Yesterday, we discussed the potential impact of ETFs on the price of Ether. Today, we’ll focus on their significance for institutional investors.

ETFs offer unique opportunities, especially for traditional companies and funds, by significantly simplifying investments in ETH.

Let’s look back at last year. How difficult was it for companies to invest in cryptocurrency?

There were numerous scandals around staking and doubts about whether it was considered a security. Regulation was, to say the least, inadequate.

With the introduction of ETFs, institutional investors can invest in ETH with just a few clicks, without worrying about regulatory issues and managing private keys.

Three key benefits of Ethereum ETFs for traditional investors:

- Low fees. No one wants to lose money on every transaction.

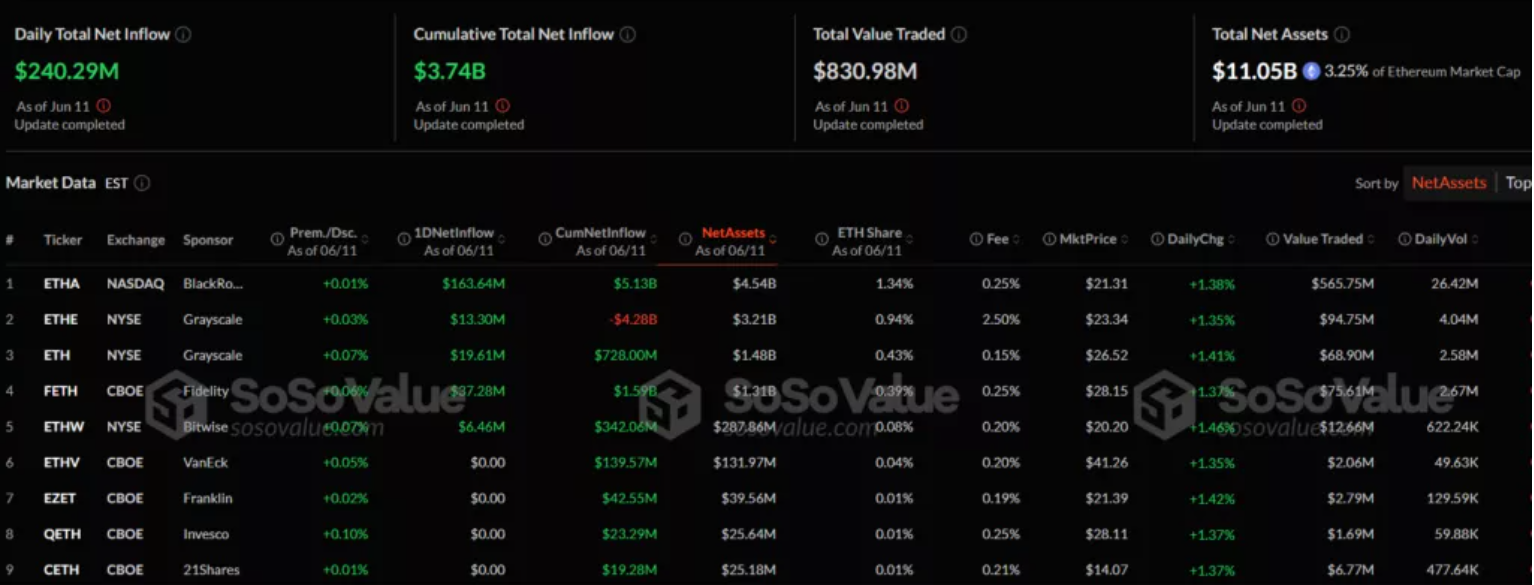

- Recognized names. Attracting investors requires a combination of reliable brands like BlackRock, VanEck, and Grayscale, along with effective marketing (ETFs are now in the spotlight of stock exchange news).

- High trading volume. This attracts more market makers, ensuring tighter spreads and better prices, which is especially important for large players.

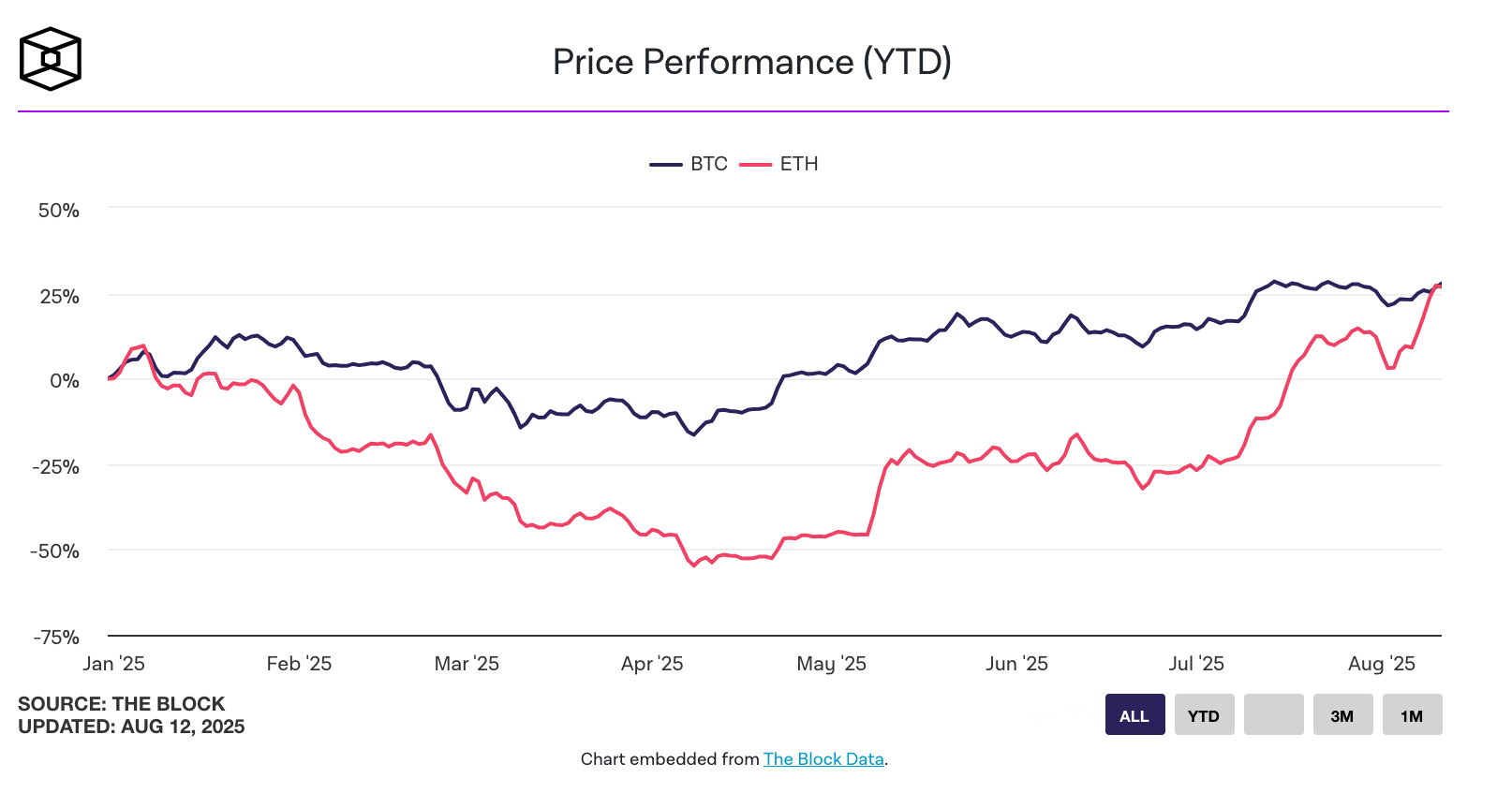

Overall, ETFs offer numerous benefits and can positively affect BTC and ETH in the long term.