The Zora (ZORA) token, linked to the eponymous NFT and creative launchpad built on Base L2, has gained over 118% in the past week and nearly 50% in the last 24 hours. According to CoinGecko, the project’s market capitalization has reached $450 million, placing it among the notable players in the NFT infrastructure and tokenization space.

Growth Factor #1: Perpetual Futures Listing

August 8–10 marked a turning point for the asset. Major cryptocurrency exchanges, including Binance, launched perpetual futures for ZORA with leverage of up to 50x.

This development delivered several key effects:

- Wider accessibility – ZORA became available to more traders worldwide, including those who favor derivatives over spot trading.

- Speculative capital inflow – high volatility and significant leverage opportunities attracted short-term trading strategies.

- Improved liquidity – tighter spreads and higher trading volumes were recorded in both spot and futures markets.

Growth Factor #2: Sharp Trading Volume Spike

On August 10, ZORA’s trading volume reached $284 million, compared to less than $160 million the day before — a 78% daily increase.

Such liquidity surges often accompany phases of heightened market participation, whether driven by fundamental interest or short-term speculative waves.

Growth Factor #3: On-chain Metrics and NFT Activity

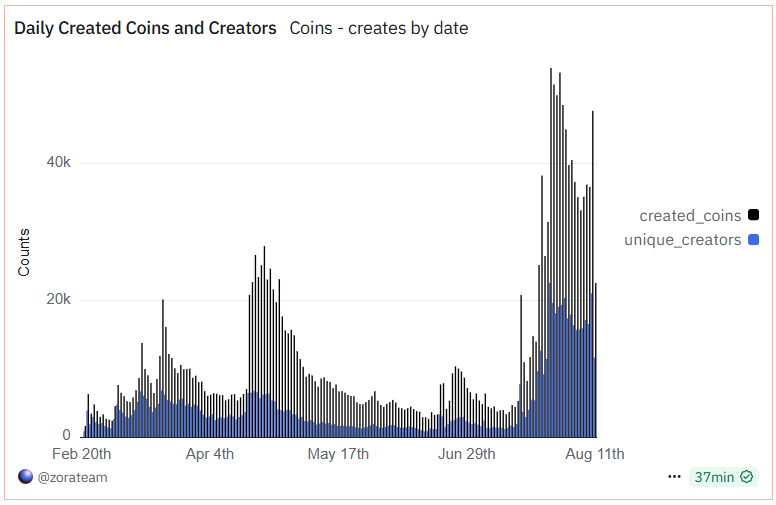

On the same day, August 10, on-chain data recorded the highest activity in recent weeks within the Zora ecosystem:

- 21,000 creators minted 47,000 NFTs — the largest daily figure since July 31.

- The Base network, which powers Zora, also saw a noticeable increase in transactions, pointing to growing user engagement.

Historical Context: Meme Token Leadership

Interest in Zora didn’t appear out of nowhere. In July, the project surpassed former leaders Pump.fun and LetsBonk in the number of tokens issued. This solidified Zora’s reputation as an innovative platform for creators and community-driven projects.

Current Price and Outlook

At the time of writing, ZORA is trading at $0.12. The main question for investors is whether the token can sustain its current levels, or if the rally is primarily a result of short-term speculative momentum triggered by derivatives listings.

Analysts note that sustained growth will require:

- Maintaining high on-chain activity,

- Attracting new users into the ecosystem,

- Expanding trading pairs and integrations.

Bottom Line: Zora has once again shown that it can quickly mobilize its community and capture market attention. If the team continues to enhance its NFT functionality and maintain strong user activity growth, the token could secure its place among the top assets in the sector. However, investors should remain aware of the high volatility and speculative nature of the current price action.