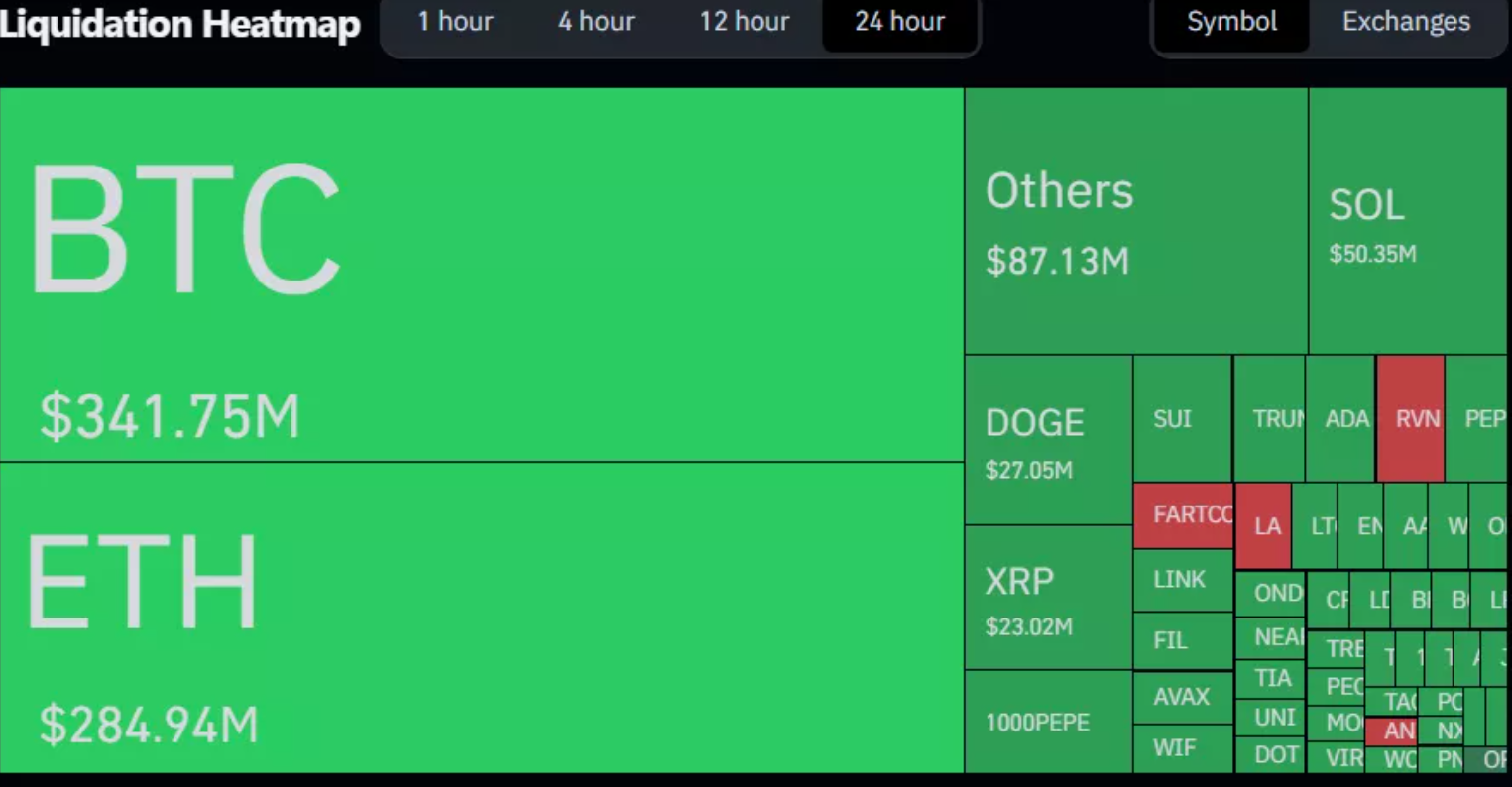

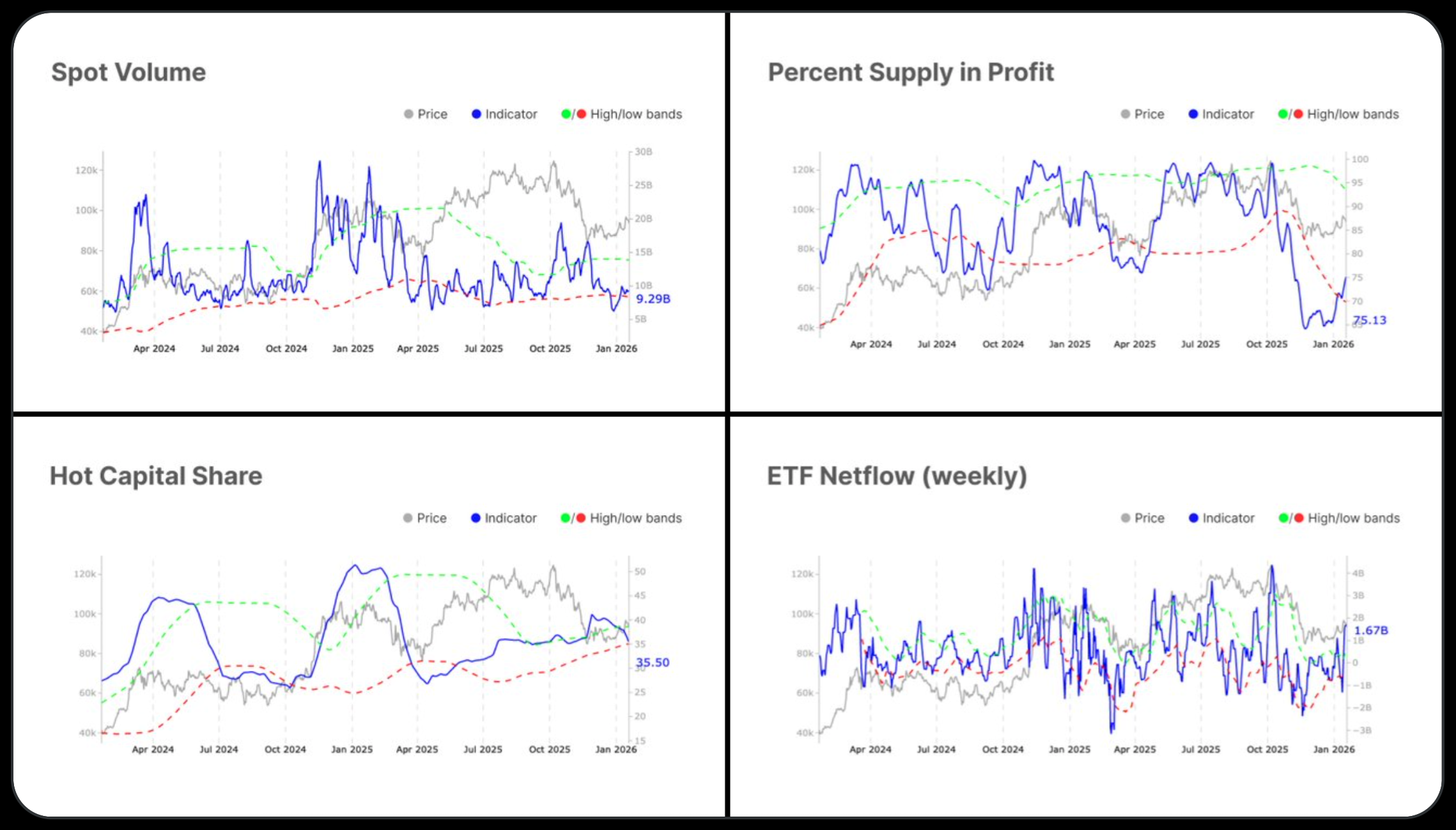

This means that about a third of all ETH holders are still facing losses despite the recent price surge. The last time this percentage of profitable holders was observed was in October 2023, when Ethereum was trading around $1800.

In comparison, Bitcoin is faring much better: over 80% of addresses are in profit, and not long ago, this figure exceeded 95%. This indicates a stable profitability for most BTC holders, even amid market fluctuations.

Altcoins generally show a significantly lower level of profitability. On average, less than 50% of addresses are in profit, and in some cases, this figure drops even lower. This reflects the high volatility and risks associated with investing in alternative cryptocurrencies compared to more established assets like Bitcoin and Ethereum.