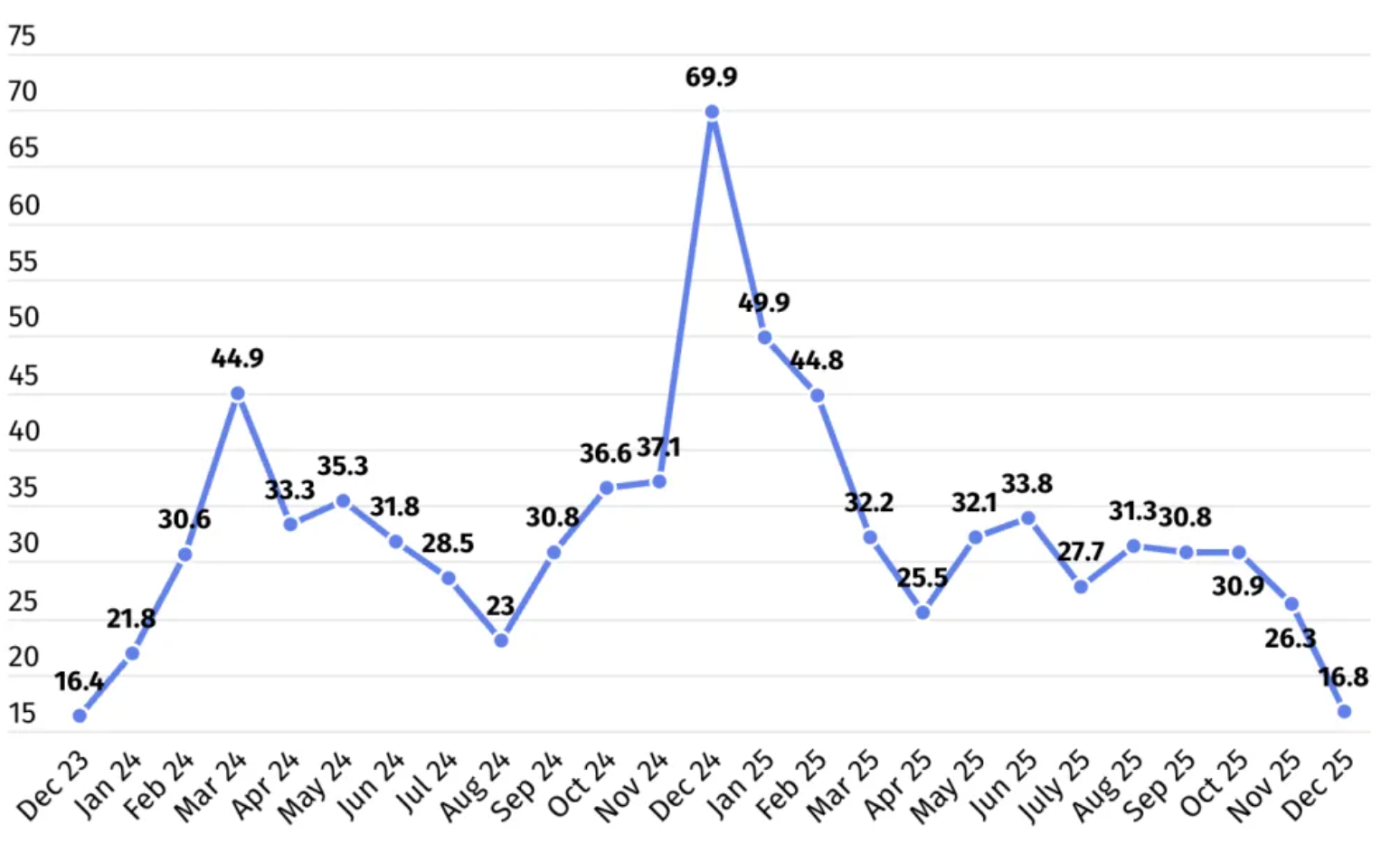

The past few years have been challenging for ETH holders.

Despite the optimism surrounding Ethereum, its growth has significantly lagged behind Bitcoin. Since December 2021, ETH has dropped 60% against BTC.

However, in terms of ecosystem development, Ethereum is thriving: updates are regularly released, L2 solutions are expanding, use cases are growing, TVL is increasing, and the number of users continues to rise.

Why is ETH underperforming compared to BTC and the broader market?

The main challenges Ethereum faces are:

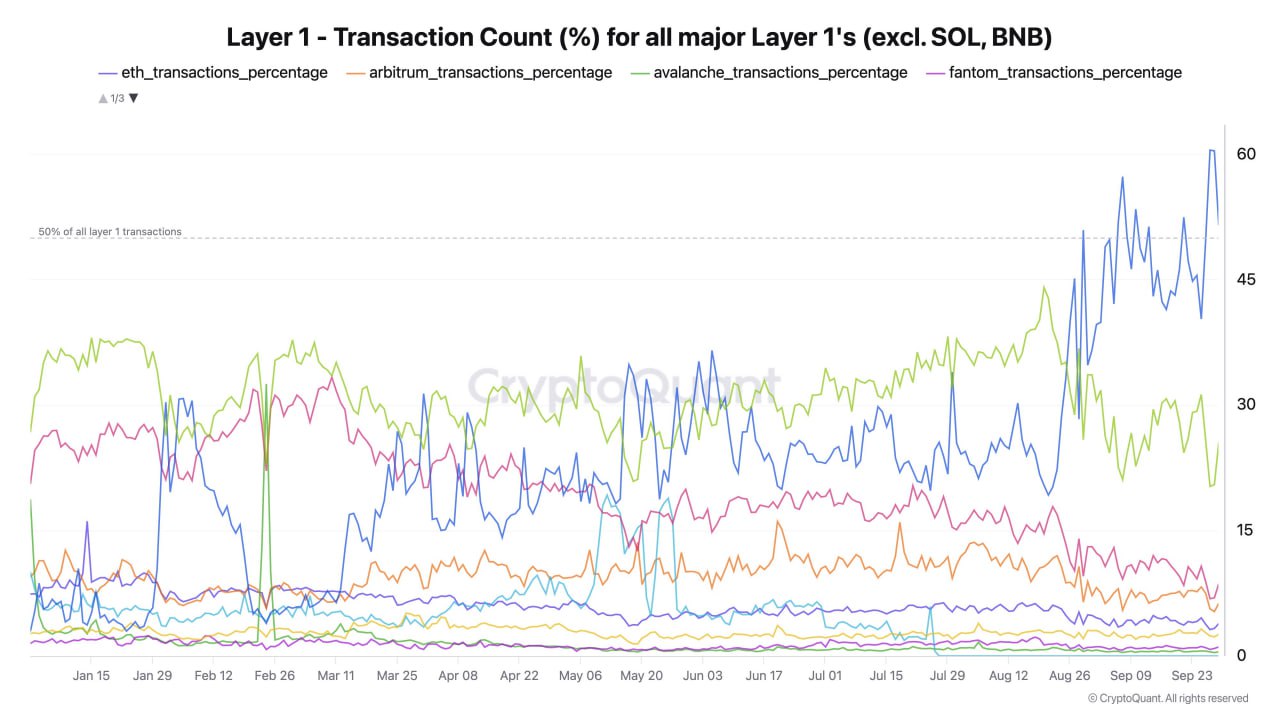

- Capital fragmentation.

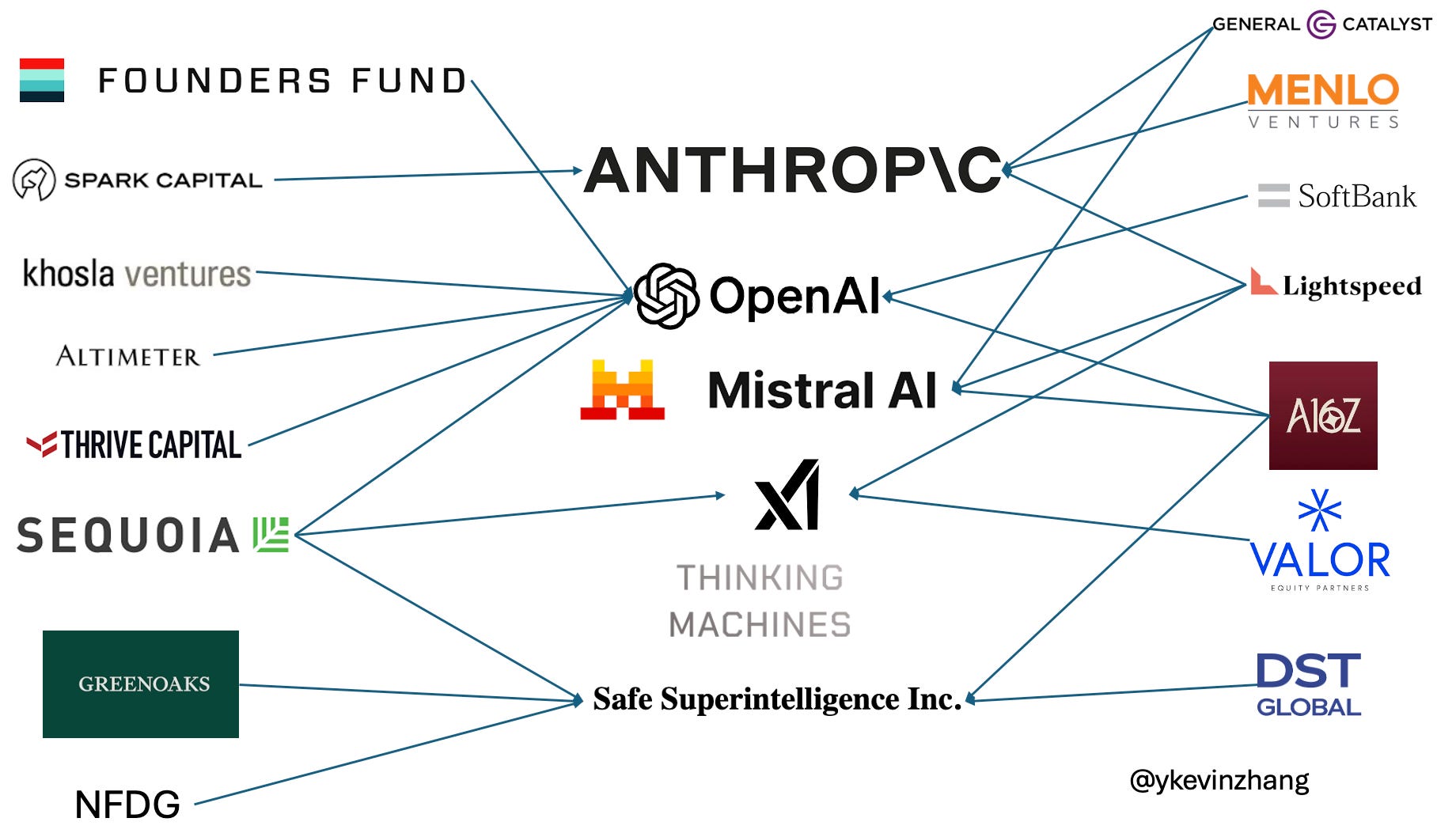

If you believe in Bitcoin’s growth, you invest in BTC. If you believe in Solana, you buy SOL. Ethereum, however, is more complex. Dozens of L2 networks have been built on Ethereum, many of which issue their own tokens (e.g., ARB or OP). As a result, investors are putting their money into projects like Arbitrum, Optimism, and zkSync, which reduces the inflow of capital into ETH itself. - Strong competition.

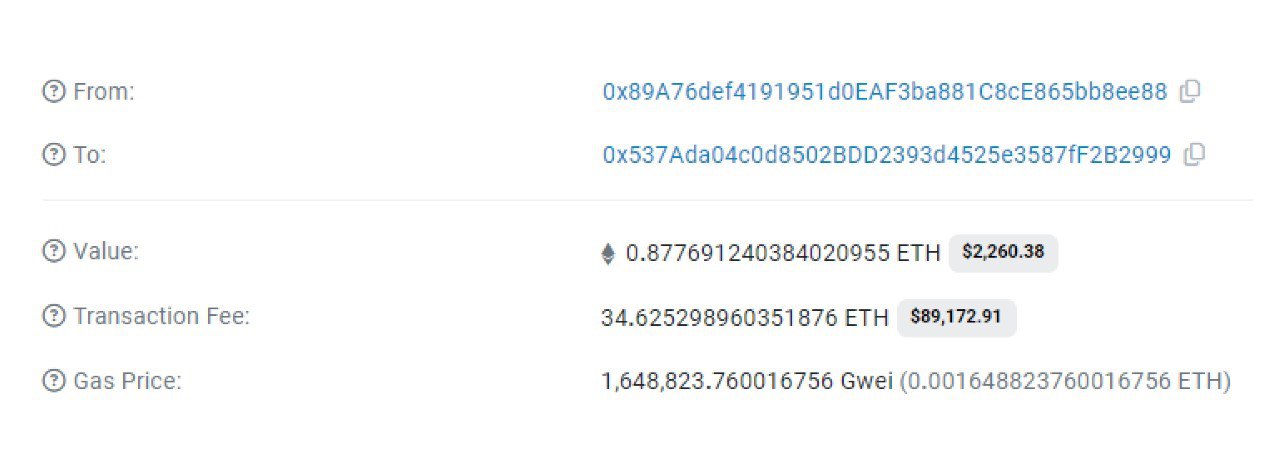

Projects like Solana, Avalanche, and Sui are rapidly updating their networks to align with new trends such as memes, AI, gaming, and more. Ethereum, on the other hand, takes years to test and implement updates due to the “high cost of mistakes,” which slows its progress. - High transaction fees.

The cost of transactions on Ethereum’s main network remains one of its biggest drawbacks, deterring users. - Complexity of L2 networks.

While Layer 2 solutions make transactions cheaper and faster, they are still too complex for newcomers. This simplicity gap gives an edge to monolithic blockchains like Solana, which attract users with their ease of use.

The good news is that Optimism and Polygon are already working on unifying Ethereum’s L2 ecosystem into a single network. However, it’s unclear when these solutions will be fully operational.

Why believe in ETH?

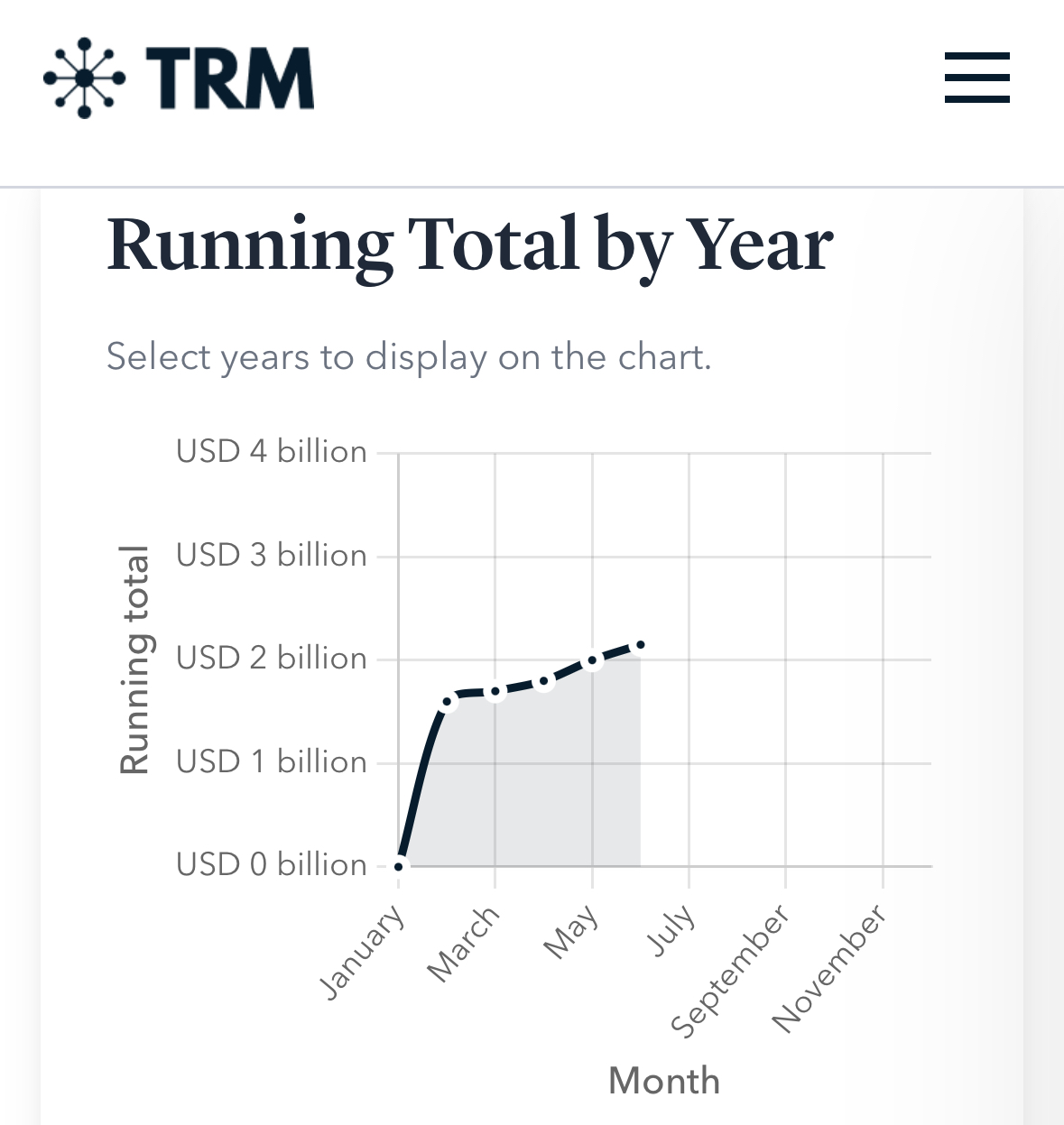

- TVL leader. Ethereum holds the largest total value locked (TVL) among all blockchains.

- Developer activity. Ethereum remains the most popular blockchain for creating smart contracts and decentralized applications.

- Reliability. Ethereum is considered the most secure blockchain for implementing complex smart contracts.

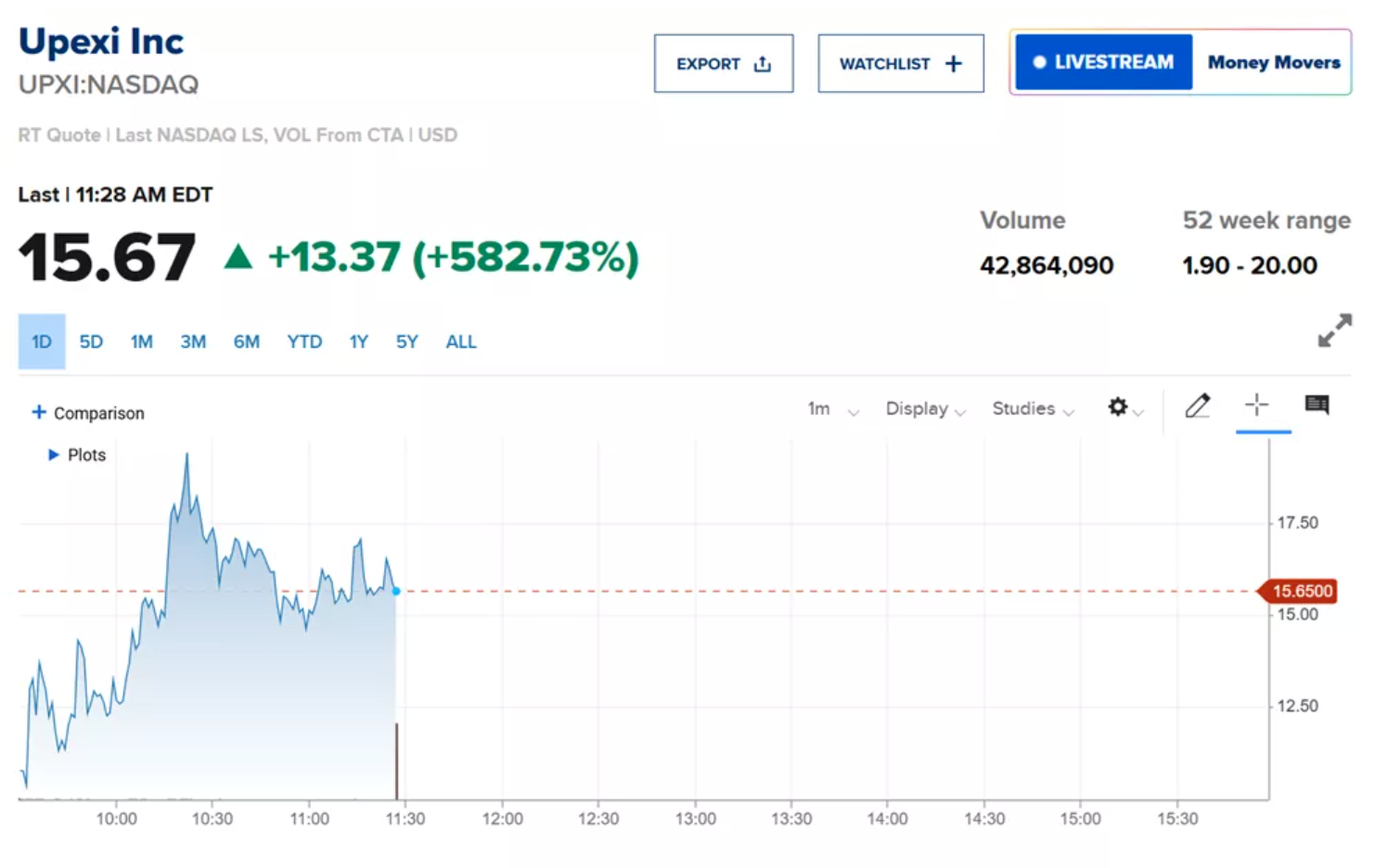

- Institutional adoption. Major players like BlackRock have chosen Ethereum for tokenizing their funds.

- Whale accumulation. Data suggests that large investors continue to accumulate ETH, withdrawing it from centralized exchanges.

And most importantly: history is on Ethereum’s side. In previous cycles, BTC always led during the early stages, but ETH consistently caught up in the later phases.