Institutionalization, stablecoins, and tokenization are the foundations of financial innovations on public blockchains like Ethereum, according to Bernstein analysts, as reported by The Block.

“Bitcoin is great, we love it, and we still believe the $200,000 level is achievable. This is our conservative, but well-supported target for this cycle,” the analysts noted.

However, investor interest is gradually moving beyond Bitcoin’s role as a store of value. According to the experts, many market participants are beginning to notice “early signs of financial innovations being unlocked by blockchain.”

“Some still separate the ‘useful blockchain’ from ‘useless crypto,’ but Ethereum deserves recognition,” they emphasized.

Since the launch of U.S. spot Bitcoin ETFs in January 2024, they have become one of the most successful investment products in history. In less than two years, their assets under management (AUM) surpassed $130 billion.

Ethereum-based products, launched later, remain in the shadow, with only $9.8 billion under management. However, given Ethereum’s market capitalization (slightly over $300 billion compared to Bitcoin’s $2.1 trillion), this gap is understandable, the analysts stated.

The uniqueness of Ethereum lies in its role as a decentralized computer, the experts explained. According to them, stablecoins and tokenization are native use cases for the second-largest cryptocurrency network.

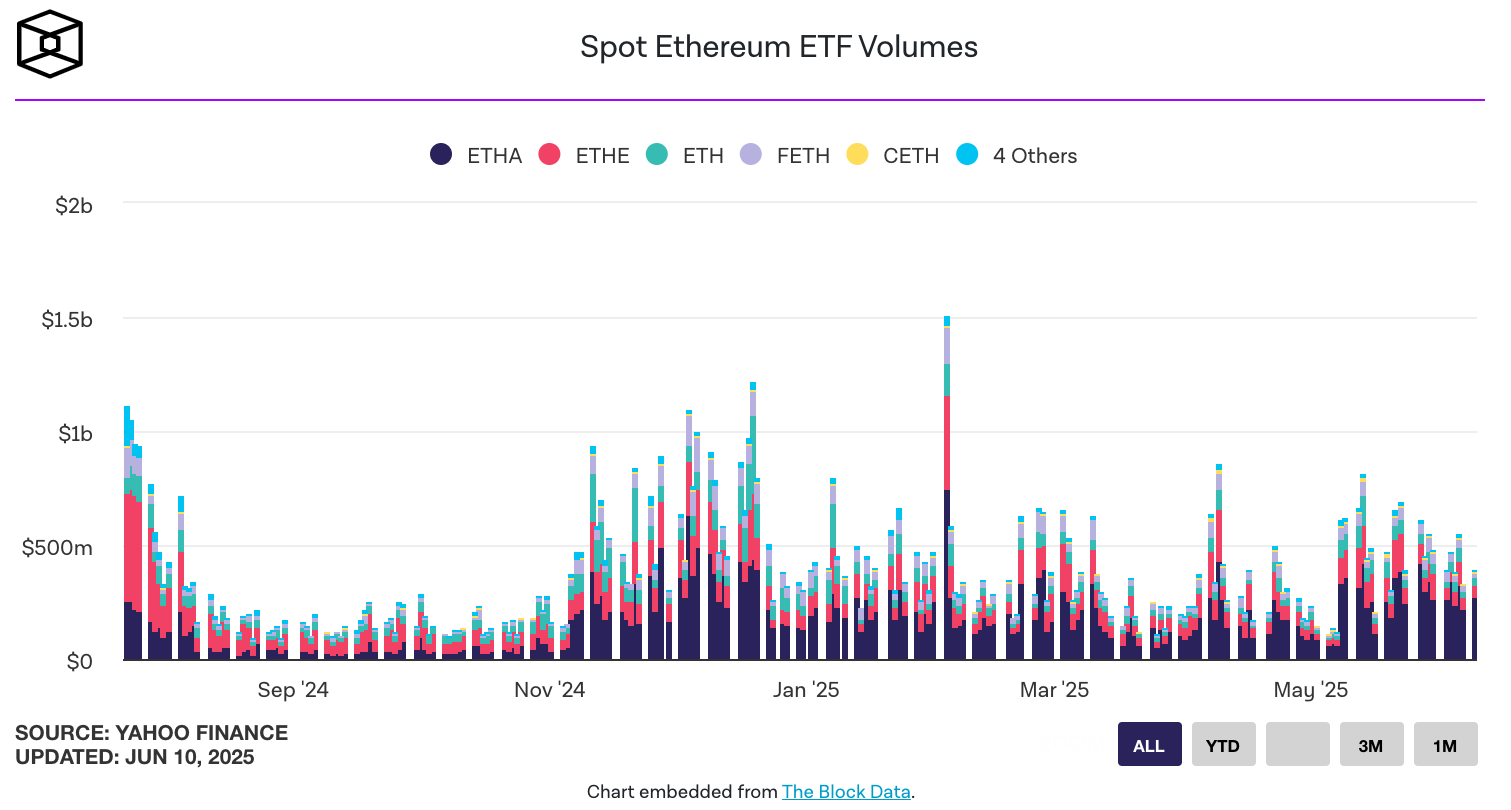

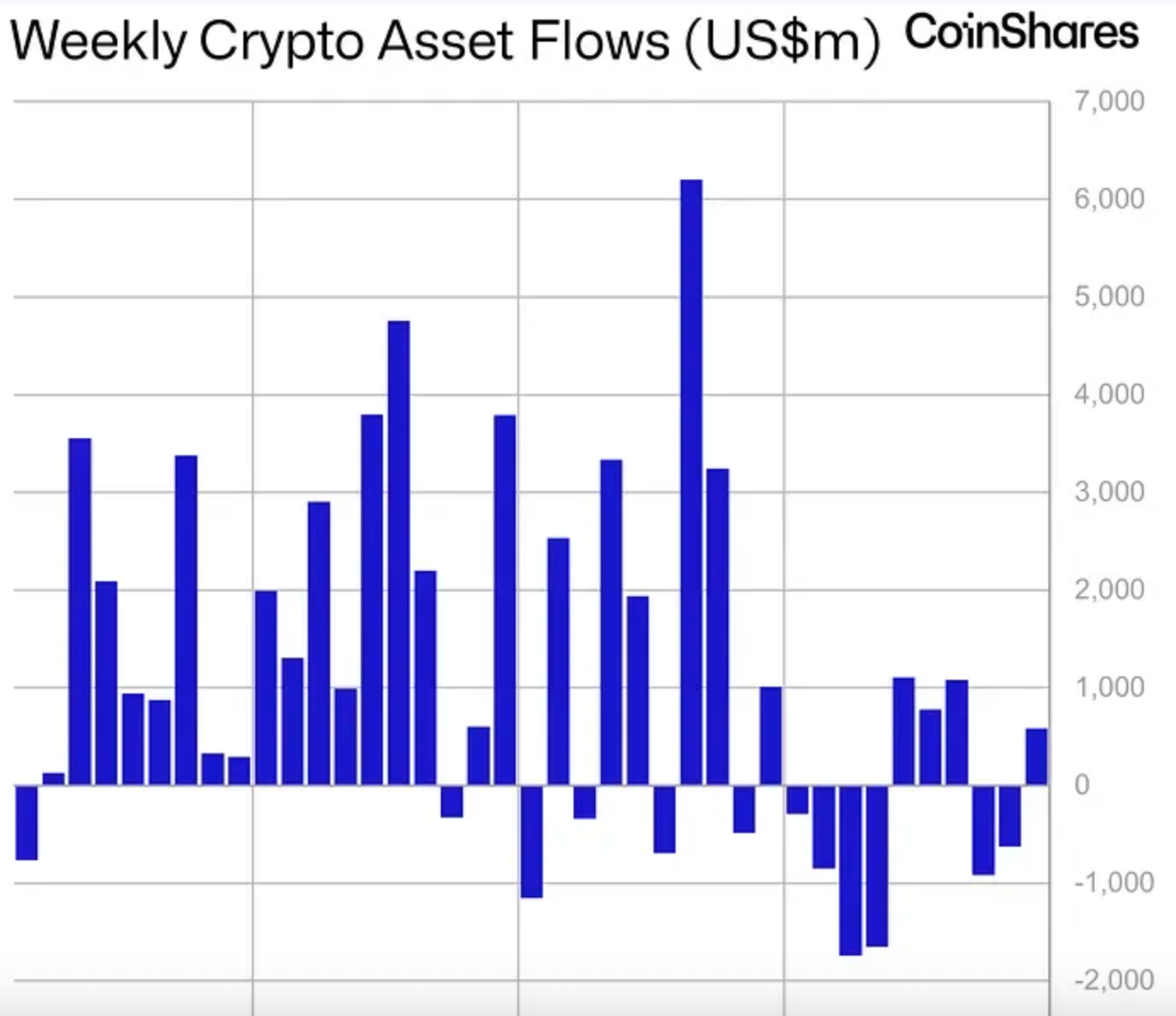

“It’s no surprise that with the growing institutional interest in Ethereum, we are seeing an influx of capital into Ethereum ETFs. Over the last 20 days, inflows have amounted to $815 million. Since the beginning of the year, the net inflow has turned positive, reaching $658 million,” the report says.

The crypto industry is entering a phase where the focus is shifting from speculative trading to blockchain innovations, according to Bernstein. Activity is moving “from meme token trading to building open financial infrastructure for capital markets, payments, and next-generation fintech — in conjunction with stablecoins and tokenization.”

Turning Point

Payment giants such as Visa, Mastercard, and Stripe are already working on strategies for the stablecoin segment, Bernstein notes. The adoption of blockchain innovations by “real companies and institutions” increases the value of networks and native assets like ETH.

“Investors have always told us: ‘Crypto is useless, blockchain is important.’ But these are inseparable things. If you believe in payment innovations based on stablecoins, why wouldn’t you value Ethereum, which issues these ‘stablecoins’ and processes transactions? Any company using such technologies pays fees to the Ethereum network. This is no longer just utility; it’s real value accumulation. We are confident that the narrative around the value of public blockchains has reached a turning point. This is becoming evident in the growing interest in Ethereum through ETFs,” the analysts shared their thoughts.

They also mentioned the increasing adoption of distributed ledger technology solutions among leading crypto companies, including Coinbase’s pilot program for accepting stablecoins as payment and the development of the L2 network Base. Additionally, the analysts mentioned Robinhood’s RWA initiative and Kraken’s plans to launch tokenized U.S. stock trading for users outside the country.

“Our goal is to help institutional investors ‘connect the dots.’ Coinbase and Robinhood are no longer just platforms for trading cryptocurrencies; they are building financial applications on blockchain. Yes, not all tokens have value. But fundamental native assets like Ethereum are moving from speculative toys to tools for real financial innovations,” the analysts at Bernstein stated.

They also noted the growing market awareness of the ongoing transformation, which is driving more investors to look at alternatives to Bitcoin.

It is worth mentioning that Ethereum developers have proposed a protocol design that complies with EU regulations.