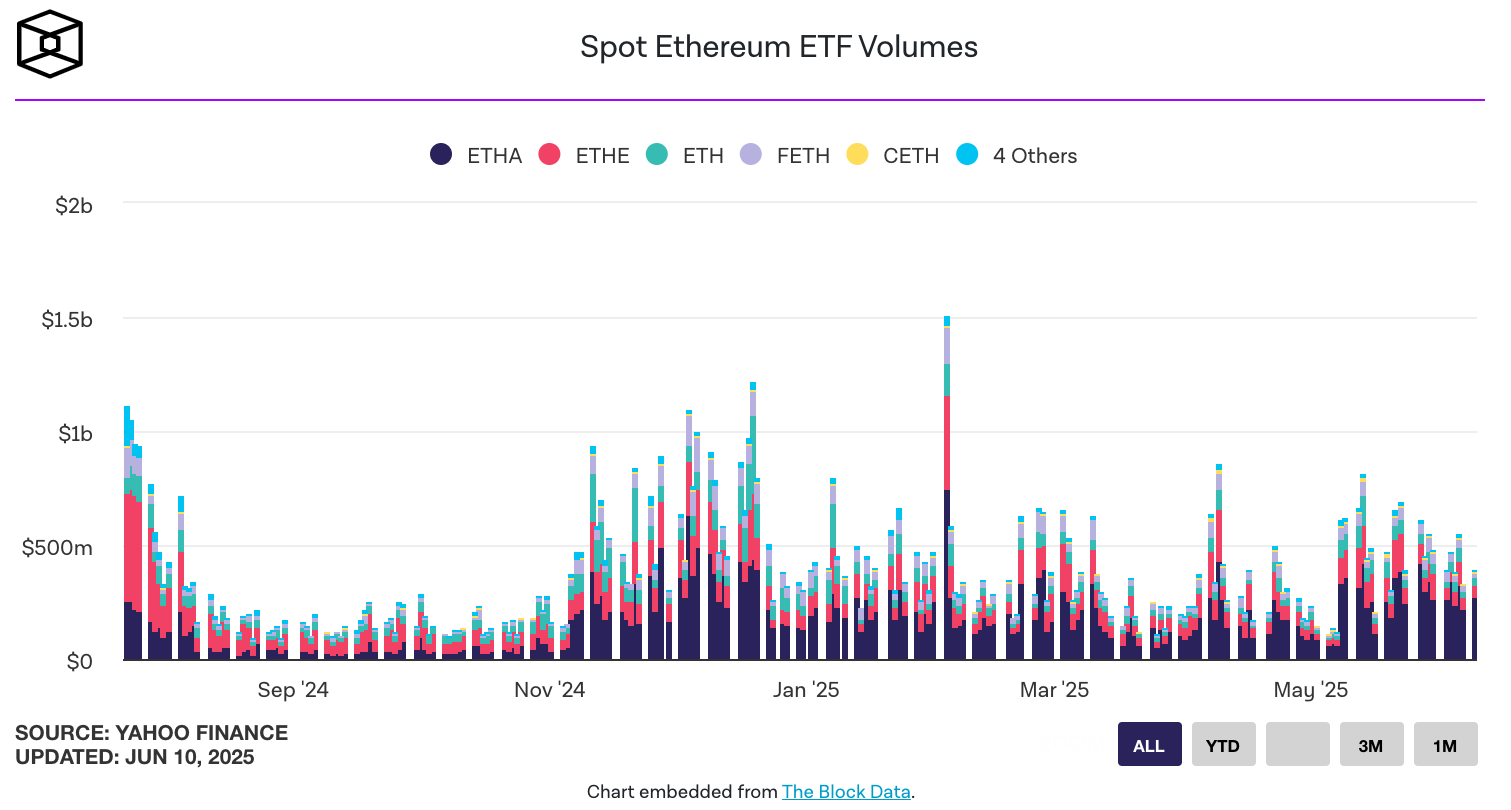

Senior Bloomberg analyst Eric Balchunas has reported that the first spot ETFs based on Ethereum could be launched as early as July 23. This marks a significant step for the cryptocurrency market, providing investors with a new tool for investing in Ethereum.

According to Balchunas, at least three out of the eight proposed issuers, including BlackRock, Franklin Templeton, and VanEck, have already received approval from the U.S. Securities and Exchange Commission (SEC). However, it is expected that all eight funds will be launched simultaneously, highlighting the high interest and market readiness for this new financial product.

According to information provided by The Block, the final S-1 forms must be submitted to the SEC by Wednesday. This is a mandatory requirement for all issuers seeking approval to launch their funds within the established timeframe.

The launch of spot ETFs based on Ethereum could significantly change the landscape of cryptocurrency investing, providing both institutional and retail investors with a safer and more regulated way to invest in digital assets.