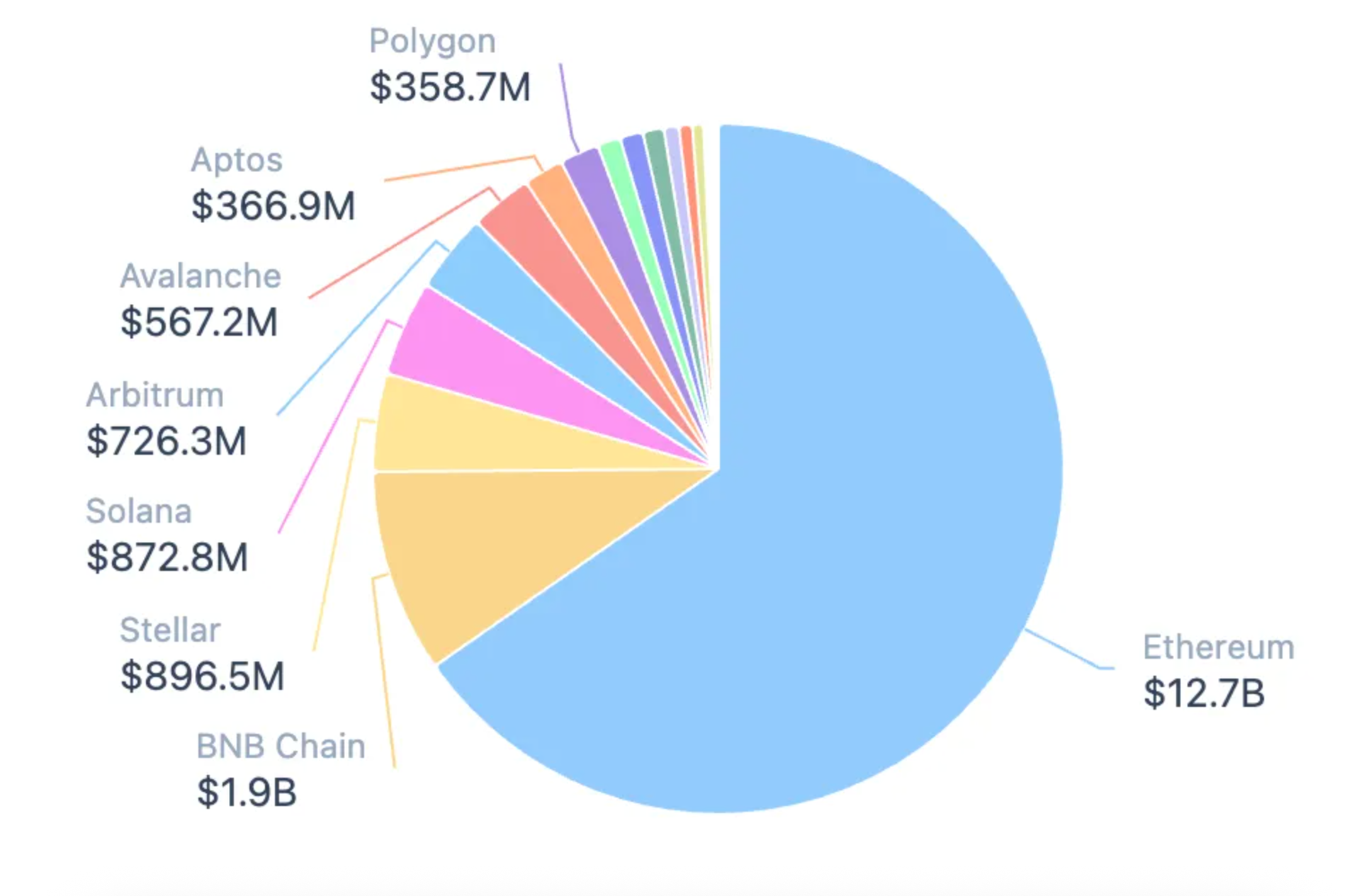

- TVL. Up 14% over the week to $9.1 billion.

What’s Powering the In-Ecosystem Momentum

- Meme-coin season. Frenzy around BNB Chain–based “funny coins,” officially green-lit by CZ, drew new speculative and arbitrage flows.

- Perpetuals trading. After the ASTER token launch, the namesake DEX (supported by Binance) became the segment leader. The protocol’s TVL now exceeds $2.4 billion (futures volume data not disclosed).

Bottom Line

A mix of on-chain demand, concentrated liquidity on Binance, regular BNB burns, and expanding institutional partnerships is laying the groundwork for the trend to continue. Within the ecosystem, meme activity, rising DEX volumes, and perpetuals trading amplify BNB Chain’s network effects and bolster the durability of the current rally.