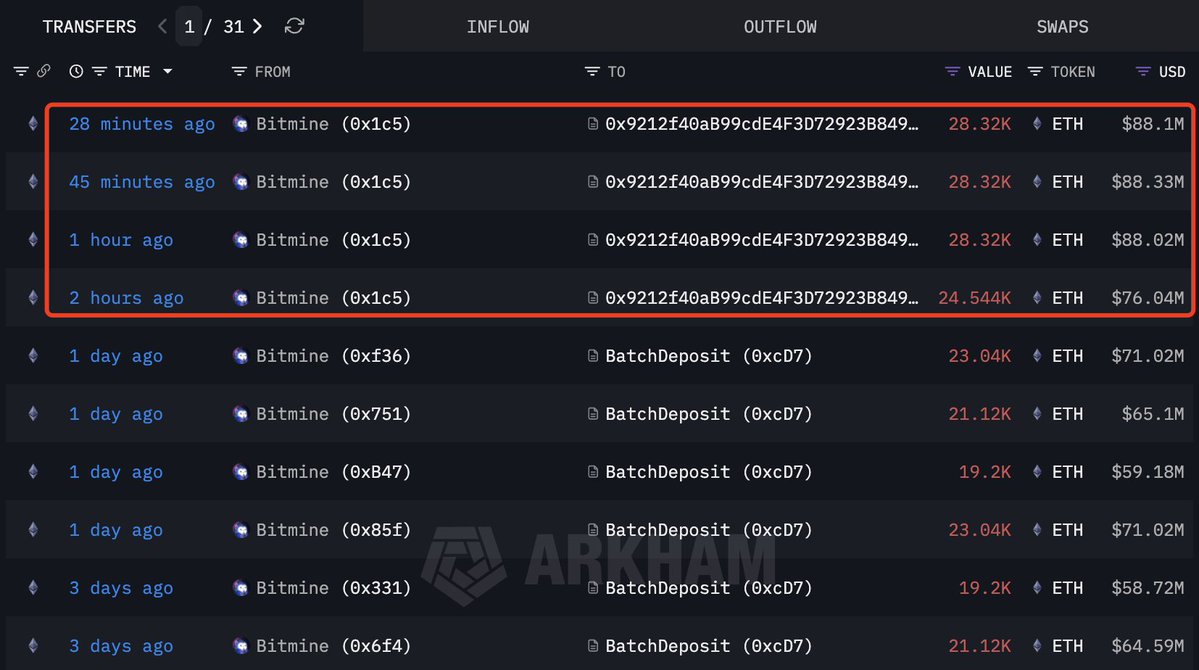

BitMine has increased its Ethereum staking position to a new record of $3.7 billion. The firm staked an additional 86,400 ETH, splitting the move into four transactions. According to Lookonchain, BitMine’s total Ethereum holdings are now valued at roughly $3.7B.

What happened

- BitMine transferred 86,400 ETH into staking via several large transactions.

- Breaking the operation into multiple transfers is typically done to:

- reduce operational risk (if one transaction fails, others can still settle),

- distribute funds across addresses/providers,

- simplify technical management and internal limits.

Importantly, staking is not just “holding ETH.” Staked coins can generate rewards (paid in ETH), though staking also comes with constraints and risks.

Why Ethereum staking is strategically important

1) Ethereum can generate cash flow

Analyst Nick Pakrin highlighted a key difference between ETH and BTC:

- Bitcoin is often treated as a treasury reserve asset (a store-of-value bet).

- Ethereum, through staking, can produce recurring yield.

That matters for companies that:

- carry debt and need cash flow to service obligations,

- want part of their crypto strategy to be self-funding,

- aim to stay resilient during weak market periods (“crypto winter”) via yield rather than relying only on price appreciation.

2) Estimated annual income

Pakrin estimates that at a 2.81% annual yield, Tom Lee’s company could generate around $94.4 million per year.

It’s worth noting that staking yield is not fixed—it can change based on:

- the total amount of ETH staked network-wide,

- network conditions and fee dynamics,

- the staking setup (running validators directly vs using a provider/pool),

- infrastructure and service fees.

Corporate ETH holders: why “who’s #1” matters

BitMine is described as the largest corporate holder of Ethereum, with SharpLink and The Ether Machine mentioned among the next major players.

Why investors track these rankings:

- it signals a growing class of companies building treasury strategies around ETH as both a reserve and an income-producing asset;

- large staking transfers often indicate long-term conviction, not just short-term trading.

Why BitMine shares are still far below their peak

Despite the expansion in ETH exposure, BitMine shares trade around $30.06, roughly 80% below their all-time high reached in July 2025.

That disconnect can happen for several reasons:

- The market may doubt that crypto holdings will translate into stable, reportable earnings.

- Staking and crypto-market risks may be priced more heavily than the headline “record holdings.”

- Investors may worry about potential dilution, especially after talk of increasing the authorized share limit.

- Broader sector sentiment and macro conditions can weigh on equities even when company news is positive.

Increasing the authorized share limit: what it’s for

In early January, Tom Lee proposed raising the authorized share limit from 50 million to 50 billion. He said the move is primarily technical, intended to enable potential future stock splits.

What a stock split does

A split increases the number of shares while lowering the price per share proportionally (for example, 1 share becomes 10). Economically, ownership doesn’t change, but:

- the share price can look more “accessible,”

- trading smaller amounts becomes easier,

- liquidity sometimes improves.

BitMine’s stated goal is to keep the stock price in an “accessible” range around $25.

⚠️ Key nuance: increasing authorized shares does not automatically mean dilution—but markets often treat it as opening the door to large future issuance, which can pressure sentiment.

Staking risks that are easy to overlook

To round out the picture, here are the main risks:

- Variable yield: 2.81% is a snapshot, not a guarantee.

- Infrastructure risk: third-party providers introduce fees and operational dependency.

- Slashing risk: validator misconfiguration can result in penalties (depending on how staking is structured).

- Liquidity constraints: staked ETH can be less flexible to redeploy (depends on direct staking vs liquid staking).

- Market risk: rewards are paid in ETH—if ETH price drops faster than rewards accrue, USD results can still deteriorate.

What to watch next

Going forward, the key questions are:

- Will BitMine continue accumulating ETH, or pause at current levels?

- How exactly is staking executed—direct validators or external providers (risk and margin implications)?

- Will financial reports disclose clearer metrics such as realized yield, infrastructure costs, and net contribution?

- Will the authorized-share proposal lead only to splits, or also to new issuance?