Spot XRP ETFs launched in mid-November have been showing steady investor demand. According to SoSoValue, the funds recorded 30 consecutive days of net inflows, bringing in $990 million over the past month.

What Products Make Up the Sector

The segment is represented by five spot XRP ETF products from major issuers:

- Canary — XRPC

- 21Shares — TOXR

- Grayscale — GXRP

- Bitwise — XRP

- Franklin Templeton — XRPZ

Total assets under management (AUM) across the sector are estimated at $1.1 billion, which equals roughly 0.98% of Ripple’s total token supply.

Ripple CEO Brad Garlinghouse noted that XRP-based exchange-traded funds reached $1 billion in AUM in under four weeks. By speed of asset growth, this became the second-fastest result after the launch of ETH ETFs in the U.S.

Trading Activity and Inflow Breakdown

As of December 12, trading volume in the XRP ETF segment totaled $29.2 million.

The largest inflows went to XRPC, which attracted $374 million. Other products have also posted significant numbers:

- GXRP — $218 million

- XRP (Bitwise) — $212 million

- XRPZ — $184 million

Why XRP ETFs Stand Out Versus BTC and ETH

XRP ETF performance contrasts with investor behavior in other major segments:

- In November, Bitcoin ETFs saw total outflows of $3.4 billion, and since early December they have attracted only $198 million.

- Ethereum-focused ETFs lost $1.4 billion last month and had brought in $143 million as of December 12.

Even Solana ETFs drew less interest: since launching in late October, they have attracted $674 million and experienced several days of net outflows.

XRP Price Action: Pressure Still in Place

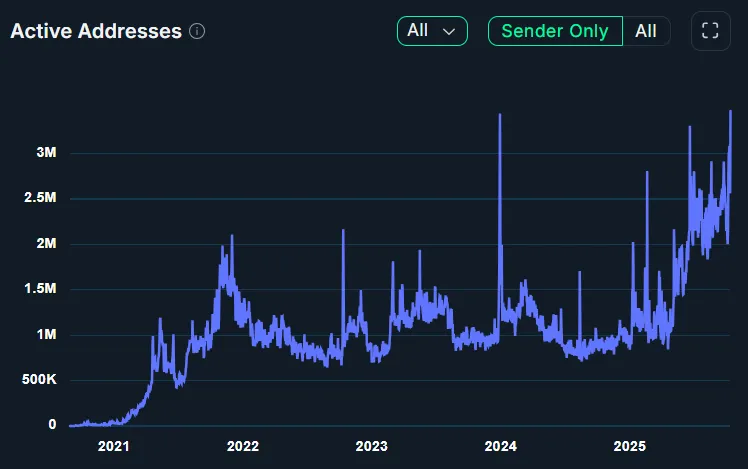

Over the past month, XRP has declined by 12.3%. At the time of writing, the asset is trading around $2, a key resistance level.

Trader Noman__peerzada described the current phase as a “bearish consolidation,” suggesting sellers still control the market. In his view, the bearish scenario remains valid until price breaks above the $2.15–$2.20 resistance zone. A close above $2.20 would invalidate this outlook.

Another market participant, Ace of Trades, highlighted the $2.00–$2.01 area as a major liquidity barrier where significant absorption of buy orders has repeatedly occurred, strengthening resistance. He believes a trend reversal would require a sustained move above $2.

Earlier, analysts at Santiment pointed to an increase in bullish sentiment around XRP on social media—an element that could help support interest in the asset over the medium term.